LANSDOWNE, Va. — Experts in the data center field discussed the challenges of meeting accelerating computational load during the PJM Annual Meeting, held in the core of Northern Virginia’s Data Center Alley.

Panelists were united in their belief that data centers and other large load additions are likely to continue to proliferate in PJM and across the U.S., posing reliability risks and cost assignment challenges.

PJM Executive Vice President of Market Services and Strategy Stu Bresler, who moderated the May 13 panel, said load not only is expected to increase at an unprecedented pace, but it also would act uncharacteristically compared to traditional consumption by following a novel profile.

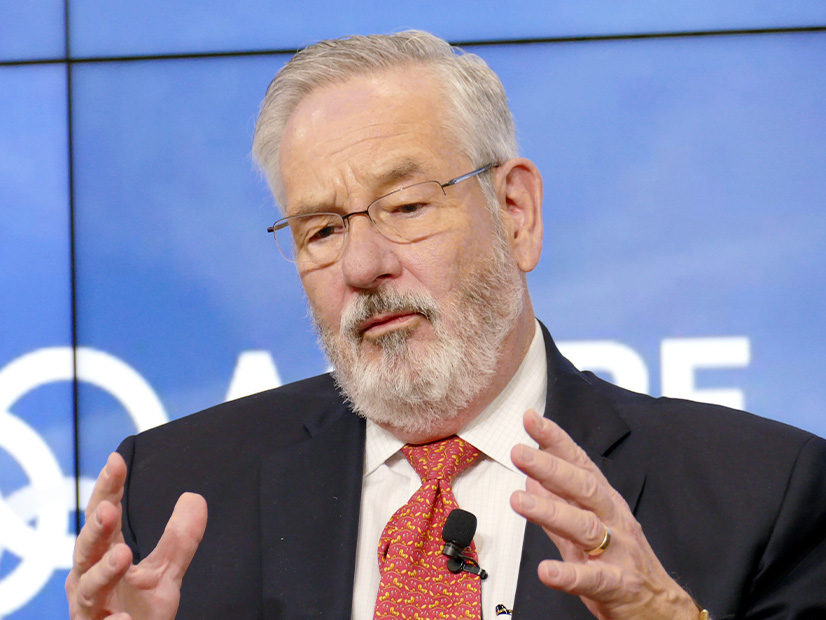

Brian George, Google’s head of global energy market development and policy, said data center load is sure to grow, but there is risk inherent in any predictions about the future. Ensuring that load can be served reliably without costly overbuilding will require a load forecast that weeds out duplicative projects being proposed at multiple locations.

“I can tell you not all of it is real; if we look a few years out, that forecast is wrong,” he said.

Dan Thompson, principal research analyst for S&P Global Market Intelligence, gave the example of two developers seeking to build a data center for the same customer at different locations within Georgia Power’s territory. That caused the projected load to appear twice in the utility’s forecast, none of which manifested after the customer backed out of the project.

Tech Companies Adjust to New Interconnection Reality

George said the tech industry has long benefited from an overbuilt grid and has developed an assumption that power would always be available from utilities. Adjusting to a new reality where new transmission, and possibly generation, must be built before data centers can come online is a hard reality the sector will have to adjust to.

Google is pivoting to that paradigm shift by putting more skin in the game when negotiating tariffs with electric distribution companies, he said.

“We are now in a position where we have to go back to our executives and say we are now imposing this cost on the grid,” George said. “We have to come to terms with the fact that energy is not risk free.”

Thompson said utilities increasingly are passing interconnection costs to data centers, particularly as investors grow more willing to finance large projects. It used to be difficult to find capital to develop projects beyond 24- or 36-MW buildings, but the scale now is growing to the hundreds of megawatts. As that continues, developers will have to grow more accustomed to building to spec and accounting for substation and interconnection needs and costs.

Data Center Characteristics Pose Reliability Challenges

Mark Lauby, NERC senior vice president and chief engineer, said properly modeling how data centers may act on the grid is critical to ensuring they do not cause the sort of voltage issues that caused 1.5 GW of load to go offline July 10, 2024.

When the sensitive devices housed in data centers switch off suddenly, they can rock the frequency and voltage of the entire grid. (See NERC Report Highlights Data Center Load Loss Issues.)

Thompson said data center operators in ERCOT showed they are capable of flexible operations by curtailing their load when the grid operator asked consumers to cut back while ice storms were hitting Texas. Overall, however, he said their demand response potential remains largely academic because operators typically have contractual requirements to their customers to provide a predefined degree of service to their customers, hampering their ability to throttle servers or switch them offline.

Kevin Hughes, STACK Infrastructure senior vice president of public affairs, said installing backup generation for data centers has long been seen as an avenue for unlocking more flexibility, but regulatory and hard infrastructure constraints limit the feasibility of that approach.

Data centers also are a capital-intensive business, with land in Data Center Alley running about $4 million/acre and the hardware costing between $500 million and $1 billion, Hughes said, adding that these are not assets operators want to leave idle.