By Michael Yoder

PJM’s Reliability Pricing Model is acquiring more capacity than needed, leading to dirtier, less efficient generation and billions annually in excessive costs for consumers, according to a report released Monday.

Economist James F. Wilson said PJM is purchasing unnecessary capacity because of auction design features and inaccurate peak load forecasts, leading to a retention of “older, inefficient and often environmentally damaging” power plants that should be retired and the entry of new power plants that are not yet needed.

The report, prepared for the Sierra Club and the Natural Resources Defense Council, reiterates longstanding complaints about PJM’s capacity market while also attempting to quantify the impact of them.

Wilson said the total cost of the most recent Base Residual Auction, held in 2018, would have been $4.4 billion lower if its demand curve was corrected (by reducing the net cost of new entry (CONE) from $321.57/MW-day to $160.79/MW-day) and the reliability requirement was reduced by 8,000 MW. (See related story, PJM MOPR Floor Prices Reduced for Gas, Nuclear, Solar Units.)

Wilson also found that the excess capacity depresses spot prices for electricity and ancillary services, dampening price signals that could attract flexible resources that are increasingly needed to supplement renewables.

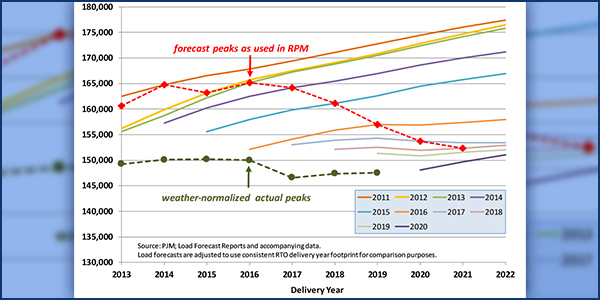

Although PJM’s target installed reserve margin is generally around 16% of the forecast peak load, Wilson found the RPM auctions regularly clear significantly more, accounting for an equivalent to reserve margins of 20% or more.

When the reserve margins were recalculated based on the final peak load forecast for each delivery year, the reserve margins have been 24% or more for all but one of the delivery years between 2012/13 and 2020/21. Wilson said RPM typically results in commitments that are roughly 10% or more in excess of the target, resulting in more than 15,000 MW of excess capacity in recent years.

Wilson said excess capacity is likely to increase in the future because FERC’s order expanding the minimum offer price rule (MOPR) will prevent additional resources that receive state subsidies from clearing the RPM. The removal of nuclear plants and renewable sources from the RPM through the MOPR will set a higher clearing price through duplicative capacity that falsely signal a need for additional resources, Wilson said, worsening the over-procurement issue.

“RTOs such as PJM are responsible for reliability and resource adequacy, not its cost, and they generally prefer more capacity, committed sooner, and under the most stringent performance requirements,” Wilson said in the report. “Capacity sellers also prefer market rules that raise capacity procurement quantities and, as a result, increase the capacity auction clearing prices they receive. Thus, the current planning procedures and market rules lead to over-procurement and higher capacity prices and have not been designed to achieve a reasonable balance in the interests of consumers between the value of more capacity and its cost and other market impacts.”

PJM Responds

Asked to respond Monday to the report, PJM said that its capacity market has helped to maintain a reliable system that has kept market-driven electricity costs flat for two decades, while at the same time incentivizing new technologies that have helped reduce emissions rates by 34% since 2005.

“PJM is constantly refining and enhancing its forecasting and capacity procurement models,” Jeff Shields, PJM’s media relations manager, said in a statement. “Changes made to the forecasting models starting 2016 — to account for energy efficiency, distributed solar generation and other factors — have greatly improved forecasting accuracy. In addition, the factors we used to determine the capacity needs for 13 states and the District of Columbia are developed through an independent consultant, thoroughly vetted in a stakeholder process, then submitted to FERC, which considered similar arguments raised in the report before it approved the best course to maintain resource adequacy.”

Although Wilson acknowledged PJM has made improvements, he said its peak load forecasting model “has failed to fully capture this trend toward increasing efficiency, and its three-year-forward forecasts have generally been 10,000 MW or more too high.”