By Amanda Durish Cook

CARMEL, Ind. — A new report from MISO concludes that stakeholders will need to quickly adjust the RTO’s capacity construct and offer new market products to accommodate a resource mix in which renewables represent a majority.

The second annual Forward Report was framed from the perspective of MISO’s rapidly evolving utilities and what they will need from a grid operator in the near future. The report includes five hypothetical utility profiles based on integrated resource plans, interviews with stakeholders and investor presentations. MISO used the profiles to conclude it needs to change its capacity auction and resource accreditation, while developing new market products to incentivize a flexible supply.

“Utilities need MISO to act now to develop transitional and transformational solutions,” CEO John Bear wrote in the report’s introduction. “As customers continue to push for decarbonization goals, utilities are adopting significantly more diverse business models. Supply and demand of availability, flexibility and visibility will vary by utility. MISO’s ecosystem for exchange must accommodate this significantly increased degree of diversity and facilitate members to leverage that value.”

Bear said MISO utilities must “redefine what is needed” to manage risk on the grid.

The first Forward Report in 2019 concluded that market changes are necessary as the RTO footprint experiences demarginalization, decentralization and digitalization. (See New MISO Report Starting Point for Major Grid Change.)

“We have an imperative to act quickly,” MISO Executive Vice President of Market and Grid Strategy Richard Doying told the Resource Adequacy Subcommittee on Wednesday. He added that the Organization of MISO States and state regulators have said their utilities are weighing millions of dollars in investments and are wondering if the MISO market can accommodate their new resource portfolios.

Doying pointed to MISO’s 77-GW interconnection queue, now dominated by nearly 46 GW in solar generation projects.

“Not a lot of traditional resources; they’re new resources with operational characteristics that we aren’t used to,” Doying said of the queue makeup.

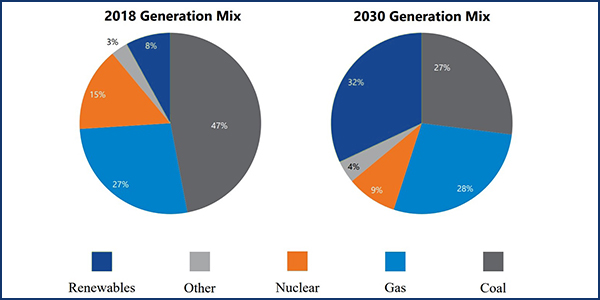

MISO predicts that by 2030 its generation mix will contain 32% renewables, 28% natural gas, 27% coal and 9% nuclear. In 2018, MISO’s generation mix was fueled by 47% coal, 27% natural gas, 15% nuclear and 8% renewables. Doying said the 2030 mix isn’t a MISO forecast but based on utilities’ announced plans.

“This is what all of your companies have said they’re doing. … This is not based on a bunch of assumptions,” he told stakeholders.

Sunset on the Planning Horizon

MISO said its footprint will soon contain “very diverse utilities that will rely on each other as neighbors in a shared resource pool in new ways.”

Customized Energy Solutions’ Ted Kuhn asked what role MISO sees itself playing: planner, or facilitator to the rapid change.

Doying said MISO will concentrate more on making sure it gathers more detailed and accurate information to share with its members making investment decisions.

The new report reiterated MISO’s now familiar prediction that its annual loss of load expectation process for estimating reliability needs will eventually be broken down by season to assess risks in all hours of the planning year.

“We count megawatts based on one thing: peak load. … If we only count megawatts based on the requirement we established, does that account for all reliability risks?” Doying asked rhetorically, referring to MISO’s current process of establishing accreditation and reserve margin requirements to serve load on the hottest summer day.

“I think a simple, summer-based loss-of-load expectation study doesn’t account for all risks. … It does a very good job, but it’s incomplete,” Doying said. “Is annual the right time frame to conduct that assessment, or should it be done seasonally?”

Doying said MISO is advancing on developing some sort of “sub-annual component” for its Planning Resource Auction. The RTO last year said a seasonal capacity auction would be beneficial though some stakeholders have pushed back on the idea. (See MISO Gives Tentative Nod to Seasonal Capacity Design.)

Kuhn said he was worried MISO was focusing too much on seasonal or monthly divisions of the planning horizon when an influx of solar generation will require an hourly analysis of risk.

“You can break the horizon down as much as you like; the sun doesn’t shine at night,” Kuhn said.

Doying also said MISO may create new market products that reward flexibility.

“We don’t have a proposal, but we do know that’s been done in other regions,” Doying said. “There are a lot of ramping needs when you get a lot of wind and solar on the system.”

He said MISO will re-evaluate its scarcity and emergency pricing in the coming months. Both items appear on the RTO’s Integrated Roadmap list of market improvements to undertake in 2020. MISO staff have said emergency pricing has generally been inefficiently low.