Heading into 2026, the New England states, ISO-NE and energy industry stakeholders are counting on an increasingly collaborative approach to energy policy as federal opposition to renewable energy development threatens affordability, reliability and decarbonization objectives in the region.

As President Donald Trump ramped up his anti-renewable resource policy in 2025 — punctuated by the administration’s Dec. 22 order halting all U.S offshore wind construction — the New England states moved forward with multistate transmission and generation procurements intended to meet forecasted load growth and state clean energy goals.

ISO-NE forecasts power demand to roughly double by 2050, and the RTO has expressed concern about resource adequacy starting in the 2030s, especially in light of the offshore wind industry’s challenges.

How the region will meet growing demand in the coming decades is an unsettled question, and there is no certainty that the region’s offshore wind industry will be able to rebound after the end of Trump’s presidency. It also remains to be seen how effective the states’ collaborative approach will be at supporting the continued growth of the region’s power system.

While these questions may not be fully answered in the new year, 2026 will likely provide some important indications about the success of the states’ approach, including results from a pair of major transmission procurement efforts. 2026 is also poised to be a crucial year for ISO-NE’s ongoing effort to overhaul its capacity market, as the RTO has filed with FERC a potentially controversial set of resource accreditation and seasonal auction changes with a proposed effective date of March 31.

The recent political attention around energy affordability — which may be heightened by 2026 gubernatorial elections — likely will put pressure on ISO-NE and state officials to prioritize cost savings in all areas, including the capacity market changes and efforts to rein in spending by transmission owners on local transmission upgrades.

In an event in December, Gordon van Welie, who served as ISO-NE CEO from 2001 through the end of 2025, spoke about the improvements in stakeholder collaboration he saw during his 25 years at the RTO, saying, “Even when things do seem a bit tense, we’ve developed mechanisms to deal with those frictions.”

2026 is poised to be a substantial stress test for New England’s mechanisms to deal with energy policy frictions.

Accreditation Mad Dash

In 2026, ISO-NE and New England stakeholders face a heavy workload and a ticking clock in the effort to develop and build consensus around capacity accreditation changes and a new seasonal capacity auction design.

The changes are a major focus for a wide range of interests because of the potential effects on clearing prices and capacity revenues for individual resources.

The RTO first introduced its Resource Capacity Accreditation project in 2022 before expanding the project to include a wider array of changes, including to the timing of auctions and capacity commitment periods (CCPs).

On Dec. 30, ISO-NE filed the first phase of the Capacity Auction Reform (CAR) project, which proposes to drastically reduce the amount of time between auctions and CCPs and decouple resource deactivation from the auction process (ER26-925).

The RTO is poised to spend much of 2026 working to finalize the second phase of the CAR project, which includes accreditation changes and the development of a seasonal auction design splitting CCPs into six-month winter and summer periods.

Overarching affordability concerns may increase the stakes of the process. While the capacity market has not been a major driver of consumer costs in the region, state officials are eager to avoid the major capacity price spikes experienced recently in PJM and MISO. Some market participants in New England expect demand growth and Pay-for-Performance risks to push up prices in future auctions, and the proposed CAR changes add to the price uncertainty.

“Consumer affordability concerns and gubernatorial elections across the six states will heighten the political focus on all actions in this industry,” said Dan Dolan, president of the New England Power Generators Association.

He emphasized the importance of “a cooperative structure of government policies and regulations” to help strike the right balance between reliability, affordability and clean energy investment, adding that “the public spotlight to get this right will be extraordinary.”

The accreditation reforms would introduce several important factors into the capacity auction process, including gas supply constraints, on-site fuel storage, pipeline contracts, resource outage rates, battery duration and seasonal resource performance variability.

Resource accreditation values would be dynamic auction-to-auction, with changes in the region’s generation and demand profile affecting the value of each resource.

ISO-NE is aiming to complete the accreditation and seasonal auction changes by the end of 2026, which may be no easy task given the high-stakes and potentially controversial nature of the reforms. The RTO hopes to have the full suite of CAR changes in place for its 2028/29 CCP. (See NEPOOL Supports First Phase of ISO-NE Capacity Market Reform.)

The RTO will also have to navigate the rocky waters of accreditation under new guidance; longtime COO Vamsi Chadalavada took over for van Welie as CEO at the start of January.

Chadalavada’s appointment has been met with strong support from NEPOOL members, with some expressing optimism that he will build on the collaborative approach taken by ISO-NE in the first phase of the CAR project.

If ISO-NE is not able to complete the project and obtain FERC approval in time for the 2028/29 CCP, it may be forced to run the first phase of CAR changes as a standalone design, a circumstance that many stakeholders in the region hope to avoid.

Transmission, New and Old

Van Welie’s tenure at ISO-NE was characterized, in part, by a strong reliability record and a major shift in the region’s generation fleet as more efficient gas-fired plants replaced aging coal, nuclear, gas and oil generators. This transition was aided by investments in new transmission in the mid-2000s, which reduced congestion and allowed lower-cost resources to come online. (See Retiring ISO-NE CEO van Welie Reflects on 25 Years at the RTO.)

Chadalavada has assumed the leadership role amid another period of transition, characterized by demand growth and renewable power proliferation. The changing mix of demand and supply will likely require a large amount of new transmission investment over the next couple decades: A 2023 study by ISO-NE estimated that transmission upgrades needed to meet 2050 demand could cost up to $26 billion. (See ISO-NE Prices Transmission Upgrades Needed by 2050: up to $26B.)

New England already has some of the highest transmission rates in the country, and long-term transmission needs could put significant additional pressure on transmission costs.

Given the anticipated long-term needs, consumer advocates are hoping to rein in some of the region’s transmission spending through added scrutiny on asset condition projects. These upgrades account for the majority of the transmission investment in New England and have been a topic of growing concern for states and ratepayer advocates in recent years. In spring 2025, ISO-NE agreed to take on a non-regulatory role reviewing asset condition projects.

While ISO-NE has emphasized it will not make judgments on the prudency of transmission investments, its findings on projects could be used by other third parties in FERC proceedings to challenge investments. As it works to develop these internal review capabilities, the RTO plans to rely on a hired consultant to conduct reviews for a subset of asset condition projects.

State officials also have gone directly to FERC to seek relief; in mid-December, the Maine Office of the Public Advocate asked FERC to initiate evidentiary hearing procedures to investigate the prudency of asset condition projects placed in service in 2022. (See Maine Public Advocate Asks FERC for Hearing on Asset Condition Costs.)

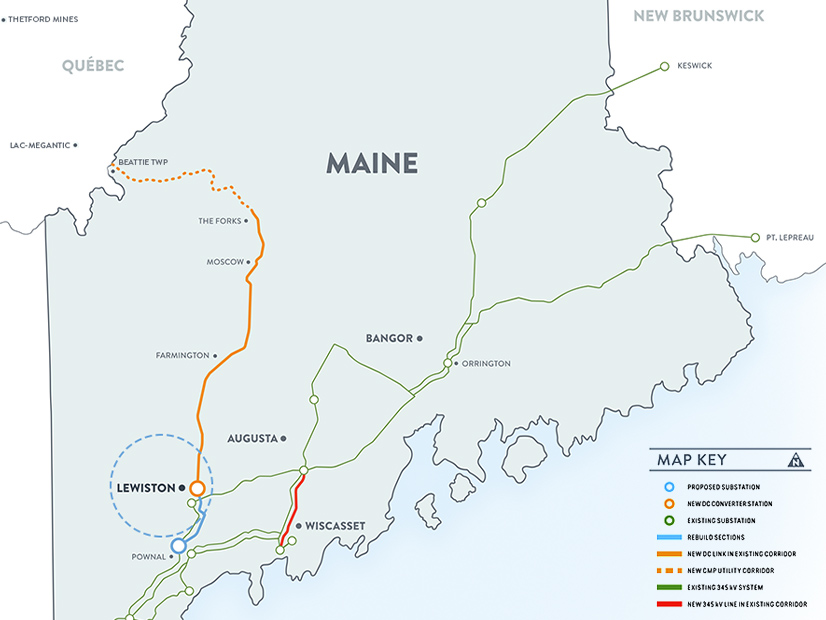

To address long-term transmission needs, ISO-NE and the states kicked off in 2025 the first transmission procurement under the new Longer-term Transmission Planning (LTTP) process. The solicitation is aimed at reducing transmission constraints in Maine to enable renewable development in the northern part of the state.

ISO-NE received six project submissions in response to its request for proposals in the fall, and it intends to select a preferred solution by September 2026. (See ISO-NE Provides More Detail on Responses to LTTP Procurement.)

To be eligible for selection, each project’s estimated benefits must exceed its estimated costs. If no projects pass this threshold, the LTTP process allows states to opt to cover the extra costs, but it is unclear whether a state would assume this responsibility in the current environment of affordability concerns.

A successful first LTTP procurement could set a strong precedent for future procurements and other collaborative efforts among New England states, while a failed procurement would likely represent a significant setback for transmission development in the region.

In conjunction with the LTTP procurement, Maine has launched an additional solicitation of renewable energy and associated transmission in Northern Maine. The Public Utilities Commission published its RFP for the Northern Maine procurement on Dec. 19 and aims to select winning bids by the end of May 2026. (See Maine PUC Issues Multistate Transmission, Generation Procurement.)

Also in 2026, ISO-NE is slated to begin stakeholder discussions for its compliance with FERC Order 1920, which will likely build on the existing LTTP process.

“While our LTTP process is an excellent starting framework for planning and procuring regional-first beneficial transmission, Order 1920 will require further improvements that ISO-NE must incorporate into its practice, such as scenario-based planning, consideration of rightsizing and use of alternative transmission technologies,” said Alex Lawton, a director at Advanced Energy United.

Long-term Energy Adequacy and Resource Development

While ISO-NE expects to have adequate resources to meet demand in the coming year, it has expressed concern about potential supply issues in the 2030s.

If able to complete construction, the Vineyard Wind and Revolution Wind offshore wind projects would provide a combined 1,500 MW of nameplate capacity to the region’s grid. Vineyard is partially operational, and Revolution is nearing the completion of construction.

Susan Muller, senior energy analyst at the Union of Concerned Scientists, emphasized the potential winter cost and reliability benefits of these resources.

The power from Vineyard and Revolution “should make a significant difference in the overall wholesale cost of energy supply, which will benefit all retail customers in New England on an ongoing basis,” Muller said, highlighting a study by Daymark Energy Advisors that found that 3,500 MW of offshore would have cut ISO-NE energy market costs by about $400 million in the winter of 2024/25. (See New Study Highlights Winter Benefits of OSW in New England.)

In a statement responding to President Trump’s suspension of offshore wind construction, ISO-NE wrote that the affected projects “are particularly important to system reliability in the winter when offshore wind output is highest and other forms of fuel supply are constrained.”

“While ISO-NE forecasts enough generation capacity is available for the current season, canceling or delaying these projects will increase costs and risks to reliability in our region,” the RTO added.

The New England Clean Energy Connect (NECEC) transmission project — itself delayed by multiple years because of political challenges in Maine — should be online for the winter of 2026. The project includes a 20-year power purchase agreement for baseload energy from Hydro-Quebec, and ISO-NE studies have indicated the line will provide significant winter reliability benefits to the region.

Beyond NECEC and the two offshore wind projects, there is a high degree of uncertainty regarding the next wave of supply into the region.

Experts are somewhat divided on what the long-term effects of Trump-era policy will be on the offshore wind industry in the U.S. While some have expressed optimism that the industry will rebound with a new administration in Washington and continued state support, others have expressed doubt that investors will return.

“Unless it is a state entity or a federal entity building it, offshore wind is done in the United States,” one analyst said at an industry conference in early December. (See New England Energy Executives Debate Markets, Affordability.)

With the looming July 4, 2026, construction deadline for solar resources to receive the federal investment tax credit, solar developers and state energy officials are scrambling to push late-stage projects forward as quickly as possible.

In a coordinated, expedited procurement led by Connecticut, four New England states recently selected a combined 173 MW of advanced-stage solar projects from across the region. (See New England Coordinated Procurement Nets 173 MW of New Solar.) Massachusetts also recently announced the selection of 1,268 MW of energy storage from a separate procurement.

“Our main focus next year is very tactical — working on project-execution-related matters for our portfolio, including asset financing, trying to advance some early-stage projects and looking for growth opportunities,” said Aidan Foley, founder of Glenvale Solar, which had two projects selected in the recent solar procurement.

“We need a continued pace of procurements and long-term policy initiatives, both to bring near-term assets online and to communicate to developers [and] investors that there will be paths to market in the future,” he added.

On the distribution side, solar developers are also working to start construction and bring projects online as quickly as possible.

“The first half of 2026 is going to be a sprint to get the last batch of projects in the door,” said Jessica Robertson, director of New England policy and business development at New Leaf Energy. “Then, the next several years are going to be a really hard focus on getting things online by those ITC deadlines, and in parallel, trying to develop our storage verticals.”

She noted there are several hundred megawatts of distributed solar in the various stages of Massachusetts’ interconnection queue.

To help expedite the development process, she said it will be important to increase the frequency of Affected System Operator studies and potentially enable rolling determinations of whether a project needs a study.

In the long-term, New Leaf is looking at “figuring out how to keep solar going without the ITC,” Robertson said. “That’s not going to work everywhere right away, but certainly states like Massachusetts don’t plan to stop after next July.”