By Rich Heidorn Jr.

PJM on Wednesday submitted proposed Tariff changes to comply with FERC’s controversial December order requiring expansion of the minimum offer price rule (MOPR) to new state-subsidized resources.

A quick review of the 683-page filing did not reveal any major surprises (EL16-49, ER18-1314, EL18-178). The RTO had discussed its planned compliance filing in nine stakeholder meetings since December, including two last week. (See PJM MOPR Floor Prices Reduced for Gas, Nuclear, Solar Units.)

“These issues have been the subject of rigorous review and consideration of varying stakeholder interests within the time limitations allotted by the commission for the submission of this compliance filing,” PJM said, noting that RTO officials also have communicated with state regulators and the Organization of PJM States Inc. (OPSI).

“PJM has heard and thoroughly considered the views of all stakeholders and representatives of states and, through this compliance filing, has attempted to balance all of the competing views on these various issues into a proposal … which is designed to meet the commission’s Dec. 19 order’s directives while also ensuring orderly and timely capacity auctions going forward.”

In addition to extending the MOPR to new state-subsidized resources, the rules would continue the existing MOPR on new combustion turbine and combined cycle natural gas resources.

“Where certain elements of the commission’s Dec. 19 order required additional details to support the design and application of the modified MOPR, PJM has used its best efforts to add these additional detailed elements to comply with the overarching goal of the Dec. 19 order,” the RTO said. “To provide market certainty, PJM will await commission action on this filing before implementing the modified MOPR in the next Base Residual Auction (BRA).”

Schedule

PJM asked the commission to allow at least 35 days for comments on its filing (no sooner than April 22). “Such an extension is appropriate given the volume of this filing and current circumstances,” the RTO said. “This will afford market participants sufficient time to review and comment on the proposed changes, which is necessary given the relative importance of this filing to PJM’s capacity market.”

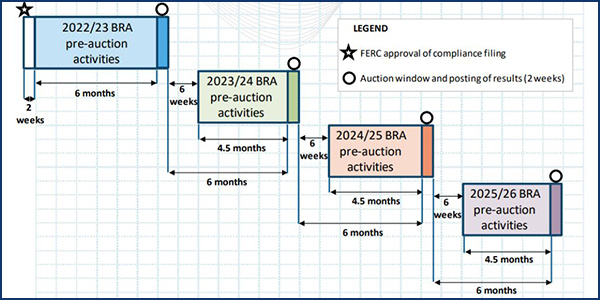

It proposed “an orderly, but compressed” auction schedule following commission action on the compliance filing, saying it would complete all pre-auction activities and open the BRA for the 2022/23 delivery year within six-and-a-half months after the commission’s acceptance of the compliance filing. (See PJM Proposes Auction for 6 Months After FERC Ruling.)

“Capacity market sellers should know before they make concrete auction preparations, for example, the specific definition of a state subsidy, the details of available exemptions, the net CONE [cost of new entry] and ACR [avoidable-cost rate] screening values for the various resource categories, and the parameters of an acceptable unit-specific exception showing — just to name a few,” it said.

Exemptions

Exempted from the MOPR would be existing resources participating in state renewable portfolio standard (RPS) programs; existing demand response, energy efficiency and storage resources; and existing self-supply resources. Federal subsidies would not trigger the MOPR.

FERC’s order also provided for exemptions for resources that forego state subsidies and those that can prove through the resource-specific exception that their costs are lower than MOPR reference values.

“While FERC’s order combined exemptions for demand resource, energy efficiency resources and capacity storage resources, PJM proposes to separate out capacity storage resources as a separate categorical exemption given the distinctions with demand resources and energy efficiency resources,” the RTO said.

It said it will offer “non-binding guidance” for capacity market sellers as to whether their resources qualify as subsidized.

“PJM and the Market Monitor will work together to develop a non-exhaustive list of programs, based on information provided by capacity market sellers, that they consider to be a state subsidy and post this list in a guidance document. Given the myriad state and local programs that may exist throughout the PJM region and the fact that such programs may change over time, it would not be practical to include a list of specific state subsidies in the Tariff,” it said.

“Instead, PJM will develop and maintain, in collaboration with the Market Monitor, a list of specific state subsidies to provide guidance on many of the most common programs that may be applicable to capacity resources. Importantly, however, it is ultimately the capacity market seller’s responsibility to ensure that they correctly certify whether its capacity resource is subject to a state subsidy, irrespective of any guidance provided by PJM and the Market Monitor.”

It said such certifications should be subject to fraud and misrepresentation rules modeled on the provisions the commission previously approved regarding to capacity market sellers seeking a categorical exemption from the MOPR (ER13-535).

Legal Challenges Expected

FERC approved the expanded MOPR on a 2-1 vote, saying it was needed to combat price suppression from growing state subsidies, such as those for nuclear plants in Illinois, New Jersey and Ohio. Commissioner Richard Glick dissented, calling the order an attack on decarbonization efforts that would add billions in increased capacity costs.

Dozens of stakeholders filed requests for rehearing or clarification of the order, with some observers predicting the issue will end up in front of the Supreme Court. (See PJM MOPR Rehearing Requests Pour into FERC.)

Todd Snitchler, CEO of the Electric Power Supply Association (EPSA), whose members own and operate more than 50,000 MW of capacity in PJM, praised the filing. “Since December, there has been a productive and extensive public conversation among all stakeholders about how competitive electricity markets can best serve the interests of consumers and the power grid,” he said. “PJM has worked diligently under a compressed timeline to conduct a thorough stakeholder process and develop a MOPR implementation plan while ensuring that perspectives from all relevant groups were considered and incorporated into its compliance filing. … Now, FERC must act expeditiously in order for PJM to move forward and hold its long-delayed Base Residual Auction as soon as possible.”

The American Wind Energy Association also gave an upbeat review.

“PJM’s proposal provides the flexibility necessary for renewable resources to demonstrate that they are among the lowest cost and most reliable sources of capacity available today,” said Amy Farrell, AWEA’s senior vice president of government and public affairs. “We appreciate PJM’s efforts to develop sensible responses to the unsustainable policies that FERC mandated for the region’s competitive market. AWEA and our members will continue working constructively with PJM to restart the capacity market and find practical solutions that recognize the value of renewable energy and protect the ability of states to control the fuel mix within their borders.”

Katherine Gensler, vice president of regulatory affairs for the Solar Energy Industries Association, said that although the organization “objects to the underlying policies presented in the current MOPR construct, PJM took a positive step in proposing how to comply with FERC’s December order. PJM’s submission will allow renewable generators to properly identify a project-specific bid price for bidding into the capacity market auctions. This process provides renewable generators a better opportunity to compete on a level playing field with other capacity providers and to help meet states’ clean energy goals.

“We request that FERC act swiftly to restore PJM’s annual capacity auctions in a timely manner. Our member companies are ready to see market certainty return to PJM and to put this multi-year debacle to a close.”