SPP is facing a two-month delay in gaining FERC approval of the Tariff for its Western Energy Imbalance Service (WEIS) market, staff said last week (ER20-1059, ER20-1060).

Regulatory Policy Manager Nicole Wagner told the Western Market Executive Committee (WMEC) on Friday that SPP, in responding in May to a deficiency letter from the commission, has asked for approval by July 21. The RTO had requested a May 21 approval date when it filed its proposed Tariff in February. (See “WEIS Tariff Approved, on to FERC,” SPP Board of Directors/MC Briefs: Jan. 28, 2020.)

The grid operator plans to launch its Western Interconnection energy imbalance market on Feb. 21, 2021.

FERC in April asked SPP for additional information in 14 categories, ranging from implementation and administrative costs to whether marketing employees will sit on the WMEC and how the RTO will ensure committee members do not “run afoul” of separation-of-function rules.

The RTO’s May response drew protests from a number of western utilities, led by Xcel Energy. The company said the WEIS Tariff could impair a joint dispatch agreement involving many of the entities. The company also said market flows may harm the Western Interconnection’s unscheduled flow mitigation plan and that SPP disregards the Northwest Power Pool’s activities.

Asked whether SPP would respond to the protests, Wagner said, “We have discussed the possibility of filing additional information with FERC.”

SPP’s WEIS market, with eight participants, is an alternative to CAISO’s Western Energy Imbalance Market. CAISO and PacifiCorp started the EIM in 2014 and have nine participants. They plan to add 10 more by 2022.

Staff said the WEIS implementation program’s various projects are all on schedule, now that it has taken delivery of the market engine that will make everything work. “That was big news for us and why we’re back on schedule,” said David Kelley, SPP’s director of seams and market design.

The program’s costs are trending at or less than 5% above budget. Market trials begin July 1 with connectivity testing. Structured and unstructured testing is scheduled for Aug. 3-Nov. 20.

Staff Close to Seams Agreement with AECI

SPP is working with Associated Electric Cooperative Inc. (AECI) to address remaining reliability concerns over a sidelined competitive interregional upgrade, staff told the Seams Steering Committee on Thursday.

The 105-mile Wolf Creek-Blackberry project in Kansas and Missouri, projected to cost $152 million, was approved by SPP’s Board of Directors last year and included in the 2020 Transmission Expansion Plan. The board suspended the project’s notification to construct (NTC) in April to give both grid operators an opportunity to hash out an agreement over costs and scope. The agreement must be approved by FERC before a request for proposals can be issued. (See “Directors Suspend Competitive Upgrade,” SPP Board/Members Committee Briefs: April 28, 2020.)

Cautioning members that he didn’t want to give a false sense that “we have fully crossed the finish line,” SPP Senior Operations Engineer Neil Robertson said additional analysis has indicated the 345-kV project would increase flows on some lower-voltage systems that would need to be mitigated.

“We’re working with AECI staff on those concerns. We have at least a tentative agreement for a mitigation plan,” Robertson said.

The AECI board of directors plans to take up the proposed agreement this week. SPP staff hope the RTO’s board will reconsider the NTC during its July meeting.

Robertson said staff are also trading possible needs solutions with MISO, SPP Staff Recommend 2020 Joint Study.)

“Hopefully, this will culminate in a set of projects that look like they have the possibility of meeting [criteria] thresholds by both organizations,” Robertson said.

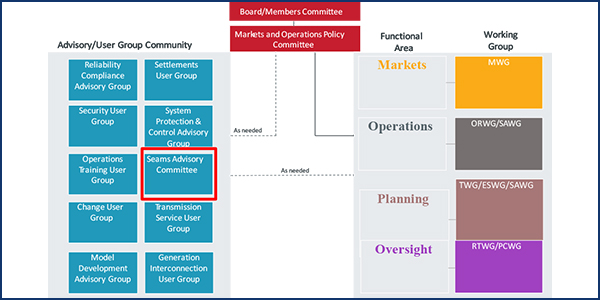

The Seams Steering Committee will likely next meet as the Seams Advisory Committee. Its July meeting has been canceled, but the Markets and Operations Policy Committee plans to recommend a reorganized structure for its stakeholder groups to the board later that month.

The reorganization aligns the MOPC’s stakeholder groups with SPP’s primary functions and oversight responsibilities, allowing the committee to focus on policy-level work.

“It’s just a name change,” System Planning Director Casey Cathey told the SSC, noting that the SAC will continue to participate in the RTO’s interregional planning stakeholder advisory committees with MISO and AECI.

Near Record $5.98M in M2M Settlements for SPP

SPP in April accrued a near record $5.98 million in market-to-market (M2M) settlements from MISO, staff said during the SSC videoconference. SPP has now piled up $82.32 million in M2M settlements since the two neighbors began the process in March 2015.

The process allows the RTOs to dispatch electricity on the most economical routes when congestion leads to constrained flowgates. Settlements have been in SPP’s favor for 46 of the 62 months.

Two temporary SPP flowgates along the Kansas-Missouri border accounted for $2.81 million of the settlements. High winds and outages led to the constraints.

Temporary flowgates were binding for 890 hours, resulting in $3.87 million in settlements to SPP. Permanent flowgates were binding for 369 hours during April, resulting in another $2.11 million in settlements, again in SPP’s favor.