GreenHat Energy has filed a motion to bar FERC’s Office of Enforcement from working on a breach-of-contract case involving Shell Energy North America, alleging commission officials conspired with an independent consultant hired by the PJM Board of Managers to change the report on GreenHat’s 2018 default.

In its June 4 filing, GreenHat alleges that in March 2019, it learned that one or more members of Enforcement’s investigative team had met with Robert Anderson, an independent third-party expert retained by PJM’s board to prepare the Report of the Independent Consultants on the GreenHat Default. The filing further alleges that FERC officials had a draft copy of the report and asked Anderson to “alter or remove language in the draft favorable to GreenHat.”

The company said that in early July 2019, it received an anonymous whistleblower letter alleging that a representative of Enforcement asked the team conducting the default review to “avoid including any information that could be exculpatory to GreenHat.”

“Enforcement’s unsavory conduct over a year ago may be out of the commission’s hands at this point. But walling off Enforcement and others who worked on the investigation is not,” GreenHat wrote in its filing.

FERC and Anderson declined to comment on the GreenHat filing. Officials from PJM said the filing was still being reviewed by the RTO.

The motion comes after a May 29 petition by Shell asking FERC to intercede in a Texas state court case in which GreenHat filed a breach-of-contract claim against the energy company regarding bilateral contracts to transfer financial transmission rights. Shell is asking the commission to interpret PJM’s Tariff provisions regarding bilateral transfers of FTRs (EL20-49).

Shell said in its petition that GreenHat does not allege the FTR agreements were breached but instead “makes the extraordinary claim that entering data into PJM’s platform for reporting FTR transfers created additional separate, binding contracts, which Shell Energy allegedly breached.”

Shell entered into three agreements with GreenHat between August 2016 and February 2017 in which it agreed to what it called a “consignment” arrangement in which GreenHat would transfer FTRs to Shell, which would attempt to sell them in the next PJM long-term FTR auction.

GreenHat transferred the FTRs to Shell and reported the transfer in PJM’s FTR center without any compensation.

Shell agreed to pay GreenHat 73% of the revenues it generated from FTRs that sold in the auction. Shell agreed to return to GreenHat any FTRs that failed to clear or to purchase them at “an agreed-upon price, also based on auction clearing prices.”

Shell said it fulfilled its obligations under the first two bilateral agreements on Oct. 18, 2016, and Feb. 10, 2017, by making one-time lump-sum payments to GreenHat of the final purchase price for cleared FTRs and those uncleared FTRs that it did not return to GreenHat.

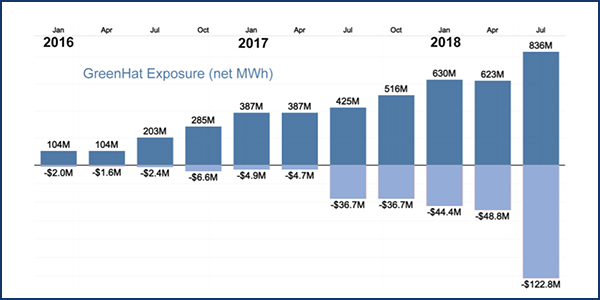

The company executed the third agreement on Feb. 27, 2017. In the meantime, FTR trader DC Energy told PJM in February 2017 that it believed “GreenHat’s portfolio would lose between $35 [million] and $40 million by the time the positions settled in two to three years.” (See Shell Demands Seat at GreenHat Settlement Table.)

In a June 1 notice, FERC set a June 29 deadline for comments in the proceeding. The deadline for comments was later changed to July 14 after FERC granted GreenHat’s motion for extension on June 11.