New England needs a CO2 price of $25 to $35/ton by 2025, rising to $55 to $70 by 2030, to meet states’ carbon emissions goals, according to a report released Wednesday by the New England Power Generators Association (NEPGA).

The report, prepared by the Analysis Group, says carbon pricing is essential to preserving wholesale electric competition and ensuring the least-cost path to meeting the New England states’ 2050 goal of reducing economy-wide greenhouse gas emissions by almost 80% compared with 2015 emissions.

While other studies have focused on the 2050 end-state, said NEPGA President Dan Dolan, “this report provides a viable pathway to meet New England’s climate change responsibilities by producing needed investments in electricity supplies and enabling electrification in transportation and heating.”

A multisector carbon price is essential to the “deep and continuous investments” needed to electrify transportation and heating and build the power system infrastructure to support the transition, the report says. “Without a multisector approach, the financial signal for electrification in transportation or residential heating would be undermined because CO2 emissions have only been valued in the electricity sector,” it says.

The study employed production cost modeling to determine the carbon prices needed in 2025, 2030 and 2035 to ensure “revenue sufficiency” for the resources required to meet GHG reductions without state or federal procurement mandates or subsidies.

Although the carbon prices calculated are lower than the estimated social cost of carbon, “they would allow for market competition to drive evolution of the region’s power system without state-mandated procurement of specific generation resources,” the study says. “The lower range of CO2 emission prices for 2025 recognizes that certain New England states have already made long-term contractual commitments that provide the financial support needed for various zero-emission resources to be brought into service or remain operational.”

The volume of zero-emission resources needed by 2030 and 2035 will increase the frequency of zero-price energy hours, putting downward pressure on prices and requiring a higher carbon price for them to remain viable without subsidies, it says.

The study assumed light-duty electric vehicle penetration of 25% in 2025, 60% in 2030 and 90% in 2035. Similarly, it assumed 25% of homes heating with oil, propane or natural gas would switch to electric by 2025, rising to 50% by 2030 and 75% in 2035.

Lower Household Prices?

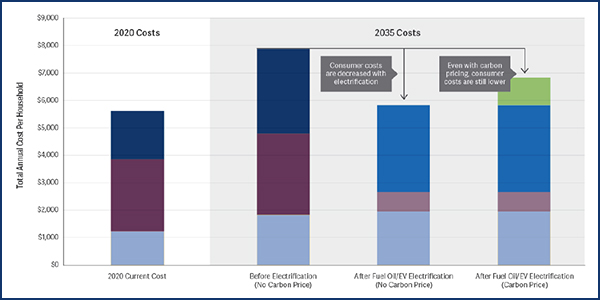

Although a carbon price would increase wholesale power prices, it “would not drive up consumer costs materially if states choose to rebate carbon revenues,” the study says.

It projects that average residential household energy costs would actually decline by 2035 under electrification.

Without the transition, the study posits annual household energy costs will rise from less than $6,000 currently to almost $8,000 by 2035. Costs would be less than $7,000 with electrification and a carbon price, it said.

Electrification of the transportation sector would be the biggest source of GHG reductions. While residential heating electrification would produce only “modest contributions” to GHG cuts, it would turn ISO-NE from a summer- to a winter-peaking region by 2030.

The study also notes the increasing need for flexible electric sector resources to respond to increased hourly net load variability. More variable renewable resources and the addition of EV and heating loads would increase average hourly ramping requirements to more than 15,000 MW at times in winter, it says.

“Even assuming a significant quantity of technologically feasible energy storage resources, the availability of existing fossil fuel generators will be vital over at least the next one to two decades” for ISO-NE to manage the change in load shape and growth in daily ramping needs, it says.

Competitive markets with efficient carbon pricing could save consumers $100 million to $300 million ($2020) between 2026 and 2035 compared with reliance on utility-administered resource procurements.

A carbon price would allow technology-neutral competition; reduce reliance on out-of-market contracts that lock in long-term costs; ensure financing in the absence of long-term contracts; increase incentives for developing new supply-side and demand-side technologies; and encourage consumer use of demand management, the study says.

“It is obvious that establishing enhanced carbon pricing in electric energy markets is not an easy path to take from political and regulatory perspectives,” it says. “Yet pursuing these objectives through state-mandated programs and procurements will almost certainly achieve the results imperfectly, and at costs in excess of what would result through efficient carbon pricing. …

“The absence of an effective carbon-pricing mechanism is a fundamental challenge to continued reliance on competitive markets,” it says, calling the Regional Greenhouse Gas Initiative insufficient. “Absent adoption of a carbon price in energy markets, the pace and magnitude of additions of out-of-market, procurement-based resources will likely undermine the continued relevance of wholesale markets in New England as a vehicle for resource development and investment. … Carbon pricing in energy markets is not an easy path to take, but it may be the only one that can preserve the operation of competition for the benefit of consumers.”