By Amanda Durish Cook

[Updated to include MISO comments from conference call April 15.]

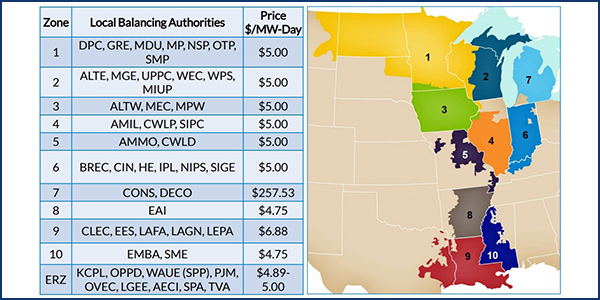

MISO’s eighth annual capacity auction marked the RTO’s first clearing price set by its cost of new entry (CONE), as prices in the Lower Peninsula of Michigan rocketed to almost $260/MW-day while all other zones cleared under $7/MW-day.

Zone 7 cleared at the CONE price of $257.53/MW-day for planning year 2020/21, beginning June 1.

The RTO’s CONE is used as the maximum offer and clearing price in the Planning Resource Auction. CONE represents the estimated annualized capital cost of constructing a 237-MW combustion turbine plant in different locations in the footprint.

Since beginning its capacity auctions in 2013, MISO has never experienced prices set by CONE. This year’s capacity prices in Lower Michigan are more than ten times the price of capacity paid in the last planning year.

The RTO said Zone 7 fell 123 MW short of its nearly 22-GW local clearing requirement and had to turn to other zones for capacity procurement, thereby triggering the CONE price. The RTO said only about 1,150 MW of load — 6% of Zone 7’s forecasted peak — must pay the CONE rate because MISO is mostly vertically integrated utilities that procure their own capacity outside the PRA.

“The results also reflect the industry’s ongoing shift away from coal-fired generation and increasing reliance on gas-fired resources and renewables,” the RTO said in a release.

All other MISO capacity zones remained below $7/MW-day, with most around $5/MW-day:

-

-

- Zones 1-6 — which include Minnesota, Iowa, Illinois, Indiana, Missouri, Montana, Wisconsin and the Upper Peninsula of Michigan — cleared at $5/MW-day;

- Arkansas’ Zone 8 and Mississippi’s Zone 10 cleared at $4.75/MW-day; and

- Louisiana and Texas’ Zone 9 cleared at $6.88/MW-day.

-

Additionally, external resource zones cleared between $4.89-$5.00 depending on where they connect to the MISO system.

Last year, all zones cleared at $2.99/MW-day except for Zone 7, which cleared at $24.30/MW-day. (See Most MISO Zones Clear at $3/MW-day in 2019/20 PRA.)

The RTO received 141.5 GW worth of offers in this year’s auction, about 6 GW above the nearly 136-GW reserve margin requirement for June 2020 through May 2021. It expects an almost 122-GW coincident system peak this summer.

MISO also said the South-to-Midwest transmission transfer limit bound during the auction, causing a $0.25 price separation between the Midwest and South. The last time the transfer limit bound in the capacity auction was in 2016. Zone 9 also experienced a slightly more expensive clearing price than most other zones because of a higher local clearing requirement. MISO predicts zones will hit their summer peaks at different times and assigns separate local clearing requirements.

MISO stressed that it continues to have sufficient capacity in the footprint.

“This year’s results reflect adequate resource availability for the upcoming planning year,” MISO Executive Director of Market Operations and Resource Adequacy Shawn McFarlane said. “The grid’s capability to effectively transfer resources among zones remains strong, and we appreciate our members’ participation.”

“Most of the zones cleared at a relatively low prices, reflecting trends we’ve seen over the last few years. The vast majority are well-positioned to meet their capacity needs,” MISO Manager of Capacity Market Administration Eric Thoms said during a special April 15 conference call to discuss auction results. “That’s indicative of the makeup of the footprint.”

But Thoms said Zone 7 has frequently been “very tight, capacity-wise.”

Thoms also emphasized to stakeholders that CONE is function of MISO’s FERC-accepted Tariff, and most load-serving entities in lower Michigan would not be exposed to the CONE price.

“Per the Tariff, if the zone is short of its local clearing requirement, it’s capped at CONE,” he explained.

Thoms also said Zone 7 was impacted by a new rule this year that prohibits resources from offering into the auction if they will be on outage for longer than 90 days of the first 120 days of the planning year. Thoms estimated that the rule impacted 200 to 300 MW of planning resources in Zone 7.

“Being that Zone 7 was tight on a razor’s edge … the outage policy contributed to the zone not being able to meet its local clearing requirement,” he said.

MISO fully expects to field more questions about Zone 7 at upcoming Resource Adequacy Subcommittee meetings, Thoms said.

“There’s going to be a lot of speculation about what this means for Zone 7 this summer,” Coalition of Midwest Transmission Customers attorney Jim Dauphinais said.

Before this year’s Zone 7 price, the most expensive capacity price ever recorded in MISO was the $150/MW-day in southern Illinois’ Zone 4 during the 2015/16 PRA. The price spurred allegations of market manipulation, a three-year FERC investigation and — five years later — a contested FERC assurance that nothing untoward occurred. (See FERC Shelves Grievances over MISO Capacity Auction.)

MISO said auction results line up with the annual Organization of MISO States-MISO resource adequacy survey, which predicted adequate reserves through 2022 but warned that Zone 7, Zone 4 and Indiana and western Kentucky’s Zone 6 have the greatest resource adequacy risks. Last year’s survey indicated a potential 0.9-GW shortage in lower Michigan in 2020. (See Supply Future Brighter, OMS-MISO Survey Shows.)

The RTO said conventional generation will provide about 80% of capacity this planning year. Coal is set to provide 34% of capacity, while natural gas will provide 38%. Nuclear generation again holds steady at about 9%.

However, MISO said renewable capacity continued to gain market share. It reported 850 MW of solar generation cleared this year’s auction — an increase of 25% from last year — and 3,275 MW of wind generation cleared, a 21% year-over-year increase. Demand-based resources also climbed, providing nearly 16 GW of capacity as compared to last year’s nearly 15 GW.

The RTO said will publish the cleared load-modifying resources to the nonpublic MISO Communications System by May 25.