The expanded minimum offer price rule (MOPR) will cost PJM ratepayers almost $9.7 billion over the next nine years if FERC adopts revised floor prices allowing most nuclear plants to clear, according to a new analysis by critics of the commission’s directive.

Michael Goggin and Rob Gramlich of Grid Strategies generated headlines last August with a report that predicted an expanded MOPR could add $5.7 billion annually to PJM’s capacity costs. (See MOPR Impact Study Ruffles Feathers Ahead of FERC Ruling.) The estimate was cited by those calling for pulling the Commonwealth Edison zone in Northern Illinois out of the capacity market — and criticized by others, including Independent Market Monitor Joe Bowring, as wildly inflated.

Gramlich said the new analysis was prompted by FERC’s December order, which exempted more existing renewable energy than prior proposals, and PJM’s March 2020 compliance filing, which reduced MOPR floor prices for nuclear plants and renewables. (See PJM MOPR Floor Prices Reduced for Gas, Nuclear, Solar Units.)

The new analysis considers two scenarios: one in which FERC accepts PJM’s lower floor prices, and one in which the prices reflect the RTO’s original October 2018 proposal.

The authors say the new report is subject to many uncertainties, but that even under the best-case scenario, the MOPR is guaranteed to raise prices. “There are so many versions of MOPR and factors such as bid levels that vary between versions and over time that it is not possible to definitively conclude, as some have, that MOPR will have limited cost impacts,” the report says. “Under most scenarios, MOPR will result in billions or tens of billions of dollars in excess costs to electricity consumers across PJM.”

The report notes that the clearing price for the most recent Base Residual Auction in 2018 was $140/MW-day, with some zones clearing at between $165.73 and $204.29/MW-day.

PJM reduced MOPR floor levels of $175/MW-day for solar PV with tracking, which would have been low enough to clear in some areas of the RTO in 2018. But the RTO’s proposed $367/MW-day for solar PV without tracking, $1,023/MW-day for land-based wind and $3,146/MW-day for offshore wind are well above prior clearing prices.

PJM’s new proposal would allow multiunit nuclear resources to clear the market along with most or all single-unit nuclear plants. The authors assumed new renewable sources would not clear under either of the two scenarios, regardless of whether they were using the default bid levels proposed by PJM or resource-specific offer floors.

“It is likely that some solar, and potentially some land-based wind projects, could demonstrate evidence for unit-specific bid levels that are low enough to clear the capacity market,” the report acknowledged. “If resources do not clear, capacity market prices increase and redundant replacement capacity must be purchased and paid for by consumers, further increasing their bills.”

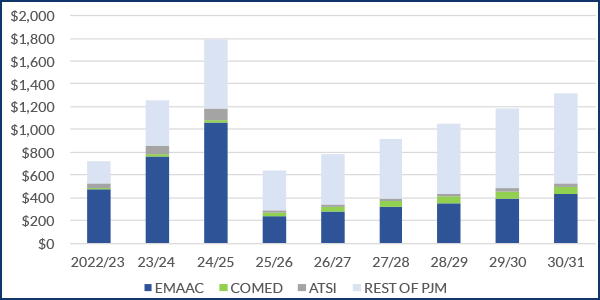

Under the first scenario, the new MOPR could increase capacity costs by nearly $10 billion total over its first nine years, an average of more than over $1 billion annually. PJM’s capacity costs last year totaled $8.7 billion.

Under the second scenario, subsidized nuclear units in Illinois, New Jersey and Ohio would fail to clear, resulting in an increase of almost $24 billion over the nine years, an average of $2.6 billion annually, the authors say.

Caveats

The authors said their estimates are likely conservative because they don’t include the impact of subjecting self-supply, state default service auctions, demand response and energy efficiency resources to the MOPR.

Another variable is how quickly PJM states meet their renewable portfolio standards. Grid Strategies estimates almost 47 GW of nameplate capacity wind, solar and storage will be needed by 2030 to meet state targets.

“The cost of MOPR would be higher if renewable deployment is front-loaded into the next few years to benefit from federal renewable tax credits that are phasing down for projects completed through the mid-2020s” as was assumed in the 2019 study, the authors said. “This would result in a larger cost being attributable to MOPR, as those resources are subject to MOPR for a longer period of time and there is a larger price impact in the near term, but likely lower total cost to consumers because the renewable projects benefits from larger tax credits.”

Another course of uncertainty is that PJM is planning to revise the method for calculating the capacity value of wind and solar projects. (See PJM MRC Moves Forward on Storage, Hybrids.)