ISO-NE’s Energy Security Improvements (ESI) initiative hit a stumbling block last week when the New England Power Pool Markets Committee failed to approve a motion to recommend that the Participants Committee back the measure at its April 2 meeting.

The proposal won only 52% support, below the 60% needed for a recommendation to the PC.

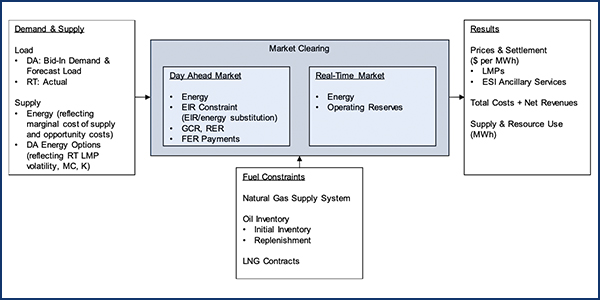

ESI seeks to improve the region’s fuel security by creating option-based energy and reserve services that reflect the operational capabilities the RTO relies on but does not compensate in the day-ahead time frame. The RTO says it would incentivize resources providing those capabilities to firm-up their energy sources.

“We’ll be presenting the proposal to the Participants Committee next week and will be making our filing by the April 15 deadline,” ISO-NE spokesman Matthew Kakley told RTO Insider. “If the PC votes to support an amended version of the ESI proposal that we do not support, we will include that version in our filing, along with our proposal.”

Stakeholders have for months been attending extra meetings of technical committees to ready the market design ahead of the April 15 filing deadline (EL18-182). (See “ESI Virtually Rolls to April Deadline,” NEPOOL Markets Committee Briefs: March 10-11, 2020.)

Before the vote on the main ESI motion, as outlined in a memo from the RTO, the MC voted to amend the motion to reflect the changes contained in materials provided by the New England States Committee on Electricity (NESCOE) relating to setting replacement energy reserves (RER) to zero for non-winter months.

All sectors had a quorum, and the motion to amend the main motion was voted on by roll call, passing with a vote of 60.73% in favor, as recorded by the committee secretary.

Prior to the vote, ISO-NE economist Christopher Geissler reviewed additional tables incorporated into the draft impact analysis report. Andrew Gillespie, principal analyst with the RTO, reviewed a memo from the RTO’s Market Development department and Internal Market Monitor on additional changes incorporated into the proposed Tariff language since the previous MC meeting.

The amended main motion was later voted on by roll call. The individual sector votes were: Generation (16.79% opposed); Transmission (13.43% in favor, 3.36% opposed, two abstentions); Supplier (6.72% in favor, 10.07% opposed, five abstentions); Publicly Owned Entity (16.79% in favor, 21 abstentions); Alternative Resources (5.50% in favor, 10.54% opposed, two abstentions); and End User (9.33% in favor, 7.46% opposed, four abstentions).

Amendments Fail, Tariff Changes Go Forward

The MC did not approve a separate NESCOE amendment to remove a load forecast error in RER, the motion failing to pass with a vote of 59.61% in favor.

Before a motion was moved, the Massachusetts attorney general’s office informed the committee it was withdrawing its amendment to eliminate RER from the RTO’s day-ahead ancillary services design.

On the heels of that withdrawal, the Massachusetts attorney general’s office and NESCOE informed the committee they were withdrawing a joint amendment to establish regular assessments of the competitiveness of the ESI and the call option offers, and withdrawing a separate joint amendment to establish the so-called “look-back” provision to enable evaluation of the market design’s efficacy.

A separate NESCOE amendment to include a strike price $10 adder also failed to pass, with a vote of 56.68% in favor.

ISO-NE Assistant General Counsel for Operations and Planning Monica Gonzalez led the discussion before the MC voted to recommend the PC support Tariff revisions reflecting the early sunset of the Inventoried Energy Program (IEP), limiting the program to the winter 2023/24 period.

FERC in February rejected a request by ISO-NE and NEPOOL to roll back the sunset date for a Tariff provision that allows the RTO to retain a resource for fuel security reasons. The RTO submitted a memo to the MC explaining how it plans to refile the Tariff revision when it files its ESI proposal. (See FERC Rejects ISO-NE Fuel Security Sunset Rollback.)

Based on a voice vote, the IEP sunset motion passed with two oppositions and two abstentions in the Generation sector, one abstention in the Transmission sector, three oppositions and one abstention in the Supplier sector, four abstentions in the Alternative Resources sector, and one abstention in the End User sector.

“Back in August we communicated to the committee that what the ISO would be doing is ensuring that the two programs are not in place at the same time,” Gonzales said. “What we’re essentially presenting to the committee is the sunset of the IEP for the second winter so that we don’t have the IEP program in effect at the same time as the ESI rules.”

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

The MC also by voice vote recommended the PC support the RTO’s compliance revisions to Market Rule 1 addressing FERC’s March 10 order rejecting the economic life revisions associated with a permanent delist bid or retirement delist bid (ER18-1770). (See FERC Reverses Ruling on ISO-NE ‘Economic Life’ Rules.)

Timothy Helwick and Gregg Bradley from the IMM said the compliance filing reverts the calculation of economic life for Forward Capacity Auction 15 back to being the maximum evaluation period in which a resource’s net present value is non-negative.

It asks FERC to prospectively apply the new economic life definition — the evaluation period in which a resource’s net present value is maximized — beginning with FCA 16.

— Michael Kuser