ISO-NE is wrapping up its Energy Security Improvements (ESI) initiative ahead of an April 15 filing deadline with FERC, stakeholders learned last week during a two-day meeting of the New England Power Pool Markets Committee (EL18-182).

The committee plans to vote on ESI at its March 24 meeting, and the NEPOOL Participants Committee plans to vote on the market design at its April 2 meeting.

The start of the second day’s proceedings was delayed by a brief discussion of teleconference protocol after ISO-NE announced that, in response to the spreading COVID-19 coronavirus, its staff will not participate in person at stakeholder meetings from March 12 to April 30.

ISO-NE staff members chair NEPOOL stakeholder meetings, and the RTO now joins CAISO, ERCOT, MISO, NYISO and SPP in taking all stakeholder meetings online for the time being. (See RTOs Take Steps to Address COVID-19’s Spread.)

Later on Wednesday, NEPOOL announced that “future NEPOOL meetings in March and April will be conducted via teleconference with webinar capabilities.”

Focus on Winter Benefits

Todd Schatzki of Analysis Group presented a draft impact analysis that shows that — in addition to expected reliability benefits — ESI can also improve efficiency and lower production costs under stressed market conditions when the increase in energy inventory reduces energy production from less efficient and higher-cost fuels.

The study of winter months demonstrates that changes in net revenues vary across resource types, although the direction of these impacts (i.e., whether net revenues increase or decrease) is generally the same across resource types within each case, given the nature of the stressed market conditions, Schatzki said.

Summary of change in total payments, Winter Central Case | Analysis Group

Much of the quantitative analysis focuses on impacts in winter months, partly because the ESI proposal aims to improve market efficiency by better aligning individual participant incentives with the region’s need for energy supplies during tight market conditions, according to the full draft report.

ESI would be expected to increase total payments by load to suppliers on a rising scale, with the increase being lowest during periods when stressed market conditions are uncommon or infrequent and highest when they are frequent, while the extended case shows a 2.5% decrease in such payments.

Multiple factors influence the impact, such as the frequency and duration of the stressed conditions, and the amount of incremental energy inventory incented by ESI, as the inventory can lower market prices, particularly during stressed market conditions, the presentation showed.

Stakeholder Amendments

Massachusetts Assistant Attorney General Christina Belew presented an amendment to remove replacement energy reserves (RER) from the ESI proposal. (See “ESI Methodology in Question,” NEPOOL Markets Committee Briefs: Jan. 14-15, 2020.)

“On a high level, we think that RER is both unnecessary to successfully implement FERC’s fuel security requirements, and we think it is not required to be priced for compliance with NERC or [Northeast Power Coordinating Council] standards,” said Belew’s colleague in the Massachusetts attorney general’s office, Ben Griffiths, an energy analyst for regional and federal affairs.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

The Massachusetts attorney general’s office argues that reserve deficiencies are uncommon, so the need for reserve restoration production is low. | ISO-NE

The RTO’s impact analysis has not demonstrated that RER would actually improve system reliability, he said.

RER has a much weaker link to fuel security, the reason for the market initiative, than either generation contingency reserves (GCR) or energy imbalance reserves (EIR) products, Griffiths said.

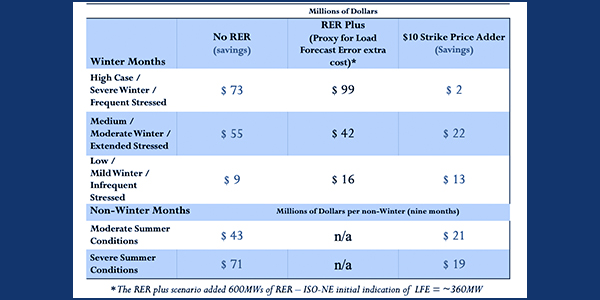

“While removing RER reduces some of the ISO’s desired incentives, it seems that removing [RER] will save $50 [million] to $142 million per year, depending on how you combine the different winter and summer seasons,” Griffiths said. “And in doing so it doesn’t disrupt the rest of the core ESI design — the GCR and EIR components, and the self-disciplining that they offer one another.”

Griffiths noted that much of the material in their presentation was not new, but that they updated data looking at the historical role of reserve deficiencies: their durations, magnitudes and season.

Based upon exogenous fuel assumptions, ESI tends to increase fuel availability, which might be helpful, “but the impact analysis does not show — when the rubber hits the road, when the system gets really tight and we start approaching reserve deficiencies — that ESI actually improves reliability,” Griffiths said.

“RER offers poor value for money,” he concluded.

Look Back, Carefully

The Massachusetts attorney general’s office and the New England States Committee on Electricity (NESCOE) are jointly sponsoring an amendment to add a look-back provision to the ESI program to enable evaluation of its efficacy.

Under the amendment, the Internal Market Monitor would assess the competitiveness of the energy call option offers and day-ahead reserve prices, determine if any uncompetitive prices are the result of market power and estimate any excess consumer payments resulting from market power.

“We are conscious of and want to respect the Market Monitor’s independence; so while we felt comfortable saying what one of the purposes of the evaluation would be, we leave it exclusively to the discretion of the IMM to determine what evaluation criteria it’s going to use,” Belew said.

The amendment proposes that the Monitor file a quarterly report of its findings with FERC, while ISO-NE will file a quarterly certification of the competitiveness of the energy call options and resulting prices.

Consumer costs scenarios under ESI | NESCOE

Jeff Bentz, NESCOE director of analysis, said his organization had open discussions of the various amendments with IMM staff, who were helpful.

“This ESI thing is in such flux, there’s only small pieces being proposed now,” Bentz said. “There’s a lot of work to do afterwards, so we thought it would not be fruitful to define the criteria here in this room between now and March 24” — the date of the MC vote.

NESCOE also put forward several ESI amendments to include a $10 strike price adder; set the RER quantity to zero for non-winter months; and remove accounting for load forecast error in RER.

“We really have worked hard starting back in July and August, and came to this committee in September, made changes and continued to work towards what we thought were amendments that would decrease consumer costs while still not harming the incentives for the objectives that ISO New England was trying to achieve,” Bentz said.

“This isn’t an attempt to just whittle down money and to be cheap,” he said. “It really comes back to what are the costs and what are the benefits. If we can get the same benefits at a lesser cost, that’s the right approach.”

The Markets Committee also voted to recommend that the Participants Committee support NESCOE-sponsored Tariff revisions relating to energy efficiency resource capacity supply obligations during scarcity conditions. (See “NESCOE Intent on EER Revisions,” NEPOOL Markets Committee Briefs: Nov. 12-13, 2019.)

— Michael Kuser