FERC granted PJM permission to use a lower peak load forecast for its second Incremental Auction scheduled for July, reflecting the impact of the COVID-19 pandemic (ER20–1870).

On May 20, PJM requested a one-time Tariff waiver to replace the summer peak load forecast it had filed earlier this year before states started issuing stay-at-home orders.

PJM stated that because it has already held the Base Residual Auction (BRA) and first Incremental Auction for the 2021/22 delivery year, capacity commitment levels, clearing prices and zonal capacity prices were already largely set for the year. PJM said the waiver would primarily affect parties newly releasing or taking on capacity commitments in the second Incremental Auction and was necessary because of “the impact of the unforeseeable economic consequences of the COVID-19 pandemic.”

Without a change, its summer 2021 load forecast would be “significantly overstated,” PJM said.

“While the lack of record evidence is not dispositive, under the circumstances presented here, we find that any potential harm to prices in the second Incremental Auction for the 2021/22 delivery year is outweighed by using auction parameters that reflect the significant economic forecast change and associated decrease in the forecast summer peak resulting from the economic consequences of the COVID-19 pandemic,” FERC said in its June 15 order approving the waiver.

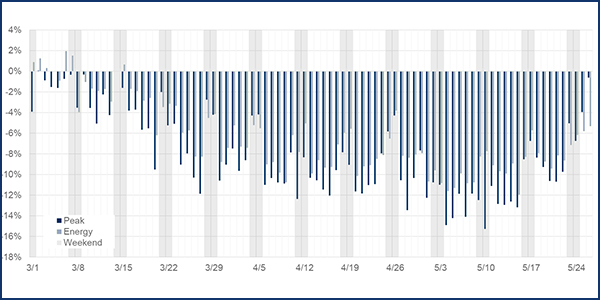

PJM forecasters have updated stakeholders on COVID-19 impacts for several months, saying weekday load peaks have come in 10.4% less, or around 9,300 MW, than what would be anticipated without COVID-19. At the May 12 Planning Committee meeting, PJM told members new parameters were being used for the forecast. (See “Load Forecast Update,” PJM PC/TEAC Briefs: May 12, 2020.)

The new parameters incorporate an updated economic forecast PJM received from Moody’s Analytics in April.

PJM said the April report’s forecast for third-quarter 2021 real gross domestic product is 7.1% lower than that assumed in Moody’s September 2019 forecast and that the drop, along with the “associated significant” decrease in forecast peak load, was “too large to ignore.” It said the waiver would “align the auction parameters with currently expected conditions.”