By Michael Yoder and Michael Brooks

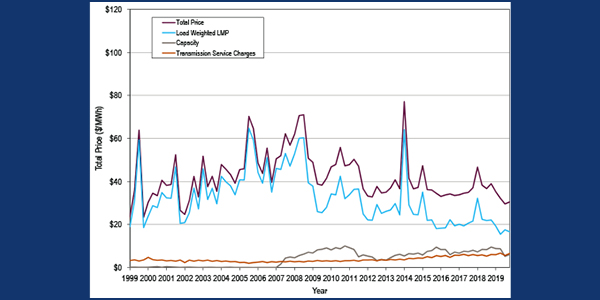

The average load-weighted, real-time LMP in PJM was $27.32/MWh last year, a 28.6% decrease from 2018 and the lowest in the RTO’s 21-year history, the Independent Market Monitor said Thursday.

According to the Monitor’s annual State of the Market report, energy prices made up only 54.3% of the average total price of PJM’s markets ($50.33/MWh), also the lowest of any year. Capacity and transmission made up 22.4% and 20.6%, respectively, of the total price.

“The most significant single source of the reduction was natural gas and coal prices,” Monitor Joe Bowring said in an online press conference presenting the report. “The rest was the lower markups as people add less to their costs. That’s a way for saying the market was more competitive. In addition, load was down annually 2.4%, so it was a combination of three of those things.”

Of the $10.92/MWh decrease, 41.5% was a result of lower fuel costs, the dispatch of lower-cost units, decreased load and lower markups, Bowring said.

2019’s average LMP beat the prior record low, set in 2016 at $29.23 MWh.

Load was down 2.4% from 2018 to 88.1 GWh. Bowring said the early months of the year were mild compared to the brutal cold of January 2018.

Natural gas continued to increase its dominance in the RTO’s resource mix last year, with gas-fired output exceeding that of both coal and nuclear for the first time. Gas provided 36.2% of energy, followed by nuclear (33.6%) and coal (23.8%). Gas-fired output exceeded coal-fired in 2018 but not that of nuclear. (See Monitor Says PJM’s Capacity Market not Competitive.)

Although the Monitor found the energy markets competitive overall, Bowring pointed out a recommendation to correct flaws in the implementation of market power mitigation rules. Bowring said the rules depend on having accurate cost-based offers equal to the short-run marginal cost and clear definitions for cost-based offers highlighted in Manual 15.

He also noted a recommendation, made in the third-quarter of last year, that “PJM always enforce parameter-limited values by committing units only on parameter-limited schedules when the [three-pivotal-supplier] test is failed or during high load conditions such as cold and hot weather alerts or more severe emergencies.”

“Unfortunately, some generation participants in PJM are trying to undermine the entire role of market mitigation and are attacking the very idea of fuel-cost policies,” Bowring said.

Oct. 1 Event

Bowring highlighted PJM’s handling of an emergency event on Oct. 1, which he said the RTO mishandled. (See PJM, Stakeholders Baffled by DR Event.)

PJM issued a hot-weather alert on Sept. 30 for Oct. 2, expecting an unusually hot day. But the RTO declared a synchronized reserve event around 3 p.m. ET on Oct. 1, leading to a spike in LMPs close to $700/MWh.

In the report, the Monitor said several factors led to the spike. PJM drastically underestimated load for 2 to 6 p.m. in most of its forecasts; the Monitor noted that for the 2 to 3 p.m. hour, the actual load was 2,706 MWh above the day-ahead forecast and 1,202 MWh above the one-hour-ahead forecast. For the 5 to 6 p.m. hour, the actual load was 4,014 MWh above the day-ahead forecast.

It also faulted inadequate generator response to the event. Between 2:25 and 2:55 p.m., at least 79 units failed to achieve the output level requested by PJM, for a total of 872 MW.

But in his presentation, Bowring focused on a 25-minute gap on Oct. 1 in which PJM’s real-time security-constrained economic dispatch (RT SCED) solutions were not approved, meaning the RTO’s Locational Price Calculator (LPC) continued to use the last approved solution, produced at 4:48 p.m.

“Without an updated approved RT SCED solution, PJM does not send an updated dispatch signal to generators,” according to the report. “The dispatch signal from the case that was approved at [4:48 p.m.] continued to be the target until a new case was approved at [5:14 p.m.] that solved for a target time of [5:25 p.m.]. … For three five-minute intervals, the prices for the solved RT SCED cases differed from actual average RTO price by hundreds of dollars per megawatt-hour.”

Bowring said this could be prevented by fixing a mismatch between RT SCED, which is automatically executed every three minutes, and the LPC, which runs every five minutes. The Monitor recommended that PJM approve one RT SCED case for each five-minute interval to dispatch resources during that interval, and that the RTO calculate prices using the LPC for that five-minute interval using the same approved RT SCED case.

MOPR ‘Hysteria’

PJM held no capacity auctions last year because of the wait on FERC to act on proposals to change the minimum offer price rule (MOPR), which it eventually did in December, expanding it to all new state-subsidized resources.

“Contrary to the hysteria, there is no evidence that the expanded MOPR will lead to increased prices,” Bowring said. He said that renewable developers have told him they expect to continue to be competitive in the capacity market and qualify for unit-specific exemptions.

The Monitor’s report was critical of state consideration of exiting the capacity market via the fixed resource requirement (FRR) alternative.

“The rationale for leaving the PJM capacity market via the FRR option is based on the incorrect premise that the MOPR order will increase capacity market prices. The FRR option is more likely to increase the cost of capacity to customers than to decrease it,” according to the report. “If new renewables are not competitive in the longer run, the least-cost option for customers in states that wish to pursue renewable targets is more likely to be competitive markets plus separate state subsidies for desired technologies than ending participation in the capacity market through the FRR option.”

Other Recommendations

The Monitor made 23 new recommendations in 2019, including 12 in the annual report:

- Capacity Performance resources should be required to perform without excuses. “Resources that do not perform should not be paid regardless of the reason for nonperformance.” (Priority: High.)

- Remove all maintenance costs from the cost development guidelines. (Priority: Medium.)

- Review the FRR rules, including obligations and performance requirements. (Priority: Medium.)

- Modify the market data posting rules to allow the disclosure of expected performance, actual performance, shortfall and bonus megawatts during a performance assessment interval (PAI) by area without the requirement that more than three market participants’ data be aggregated for posting. (Priority: Low.)

- Base the net revenue calculation used by PJM to calculate the net cost of new entry and net avoidable-cost rate on a forward-looking estimate of expected energy and ancillary services net revenues using forward prices for energy and fuel. (Priority: Medium.)

- Prohibit emergency stationary reciprocating internal combustion engines (RICE) from participation as demand response when registered individually or as part of a portfolio if it does not meet emissions standards because the environmental run hour limitations mean that emergency RICE cannot meet the capacity market requirements to be DR. (Priority: Medium.)

- Eliminate the total regulation signal sent on a fleet-wide basis and replace it with individual regulation signals for each unit. (Priority: Low.)

- Remove the ability to make dual offers (as both a RegA and a RegD resource in the same market hour) from the regulation market. (Priority: High.)

- Replace the static MidAtlantic/Dominion Reserve Subzone with a reserve zone structure consistent with the actual deliverability of reserves based on current transmission constraints. (Priority: High.)

- Eliminate the variable operating and maintenance cost from the definition of the cost of tier 2 synchronized reserve and remove the calculation of synchronized reserve variable operations and maintenance costs from Manual 15. (Priority: Medium.)

- Define the components of the cost-based offers for providing regulation and synchronous condensing in Schedule 2 of the Operating Agreement. (Priority: Low.)

- Require all PJM transmission owners use the same methods to define line ratings, subject to NERC standards and guidelines, subject to review by NERC and approval by FERC. (Priority: Medium.)