PJM is “confident” it will meet FERC’s deadline for resolving pricing and dispatch misalignment issues in its fast-start pricing proposal, the RTO’s Tim Horger told the Market Implementation Committee on Wednesday.

In January, FERC held PJM’s fast-start compliance filing in abeyance until July 31, after the Independent Market Monitor and others told the commission the RTO currently computes dispatch instructions using a different market interval than it uses to calculate prices. “PJM appears to dispatch resources for a target interval that is roughly 10 minutes in the future but immediately assign the prices associated with that future dispatch interval to the current interval,” the commission said. (See FERC Stalls PJM Fast-start Compliance Filing.)

In April 2019, the commission ordered PJM and NYISO to revise their tariffs to allow fast-start resources to set clearing prices, saying their current rules are not just and reasonable.

Horger said PJM staff conducted a site visit to SPP and scheduled a conference call with MISO to learn how those RTOs implemented fast-start pricing. PJM’s plan to visit MISO was canceled because of new travel restrictions implemented in response to the COVID-19 coronavirus pandemic.

“They’re not going to be able to sit in with the [MISO] operators, but we think that the conference call … should be beneficial. All the questions that we’re looking at should still be answered. We don’t think that’s going to get in the way of any decision moving forward,” Horger said.

He said PJM is working with the Monitor to solve the alignment issues to meet FERC’s directive and hopes to develop a “comprehensive package” that could include additional changes to the RTO’s real-time security-constrained economic dispatch application.

“If we can’t move forward with the comprehensive package, PJM still wants to move forward with the narrow approach that PJM feels is in compliance with the fast-start order,” Horger said. He said the RTO will return to the MIC in April with the “path forward.”

Scope, Name Change for Credit Subcommittee?

PJM’s Dave Anders said the RTO will propose a revised charter for the Credit Subcommittee that could have it reporting directly to the Markets and Reliability Committee to raise its “visibility” and improve meeting attendance.

Anders said the subcommittee — which hasn’t met since December 2018, as members have focused their efforts on the Financial Risk Mitigation Senior Task Force in the wake of the GreenHat Energy default — is the best venue for considering a planned problem statement over a credit risk issue the RTO identified last month.

PJM told members Feb. 12 that it had identified a potential credit risk for the third Incremental Auction for the 2020/21 delivery year. “The good news is the potential credit risk … did not materialize” in the auction, which began Feb. 24, Anders said Wednesday.

Although the risk was expected to apply to only a small number of bids, PJM said that if a capacity market participant submits buy bids in an IA that could result in a position that is in excess of the committed unforced capacity for the delivery year in the same account, the RTO would require the participant to post collateral to secure any uncovered position.

PJM said that it will introduce a problem statement and issue charge to provide “additional clarity and protections with respect to certain capacity market scenarios.”

In addition to having the subcommittee report to the MRC rather than the MIC, Anders said PJM is considering broadening the subcommittee’s charter to “look more at risk issues and risk mitigation.” The revised charter of the “credit/risk” subcommittee will be brought to the MRC, perhaps as early as this month’s meeting, he said.

PJM Developing Alternative on Stability-limited Generators

PJM officials outlined a potential change in how it curtails generating output when needed to maintain stability during nearby maintenance outages.

Units must sometimes be reduced below their normal economic max limit if a planned or unplanned outage presents stability problems that could result in damage to the units.

Current rules require the RTO to implement a thermal surrogate to reflect the stability constraint in the day-ahead and real-time markets and to bind the constraint, affecting the unit’s dispatch.

Alternatively, a generation owner can voluntarily reduce its eco max limit and submit a notification ticket to PJM. In that case, the RTO will not bind that constraint and the unit will be paid the system LMP at the reduced output.

Units can also agree to reduce output in lieu of making system upgrades when stability limits are identified in the interconnection study process.

The MIC agreed in August to consider alternative approaches in response to a problem statement and issue charge by Panda Power Funds’ Bob O’Connell, who said PJM’s decision to remove supply from the market to address stability constraints will result in some units committing at price-based offers, rather than cost. Under the RTO’s rules, only the affected generator would know of the constraint, O’Connell said, gaining a competitive advantage over other units and possibly incorporating greater mark-ups into their offers. (See “Modeling Units with Stability Limitations,” PJM MIC Briefs: Aug. 7, 2019.)

PJM’s Keyur Patel outlined a proposal to model stability limits on generating units as a “capacity constraint” that doesn’t directly affect the LMP. The sum of megawatts from stability-restricted units would be capped at the stability limit regardless of virtual bidding. The sum of energy megawatts plus reserve megawatts from stability-restricted units would also be capped at the stability limit. The output of stability-restricted units would be based on their offer curve and LMPs.

Stakeholders questioned some of the examples in Patel’s presentation, saying they did not respect merit order. None offered any additional suggestions to the solution matrix.

MIC Chair Lisa Morelli said the committee will begin considering complete packages at its next meeting.

Load Management Mid-Year Performance Report

PJM’s Jack O’Neill gave a presentation on the Load Management Mid-Year Performance Report, highlighted by the performance assessment interval (PAI) event on Oct. 2, 2019, the first to occur since April 2015.

PJM dispatched both Capacity Performance demand response long lead resources and base DR from 2 to 3:45 p.m. ET in the Dominion, PEPCO and BGE zones and from 2 to 4 p.m. in the AEP zone during the event, which was caused by an underestimated load forecast, combined with typical maintenance schedules and unexpected line losses. (See PJM, Stakeholders Baffled by DR Event.)

CP resources, which were in their mandatory compliance period, produced 19.9 MW of reductions, 78% of the committed capacity of 25.4 MW. Base DR, which was not mandated to respond, produced only 373 MW of an expected 704 MW.

PJM uses the expected energy reductions reported by curtailment service providers as part of the dispatch decision-making process when DR resources are required to maintain system reliability, the report said.

The event resulted in $40,049 in penalties ($284/MW) on CP resources that failed to produce required reductions and bonuses totaling $447,666 ($34.73/MW), nearly all of it to base DR resources.

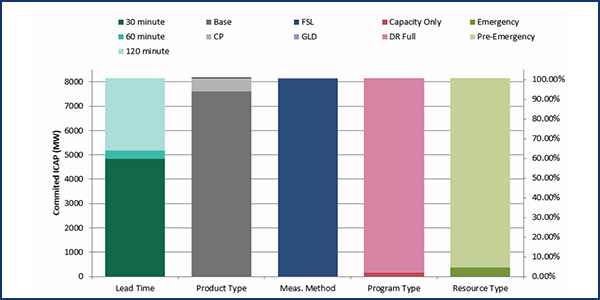

The RTO has 8,159 MW of load management resources for 2019/20.

— Rich Heidorn Jr. and Michael Yoder