FERC on Thursday approved PJM’s proposed energy price formation revisions, agreeing with the RTO that its reserve market was not functioning as intended (EL19-58, ER19-1468).

“PJM made a persuasive case that its current reserve market design must be overhauled,” Chairman Neil Chatterjee said during the commission’s monthly open meeting, held by teleconference because of the COVID-19 pandemic. “PJM showed that the current market mechanism systematically fails to enable PJM to acquire within the market the reserves it needs to operate its system reliably and [that] it fails to send appropriate price signals for efficient resource investment.

“The fact that PJM operators regularly must procure thousands of megawatts of reserves outside of the market construct is evidence of a market design that is unjust and unreasonable.”

PJM filed its proposal unilaterally in March 2019 under Section 206 of the Federal Power Act because stakeholders could not come to a consensus on one plan. It was the culmination of a year’s worth of debate and discussion among stakeholders, RTO staff and members of the Board of Managers. (See PJM Files Energy Price Formation Plan.)

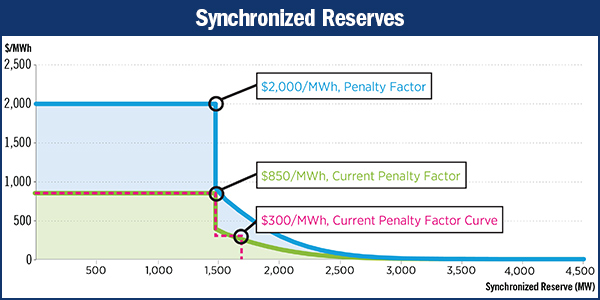

The changes consolidate the tier 1 and tier 2 reserve products, align the products that PJM procures in the day-ahead and real-time markets and revise the height and shape of the operating reserve demand curve. “Together, these reforms will ensure that market forces, rather than out-of-market decisions, drive the procurement of reserves in PJM,” Chatterjee said.

Commissioner Richard Glick issued a strong dissent, saying that “while I’m concerned that the commission made an unsupported finding that PJM’s existing rate is unjust and unreasonable, I’m even more concerned and particularly troubled that the commission accepted PJM’s proposal to revise the operating reserve demand curve. The commission is replacing marginal-cost pricing with an administrative adder that is going to force consumers to pay scarcity pricing all the time, regardless of whether there was actual scarcity or not. …

“How is it ‘market forces’ when we’re administratively drawing up a curve that makes no sense and the market wouldn’t support? We’re doing it, obviously, to raise prices,” he said. “PJM and others continue to treat low prices — due in large part to a significant amount of excess generating capacity — as a matter that requires market tweaks designed to raise prices. Instead of addressing the true cause of the problem, which is excess capacity, this commission continues to approve proposals that raise prices. And what does that raise in prices do? It further exacerbates the problem.”

The RTO had estimated in a December 2018 white paper that the changes would result in increased costs to load of about $700 million annually, but Glick said the costs could reach up to $2 billion.

Chatterjee acknowledged that “these reforms will affect the amount of reserves procured and the energy and ancillary services revenues resources receive.” To counterbalance the costs to consumers, the commission directed PJM to recognize the new changes in its capacity market’s energy and ancillary services offset, a key variable in calculating the net cost of new entry (CONE) for resources in the RTO’s capacity auctions.

The offset is calculated using energy market results from the three calendar years prior to the Base Residual Auction. Therefore, “an historic energy and ancillary services offset would likely underestimate future energy and reserve market revenues, considering that PJM’s proposal will likely result in increases in the energy and reserve prices compared to the historic values,” the RTO said in the white paper.

Staff had proposed a mechanism that would have estimated the offset had the new rules been in place the previous three years, but the PJM board ultimately declined to include it in the filing. (See PJM Advances Own Energy Price Formation Plan.)

FERC ordered PJM to submit a compliance filing in 45 days to implement the mechanism.

“Recognizing the interplay between these reforms and the pending capacity market reforms,” Chatterjee said, referring to the RTO’s pending compliance filing implementing an extended minimum offer price rule, “we’ve asked PJM to propose an implementation schedule that harmonizes the reforms while minimizing auction delays.”

FERC had not posted the order to its website as of press time.