Summer Outlook Finds Possible Reserve Shortage

The preliminary results of PJM’s look ahead at the capacity available for this summer and the expected peak loads suggest that about 5.4 GW of demand response could be needed to maintain the 3.5-GW real-time primary reserve requirement.

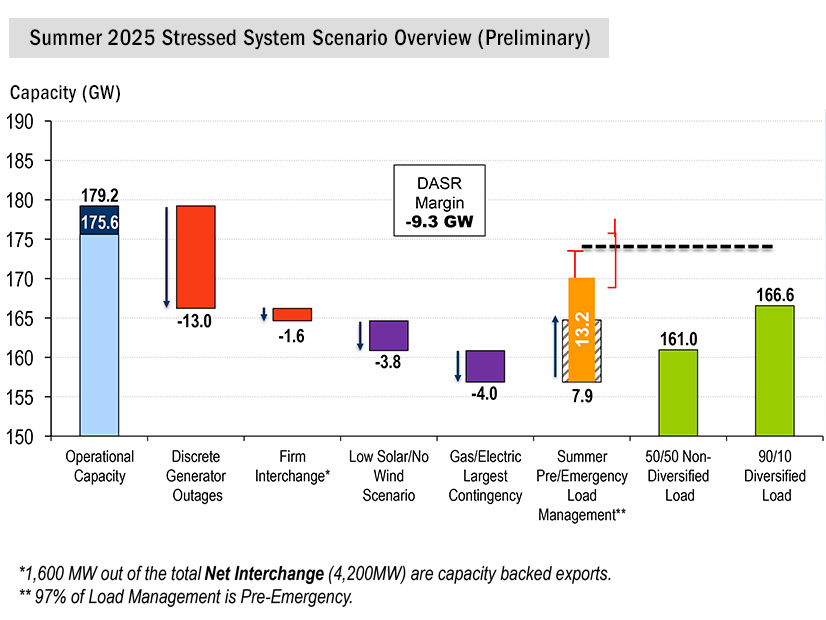

The season is forecast to see a 90/10 diversified peak load of 166.6 GW for the season, with 175.6 GW of committed capacity and fixed resource requirement (FRR) resources available, plus 3.6 GW of non-capacity resources. About 13 GW of that is expected to be on outage when called on, with an additional 1.6 GW flowing out to serve firm interchange. Even with a 5.4-GW load management deployment, PJM said it may fall 1.5 GW below the day-ahead scheduling reserve requirement (DASR).

An announcement of the outlook described the 90/10 forecast as an “extreme planning scenario” and noted that the generation expected to be available remains above 160,961-MW peak load in the 50/50 forecast. No reliability violations were identified in the Operations Assessment Task Force’s (OATF) summer report.

“This season also marks the first time in PJM’s annual assessment, however, that available generation capacity may fall short of required reserves in an extreme planning scenario that would result in an all-time PJM peak load of more than 166,000 MW,” PJM said in the announcement.

PJM’s Mark Dettrey told the Operating Committee that the OATF report focuses on meeting the forecast peak load, whereas the 90/10 analysis included reserve requirements.

In the low solar and no wind sensitivity, 3.8 GW of renewable resources are modeled as being unavailable, leading to the system falling 1.3 GW short of the DASR target and triggering a 9.2-GW load management commitment. The single largest gas-electric contingency scenario would take slightly more off the grid at 4 GW with similar impacts. PJM also modeled the two combined in a “stressed system scenario” and found that could cause a 9.3-GW DASR shortfall and require 13.2 GW of load management.

Dettrey said the drivers are in line with the resource adequacy concerns PJM has been airing over the past few years: deactivating generation, sluggish new resource entry, and accelerating load growth fueled by data centers and electrification. The outlook shows there is increased risk of emergency procedures, such as capacity deployments, and that PJM will be “heavily reliant on” good generator performance, Dettrey said.

April Operating Statistics

Presenting the April operating metrics, PJM’s Marcus Smith told the OC the month saw an average forecast error rate of 1.45%, just shy of the 1.5% benchmark, and a peak error of 1.34%.

Three days surpassed the 3% day-ahead forecast error rate, with low temperatures leading to a 3.62% overforecast of the peak load April 8. During the MIC meeting May 7, PJM presented how rapidly ramping load that morning caused reserve shortage conditions, driving high LMPs.

April 27 and 28 both saw underforecasting as higher-than-expected temperatures contributed to high consumption.

PJM experienced two spin events, two shared reserve events, five high system voltage actions, one geomagnetic disturbance warning and 11 post contingency local load relief warnings.

The first spin event was initiated at 4:21 a.m. April 5 and lasted eight minutes and 23 seconds, with 1,755 MW of generation and 452 MW of DR assigned. The generation resources had a response rate of 87%, and 89% of the DR responded.

The second event was at 12:50 a.m. April 24 in the Mid-Atlantic Dominion (MAD) zone and lasted seven minutes and three seconds. There was 1,085 MW of generation assigned, 86% of which responded. No DR was assigned.