Markets and Reliability Committee

Compliance Hotline Announced

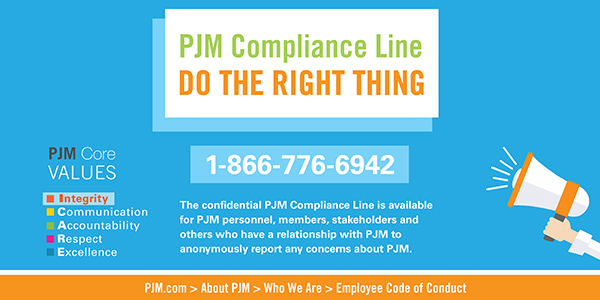

PJM Board of Managers Chair Ake Almgren opened the Markets and Reliability Committee meeting Thursday by introducing a redesigned compliance hotline for RTO personnel and stakeholders to anonymously report violations of laws, regulations or RTO rules.

Almgren said the RTO broadened the existing PJM employee hotline as part of its commitment to a “ethical conduct and the culture of compliance.” Anonymous callers can send tips on violations of the PJM Employee Code of Conduct, RTO governing documents, FERC orders and NERC reliability standards.

The hotline (1-866-776-6942), which will be operated by an independent third-party organization (Navex Global), can also be used to report issues with PJM’s financial reporting.

“In addition, credit risks to the organization that are not being addressed by PJM may also be reported to the hotline,” Almgren said. An independent investigation of the 2018 GreenHat Energy default concluded PJM staff ignored red flags about the company’s assets and exhortations from other members.

Posters highlighting the hotline will be hung around the PJM campus beginning next month.

“I believe the compliance line provides another way for PJM to achieve transparency and continue communications with members and stakeholders,” Almgren said.

Paul Sotkiewicz of E-Cubed Policy Associates called the hotline “an absolutely fabulous idea.”

“We should have had it much earlier in the game,” he said.

Sotkiewicz asked how much authority the third party has to serve as a “mediator” to resolve issues brought to its attention.

“I’ll have to come back to answer that more precisely,” Almgren responded. “The idea is to have an escalation.”

The question–and–answer document for the hotline states that the PJM board “has a formal escalation policy — like that of many of our member companies — that requires certain types of concerns to be escalated promptly to the board. Then the board has the ability to direct the next steps including engaging other independent outside expertise to investigate or otherwise assist with the resolution of the concern.”

The Code of Conduct outlines rules for PJM employees on subjects including conflicts of interest, receiving gifts and maintaining confidentiality. Employees are prohibited from accepting gifts worth more than $150 in any 12-month period and must report all gifts exceeding $50 to Ombudsman Jim Burlew.

The code says the third party will relay details of calls to the ombudsman with a copy to General Counsel Christopher O’Hara. Depending on the nature of the concern, the ombudsman may relay the information to the director of business operations, the director of internal audit, the director of human resources or the senior director of physical security and facilities, “who will conduct a prompt, impartial and thorough investigation.”

“If the violation involves a subject matter which may impact the ability of individuals who should otherwise receive a report to be impartial, the situation will be investigated accordingly,” it says.

PJM declined to say how many calls the existing hotline has received in the past year.

Shift to IMM Opportunity Cost Calculator

Stakeholders approved a compromise proposal to eliminate use of the RTO’s opportunity cost calculator and make the Independent Market Monitor’s calculator the required tool for market sellers. The action will take effect beginning June 1.

The proposal was approved on an acclamation vote with one abstention.

The new policy required changes to Manual 15: Cost Development Guidelines to document the Monitor’s calculator and provides for an annual review of the calculator to ensure compliance with the manual and Operating Agreement. (See “PJM Seeks to Retire Opportunity Cost Calculator, Use IMM Tool,” PJM MRC/MC Briefs: Feb. 20, 2020.)

The calculator is intended to ensure generators are made whole for being scheduled by PJM outside their most profitable time periods.

An opportunity cost adder can be included in a cost-based offer when a unit faces environmental restrictions on how much they can operate, an equipment manufacturer imposes an operational restriction because of equipment limitations, or the unit faces a fuel limitation resulting from a force majeure event. The value of the adder is based on historical LMPs and forecasted future fuel prices.

Jim Davis of Dominion Energy thanked PJM officials for the change.

“It seems like we’ve been talking about these things for not just months, but years,” Davis said. “We look forward to the continued discussion and documentation as changes are made to the calculator.”

Black Start Resources Initiative on Hold for 4-8 Months

PJM said it could take eight months or longer to complete additional analysis in the contentious initiative that could tighten fuel requirements for black start resources.

The RTO told stakeholders March 2 that the initiative would go on “hiatus” for up to six months to conduct the analyses, as requested by the Organization of PJM States Inc. (OPSI). (See PJM Backs off Black Start Fuel Rule.)

But PJM’s Janell Fabiano told the MRC that the analyses could take four to eight months, and possibly longer, because of the need to reconsider the prioritization of other pressing issues in light of the COVID-19 pandemic.

PJM plans to analyze restoration times, the impact of gas supplies costs and economic impact. It called for the initiative in 2018, noting that the only fuel assurance requirement for black start resources is that they maintain enough for 16 hours of run time.

The RTO has estimated that requiring 100% of black start units to have a secondary fuel source would require $513 million in capital spending, increasing annual revenue requirements by $67.2 million over the current $65 million. A proposal that would limit such fuel assurance requirements to one resource per transmission owner zone is estimated to cost $13 million, or $1.9 million per year.

Manual Changes OK’d

The MRC endorsed six manual changes, including updates from periodic cover-to-cover reviews and updated procedures:

- Manual 12: Balancing Operations as part of a periodic review.

- Manual 13: Emergency Operations as part of a periodic review.

- Incorporated changes to Manual 14A: New Services Request Process, Manual 14E: Upgrade and Transmission Interconnection Requests and Manual 14G: Generation Interconnection Requests, related to FERC Order 845 on generator interconnection procedures and agreements.

- Manual 22: Generator Resource Performance Indices as part of a periodic review.

- New sections in Manual 33: Administrative Services for the PJM Interconnection Operating Agreement for member roles and responsibilities and contact management and company account manager roles and responsibilities. Some existing sections were relocated.

- Manual 37: Reliability Coordination as part of the periodic review.

Members Committee

Voting Rule Waived

The Members Committee unanimously approved one-time revisions to Section 11.11 of Manual 34 regarding voting requirements for board elections in response to the cancellation of PJM’s annual meeting originally scheduled for May 4-5 in Chicago.

Section 11.11 calls for votes on board members to be taken by secret paper ballot by those at the meeting and by secret ballot over the phone for members participating by teleconference, PJM’s Dave Anders said.

Anders said that because this year’s meeting will now take place solely by teleconference, the members have been left with an “untenable situation” with collecting votes over the phone. PJM suggested a one-time waiver of the requirement of a secret ballot to allow the use of the RTO’s voting application.

In response to members’ concerns to keep the vote secret, Anders said PJM staff will delete the record of individual votes immediately after tabulating the results.

Some members suggested using an independent third party to tally the votes.

Anders said using a third party was a legitimate suggestion for future votes but would be difficult to implement in time for the May vote.

The revision passed unanimously by acclamation.

January Minutes Still not Approved

The minutes for the Jan. 23 MC meeting were not approved for a second consecutive month. Initially the minutes weren’t approved at the February meeting because they weren’t posted in time.

Sharon Midgley of Exelon requested Thursday that the minutes not be approved because of potential “voting anomalies” at the meeting. Midgley said she relayed questions to PJM after the meeting regarding the vote, but the voting discrepancies have not been resolved and are still being investigated.

Anders confirmed that Midgley had told the RTO that a member who voted at the January meeting may be affiliated with another member. The member organization was not identified.

Anders said PJM is working with legal staff to resolve the inquiry by Midgley. He said he had no issues with deferring the approval of the January minutes until the next meeting scheduled for May 4.

“Our concern is around two companies who appear to potentially be affiliates that both participated in the voting at the MC that day,” Midgley explained after the meeting.

Liaison Committee Meeting Rescheduled

Katie Guerry, vice chair of the MC, said the Liaison Committee meeting with the board scheduled for April 21 has been rescheduled until July. Guerry said members decided it was “not a responsible decision” to move forward with an in-person meeting for April because of the COVID-19 pandemic and have instead looked to have it in the summer. An additional Liaison Committee meeting will also be added on the calendar for December, Guerry said, so that four meetings can still be held within the calendar year.

Guerry also said PJM officials are considering whether to re-evaluate priorities in the MC Annual Plan because of the pandemic.

“There’s a mindfulness of the reality of the situation that we are all in and the limited resources that we all have,” Guerry said. “We want to minimize the burden on folks in this extreme time.”

New Finance Committee Member Elected

Mike Peters of industrial and medical gas producer Messer LLC was selected to fill an open position on the PJM Finance Committee within the End Use Customer sector.

Peters will fill the seat vacated by George Waidelich of Safeway, which recently left PJM membership. Peters’ term expires at the end of 2020.

— Michael Yoder