SPP’s Board of Directors last week approved the first two revision requests stemming from the Holistic Integrated Tariff Team’s (HITT) 15-month effort to help the grid operator adapt to the evolving grid and electricity markets.

Gathering virtually for its first meeting since the COVID-19 outbreak began, the board on April 28 signed off on both measures. The changes were previously advanced by the Markets and Operations Policy Committee, Strategic Planning Committee and Regional State Committee.

RR 391, which establishes uniform local planning criteria within each transmission pricing zone under the Tariff’s Schedule 9, received pushback, in line with the frequent tension between transmission owners and customers in SPP’s 19 zones.

As written, RR 391 places the responsibility on the zone’s host TO to facilitate a “consensus-driven” criteria for reliability upgrades, rather than have individual TOs submit their local planning criteria to SPP, to ensure all customers in the zone pay equally for the same types of transmission upgrades. Schedule 9 calculates network service request charges as a ratio share of the monthly annual transmission revenue requirement.

For many transmission customers, the issue was the loss of the words “collaboration” and “consensus” in the RR’s final language.

Golden Spread Electric Cooperative’s Mike Wise said the RR failed to convey the HITT report’s intent.

“The language did fall short,” said Wise, a HITT member. “We spent a huge amount of time discussing how the host utilities in a zone should develop a collaborative process. Certainly, the language should have been a consensus-driven process within each zone. Neither of those words showed up anywhere, and I think we fell short because of that.”

“As a [transmission and distribution user], a small transmission customer being invited to a meeting is one thing. Having your opinion heard or taken into consideration is two completely different things,” Oklahoma Municipal Power Authority General Manager David Osburn said. “I’d like to see a little more teeth, to see the [TDUs] and customers have more meaningful input in the process.”

“The Tariff language … simply requires the big utility in the zone, or the [facilitating TO] to call a single meeting and, based on that, file or not file zonal planning criteria that the FTO determines to be in their best interest,” said consultant Jack Madden, who represents several Texas cooperatives. “We believe this is a far cry from what was hammered out during the HITT discussions.”

Antoine Lucas, SPP’s vice president of engineering, tried to clarify matters by pointing out that it’s up to the entities within the zone to reach agreement.

“Nothing in this language prohibits TOs in the zone from working together to define what consensus means to them and how they want to organize themselves,” he said. “We want to ensure everyone in the zone will have comparable criteria.”

Osburn and three others on the Members Committee voted against RR 391. Wise abstained.

The second Tariff change, RR 401, faced a smoother path to approval, with only one abstention. The measure replaces credits under Tariff Attachment Z2 for certain network upgrades with incremental long-term congestion rights (ILTCRs). It replaces a previous attempt to change the Tariff, which was rejected in January by FERC Order Keeps Z2, Aids EDF’s Sponsored Project.)

Dan Simon, outside counsel for EDF Renewables, spoke out against the measure as he has during previous stakeholder groups, saying SPP’s current ILTCR rules are “inadequate.”

“I think most people would agree. No one has selected the ILTCR option,” he said, calling for SPP to improve the ILTCRs “so they’re more in line with other RTOs.”

SPP staff wasted no time in filing the change at FERC, doing so the day after the board meeting and asking for an effective date of July 1.

The HITT concluded its work last year, handing off its 21 recommendations to various stakeholder groups. The recommendations encompassed four categories: reliability, marketplace, transmission planning and cost allocation.

Directors Suspend Competitive Upgrade

The board sided with recommendations from SPP and the Oversight Committee to suspend a previously approved competitive interregional upgrade, pending negotiations with the seams partner and FERC approval.

The 345-kV Wolf Creek-Blackberry project in Kansas and Missouri was approved by the board last year and included in the 2020 SPP Transmission Expansion Plan, which the board passed in January. Part of the 105-mile project, projected to cost $152 million, would be on the Associated Electric Cooperative Inc. (AECI) transmission system and constructed by AECI.

Because AECI is not a TO under SPP’s Tariff, staff must reach an agreement with it to outline the project’s scope and define cost allocation for its work. The entities have agreed to a joint study schedule to conclude in May, after which they would finalize an agreement that must be approved by FERC before SPP can allocate funds to AECI for the latter’s portion. (See “SPP, AECI Agree to Joint Study,” SPP Seams Steering Committee: April 2, 2020.)

The OC said were SPP to commence its competitive process and issue a request for proposals without reaching an agreement with AECI, “there is significant risk that millions of dollars would be spent on a [competitive selection process] that results in nothing.”

SPP COO Lanny Nickell said were the project not suspended, staff would have to meet a Tariff deadline and begin the RFP process by July without a negotiated agreement and FERC approval in hand.

“There are risks associated with not suspending the project and beginning the RFP process,” Nickell said. “It could impose costs on members if AECI does not ultimately agree to what they have to do on their end.”

For the time being, AECI is projected to spend up to $2 million on a substation. “But if other upgrades are needed to accommodate this request, that opens up a whole series of discussions with AECI and our members, because that would create additional costs,” Nickell said.

Wise said he thought the OC made the correct decision.

“This falls in line with what I’ve been advocating, which is achieving a higher degree of quality in transmission buildouts,” he said. “These are 40-year assets that have to be paid by all consumers in the footprint. We need to ensure AECI pays its fair share.”

“The idea to initiate a process where the clock would be running, and those members wanting to participate would have to start spending time and money to develop a bid, doesn’t seem prudent,” said Brett Leopold, with independent transmission utility ITC Great Plains.

“This project can still be suspended or canceled at a later date if it’s not deemed to be right,” Evergy’s Kevin Noblet said. “Sending an RFP out on the street when the only thing at risk is a few hundred thousand dollars, if that, seems like a risk worth taking.”

Evergy was one of four member companies to oppose the recommendation. Two other members abstained.

COVID-19 Alters Sugg’s Transition Plan

Delivering her inaugural CEO report to the board and committee, Barbara Sugg had to admit her transition into the position held for 16 years by the retired Nick Brown was “not exactly turning out like I had expected.”

Sugg, who was selected to replace Brown in January, had intended to spend much of her first 90 days in the role traveling across the footprint and visiting with SPP’s many stakeholders. (See Sugg Prepares to Take ‘Dream Job’ at SPP.)

Those plans were waylaid by the COVID-19 pandemic after she had met with a dozen different companies.

“The roadshow stopped just as soon as it started. I’m really disappointed I had to cancel many of those meetings,” she said. “COVID-19 may have sidelined me right now, but I look forward to getting back on the road.”

Sugg has continued to conduct virtual meetings and has made individual calls with each of the regulatory commissioners in SPP’s footprint. “It’s good for those commissioners to hear from me so we can start building trust and respect that is mutual.”

Saying it’s “inevitable” that an employee will eventually test positive for COVID-19, Sugg said, “We continue to hope for the best and prepare for the worst.”

There is a silver lining to the pandemic. With the reduction in travel and meeting expenses, SPP has over-recovered about $2.5 million in administrative fee revenues through March. Sugg said that with “lots of meetings planned to be virtual for many months to come,” that number will grow.

However, the pandemic has also resulted in lower demand, “putting pressure on 2020 rates,” she said. SPP has also incurred about $340,000 in net savings by increasing and using the engineering staff, rather than consultants, to manage the interconnection queue.

Sugg said resolving seams issues with SPP’s neighbors remains one of the grid operator’s key goals. “We remain committed to win-win solutions on the seams,” she said.

Lowest Prices Ever for Integrated Marketplace

Keith Collins, executive director of the SPP Market Monitoring Unit, shared with directors and members a draft of the 2019 State of the Market report that found the footprint’s energy prices were the lowest since the Integrated Marketplace went live in 2014.

Day-ahead prices averaged about $22/MWh and real-time prices averaged about $21/MWh, down from $25/MWh in 2018, Collins said. With gas prices below $2/MMBtu, also among the lowest since 2014, natural gas-fired resources frequently set market prices.

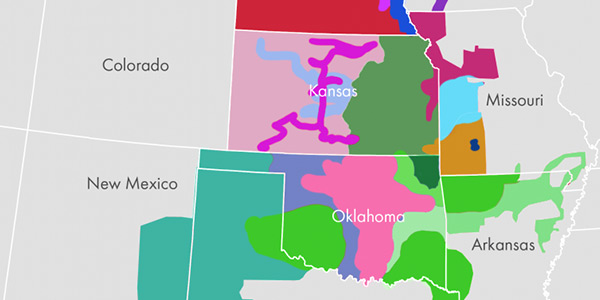

Collins also said the region’s frequently constrained areas have all been removed, partly because of transmission additions that have shifted congestion and leveled the footprint’s market prices. He said the MMU believes Central Oklahoma and the Tulsa area could potentially become frequently constrained areas in the future.

According to the report, the reliability unit commitment process’ make-whole payments rose 55% to nearly $70 million last year. Collins attributed the increase to more resources being brought on from the RUC processes, including manual commitment for capacity needs.

The MMU also said wind generation continues to catch up with coal. Wind resources accounted for 27% of all generation in 2019, up slightly from 23.5% the year before. Coal generation, meanwhile, fell from 42% in 2018 to 35% last year.

The report outlined recommendations for SPP’s market, including improving price formation during emergency and scarcity conditions, improving outage coordination, increasing flexibility and enhancing the ability to assess a range of transmission planning outcomes.

Collins said the MMU has noticed several concerning trends, including a 70% increase in scarcity intervals, increased negative pricing during the overnight hours, and increased generator outages and emergency conditions.

“Scarcity intervals highlight an increase in the volatility that occurs in the real-time market,” Collins said. “It’s driven by short-term, ramping-related scarcity events that happen on the system. That’s why we’ve been supportive of ramping products.”

The MMU’s market-enhancing recommendations include improving price formation during emergency conditions and scarcity events, incentivizing capacity performance, and updating and improving outage-coordination methodology.

“It’s important to set proper prices during these types of events,” Collins said. “Scarcity events are actually reflecting events that are happening on the system. You want the power flowing in the right direction, particularly when scarcity events occur.”

SPP has already formed the Generator Outage Task Force to improve outage coordination.

Staff Strengthening TCR Credit Practices

Director Graham Edwards, chair of the Finance Committee, said the Credit Practices Working Group (CPWG) has spent the last 18 months trying to strengthen the use of credit in SPP’s transmission congestion rights (TCR) market. The work follows the 2018 GreenHat Energy default in the PJM market, which left members liable for more than $100 million. (See FERC Orders PJM to Unwind GreenHat Settlements.)

The group is recommending increasing the minimum capitalization for participants in the TCR market to either at least $20 million in assets or $10 million in net worth, or by increasing alternative collateral requirements. The CPWG is also recommending a strengthened credit application and minimum collateral on all TCR portfolios.

The Finance Committee has approved the recommendation and sent it through the stakeholder process for Tariff language development.

The board approved the committee’s recommendation that it accept accounting firm BKD’s 2019 audit report and findings. BKD said it did not find any issues or concerns in its review of SPP’s accounting practices.

Digital Release for 2019 Annual Report

The virtual meeting marked another break in tradition for SPP. The RTO’s annual report was posted digitally instead of being placed in each director and member’s chair.

Entitled “Integration,” the report includes former CEO Brown’s final introductory message and focuses on the five major initiatives facing SPP: seams issues, transmission, Western expansion, the HITT recommendations and providing member value.

Consent Agenda Includes Exit Fee Changes

The board’s consent agenda, unanimously endorsed by the committee, included revisions to SPP’s bylaws and membership agreement that define the exit fees for transmission-owning and non-transmission-owning members upon their withdrawal.

FERC in December scuttled SPP’s alternative proposal of a $100,000 exit fee and rejected a rehearing request. It also directed the RTO to make a compliance filing that ensures non-TO members pay a lower fee should they leave (EL19-11). (See FERC Denies Rehearing of SPP Exit Fee Decision.)

Other items on the consent agenda included:

- An amendment to the membership agreement that allows Roughrider Electric Cooperative, embedded in the Integrated System as a Basin Electric Power Cooperative member, to join SPP as a TO. Roughrider, a non-transmission-owning member of SPP as of April 30, will transfer functional control of its transmission facilities to the RTO, pending FERC approval. The IS joined SPP in 2015. (See Integrated System to Join SPP Market Oct. 1.)

- The nomination of Kansas Electric Power Cooperative CEO Suzanne Lane to the Human Resources Committee.

- Revising the Corporate Governance Committee’s scope to use independent executive search firms to replace a director or fill a vacancy on the board.

- Baseline resets for five previously approved transmission projects. (See “Members Approve 1 RAS, Retirement of Another,” SPP MOPC Briefs: April 14, 2020.)