By Michael Kuser

RENSSELAER, N.Y. — NYISO on Wednesday unveiled a plan to devote about one day a month in 2020 for stakeholders to discuss reliability and market issues related to the challenge of integrating a slew of clean energy resources into the grid over the next few years, a transition driven primarily by state policy.

“Until the markets reflect the cost of the environmental attributes that we’re trying to maximize, it is difficult to get renewable energy from upstate to the load centers downstate,” Mike DeSocio, the ISO’s director of market design, told the Installed Capacity/Market Issues Working Group (ICAP-MIWG).

NYISO last month published a 122-page “Grid in Transition” report, which will serve as the starting point for stakeholder discussion.

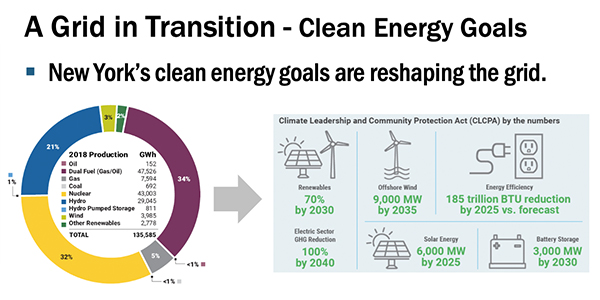

New York’s clean energy goals are reshaping the grid. | NYISO

Organized wholesale electricity markets have brought improved resource efficiency, “but there is more work to be done to deliver additional clean energy into New York City,” DeSocio said.

“New York’s electricity industry is transforming from a grid that is powered by traditional central-station, controllable fossil fuel generation to non-emitting, weather-dependent intermittent resources and distributed generation,” the report said.

Last year’s Climate Leadership and Community Protection Act (A8429) mandates the state to get 70% of electricity from renewable energy resources by 2030, develop 9 GW of offshore wind energy by 2035 and reach 100% carbon-free electricity by 2040.

The state’s clean energy goals also include doubling distributed solar generation to 6 GW by 2025, deploying 3 GW of energy storage by 2030,and upping its energy efficiency savings to 185 trillion BTU by 2025.

Reliability vs. Resilience

DeSocio said that reliability and resilience were much the same thing, with reliability the desired outcome, and resilience the means of achieving it.

Couch White attorney Kevin Lang, representing New York City, disagreed, saying that the two terms mean different things.

“In the city’s view, when it comes to resilience, the concern is the weakest link in the line or system,” Lang said. “At present, no reliability metric measures this factor.”

With respect to the grid transition discussion, Lang commented that the market provides signals for generation but not for transmission, adding that it is not clear that transmission is wholly a market responsibility.

Lang agreed with DeSocio’s response that the markets may not be the sole source of signals regarding the need for new transmission.

The grid paper did a good job of emphasizing the market, “but the afternoon will come when you need reserves, but also need energy prices not to be in scarcity pricing,” said Mark Reeder, representing the Alliance for Clean Energy New York (ACE NY).

“If you squeeze the high prices into a narrow band of hours, I wonder whether the ISO has thought about scarcity pricing,” Reeder said. “I worry about the exercise of market power.”

New York state economy-wide GHG emissions history and future reduction goals | NYISO

DeSocio replied that the ISO has thought about the topic, which it refers to as shortage pricing.

“The shortage pricing construct can be the right kind of signal for resources able to respond very quickly, from off to on in a very short period of time,” DeSocio said.

On carbon pricing, DeSocio said the ISO has done its job and that it’s up to the state to now act on the issue.

“We hope for a carbon pricing signal within the next six months, whether carbon pricing is a good idea or to stop talking about it,” he said. “We are not abandoning carbon pricing, but at the same time, we’re not talking about it much because it’s in the state’s hands to indicate where to go.”

The MIWG took over last January from the Integrated Public Policy Task Force (IPPTF), a joint effort between the ISO and the state’s Public Service Commission that spent a year-and-a-half developing the carbon pricing proposal released in December 2018.

The state must put a price on carbon in its electricity market if it hopes to meet the aggressive timelines of the decarbonization goals set out in the new law, the co-author of NYISO’s carbon pricing study, Analysis Group’s Sue Tierney, said in October. (See Carbon Pricing Vital to NY Goals, Study Author says.)

In addition, NYISO has registered support for carbon pricing in New York from many organizations, the latest of which is the New York League of Conservation Voters, which included support for carbon pricing in its 2020 Legislative Agenda.

“Putting a price on carbon is the only way New York can even come close to meeting its emissions goals,” Mark Younger of Hudson Energy Economics said Wednesday.

Howard Fromer, director of market policy for PSEG Power New York, said the state government acted to meet an environmental challenge, and that “markets have been successful at addressing environmental concerns, the most dramatic evidence being the reductions in nitrogen oxides and sulfur oxides over the past couple decades.”

Discussion Process

Energy market design specialist Ashley Ferrer presented a rough outline of the process for the grid transition discussions this winter and spring.

Associate capacity market design specialist Emily Conway laid out the timeline through May, with ICAP/MIWG meetings on grid transition reliability and market issues scheduled for Feb. 4, March 6 and 26, and May 11.

NYISO has scheduled stakeholder meetings from January to June 2020 to discuss topics related to the transformation of the grid. | NYISO

The outline referred stakeholders to potential questions in a project planning and market product file from last September, which included the following under reliability and market considerations:

- What are appropriate market structures for assuring reliability in the 2030 and 2040 cases?

- How to set reliability requirements and measure reliability with a system made of renewables and storage of different durations?

- How to accommodate potentially reduced [uninstalled capacity] contribution arising from correlated renewable outages?

- What role should real-time retail pricing play to assure customer load reductions when correlated outage events occur?

- Where should the cost of loss of load be considered?

- NYISO will kick off the discussion of each specific topic, followed by stakeholder presentations. Stakeholders need to submit materials for ISO review six business days before the meeting. Materials will be posted three business days prior to the working group meeting, consistent with current procedures.