Concluding “less is more,” stakeholders looking to shape a planned grid transition study for New England on Wednesday discussed creating a smaller, more manageable committee to oversee the hiring of consultants and conduct of the analysis.

A joint meeting of the New England Power Pool Markets and Reliability committees opened with a memo from the officers of both committees, which noted the sentiment of several stakeholders favoring adapting modeling and assumptions from existing studies or those currently underway rather than starting from scratch, as was discussed at the joint meeting in May. (See NEPOOL Markets/Reliability Committee Briefs: May 27, 2020.)

“We also need to consider how detailed workflow will be managed between meetings. For example, some have suggested hiring an independent consultant to manage these efforts, designating a small representative working group of individuals willing to commit time towards managing study details, or similar,” the memo said.

It included a draft template for collecting proposals of scenario assumptions. The final template will be distributed soon; responses are due to the MC secretary by July 17 for the Aug. 4 joint meeting, at which a presentation will be made on a grid study underway now by Energy Futures Initiative and E3.

Eversource Offers Preliminary Results

Vandan Divatia of Eversource Energy presented his company’s Grid of the Future study methodology and preliminary results, with modeling and analysis performed by London Economics International.

“I agree that this approach — with a 10- to 15-person smaller group … with representatives from each sector participating and then bringing back information for alignment — makes a lot of sense,” Divatia said.

[Note: Although NEPOOL rules prohibit quoting speakers at meetings, those quoted in this article approved their remarks afterward to clarify their presentations.]

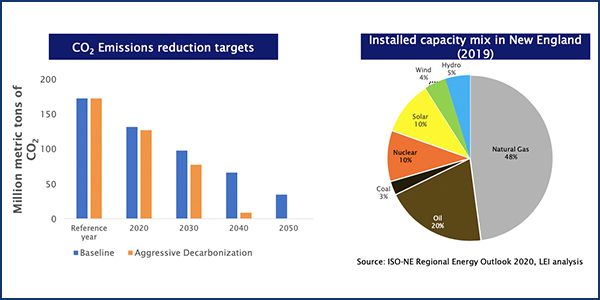

Economy-wide CO2 emissions reduction will result in major changes to the electricity industry. Increased demand from electrification of heating and transportation will shift the peak from summer to winter, leading to deployment of energy storage resources and new technologies, as well as market support for reliability services, transmission expansion and operational infrastructure, the report said.

The Grid of the Future Study is designed to understand changes in all sectors of the economy and their impact on the grid. | ISO-NE, LEI

The study said that electric vehicles could account for 48% of emission reductions from 2020 to 2040, which led Ben Griffiths of the Massachusetts attorney general’s office to ask if the study authors had “a sense of how much decarbonization will then be occurring from the power sector, or from converting gas heating customers to electric heat pumps, or something like that?”

Divatia said Eversource and LEI had assessed what would be required from each sector to achieve near total decarbonization by 2040 but had not included that level of detail in the study.

| LEI

“Transportation accounts for 42% of the carbon footprint of New England, and the electric sector accounts for only 14%, so if we want to go from here to there in a strategic fashion, the approach we’ve taken is that each sector needs to do its job,” Divatia said.

On how the study planners got from emissions to modeling, Julia Frayer of LEI said, “We made a starting assumption that we wanted to look beyond just the power sector, so we could actually reflect the intentions of policymakers, which is to decarbonize the economy.”

Because it is a long-duration study going out to 2050, the analysts incorporated a capacity expansion model with two objective function goals, she said. “One was to achieve the carbon emissions reductions, and the second criterion was to meet electricity demand reliably.”

The capacity expansion model built out a plan for resources that could meet the 2050 carbon emissions goals. “Through backwards induction, we could back into interim goals that we’ve created for 2040 and 2030 … for transformation of the electricity sector from the demand side and the supply side,” Frayer said.

National Grid 2020 Economic Study Details

Engineer Julia Grasse of National Grid presented the firm’s 2020 Economic Study request, including a pathway emphasizing the role of exchange with Québec, which previous studies indicated may be utilized as a balancing resource in a future system with a large amount of intermittent renewables. (See “2020 Economic Study Scope, Assumptions,” ISO-NE Planning Advisory Committee Briefs: May 20, 2020.)

Two recent studies in particular drove the company’s request, the first being a 2019 offshore wind study by the New England States Committee on Electricity (NESCOE) that showed high levels of renewable resource spillage, and the second being MIT’s 2020 study on deep decarbonization of the Northeastern U.S., which demonstrated that bidirectional transmission with Québec complements high intermittent resource mixes in New England.

Specifically, National Grid wants to evaluate the role that large-scale “dispatchable reservoir” hydro in the north could have in meeting the state goals, the presentation said.

ISO-NE will analyze three scenarios: the base case, with varied offshore wind, solar and thermal retirements; bidirectional transmission capability, with use of existing and new interties to explore up to 3,600 MW of export capability to Québec; and varied amounts of in-region battery storage, the lowest at 2,000 MW as used in the NESCOE study.

Stakeholders will discuss the study at the Planning Advisory Committee meeting July 22, with further refined RTO assumptions. The draft results expected, and sensitivities identified will come in the third quarter, with sensitivity results and draft ancillary services results in the fourth before the draft and final reports in Q1 2021.

Bay State Net-zero Overview

Participants also heard an overview of a Massachusetts decarbonization study to guide the state’s effort to achieve net-zero greenhouse gas emissions reductions by 2050, an initiative that boasts its own website.

“Overall, our approach is backcasting, which is an exercise to understand what is needed today to get to where we want to be in 2050,” Massachusetts Undersecretary for Climate Change David Ismay said. (See “Modeling the Future,” Overheard at 166th NE Electricity Roundtable.)

| Mass EEA

The state’s net-zero policy requires at least an 85% reduction in emissions below 1990 levels by 2050, plus carbon sequestration to make neutral the remaining emissions, he said.

“We’re modeling the mega-region of the Northeast from New York to Maine, together with Québec and New Brunswick … for a 90% emissions reduction from 1990 levels, which we think is valuable, since there are different dynamics when you go past an 80% reduction,” Ismay said.

The study will entail more than a half-dozen complete scenarios, including detailed total cost analyses, and the state will work through NESCOE this summer to share full results with colleagues in all New England states ahead of a planned full public release in the fall, he said.

When asked if Massachusetts was planning to request an economic study by ISO-NE based on the analysis, Ismay said, “We will be bringing a lot of data to ISO-NE and NEPOOL for this discussion, rather than asking ISO-NE to do it themselves.”

“At some point soon, the grid operator will need to get into the details at least at this level, though I’m not exactly sure how or when that’s going to happen,” he added.

Stakeholder Perspectives

Brian Forshaw of Energy Market Advisors proposed an analytical framework for the future grid study on behalf of the Connecticut Municipal Electric Energy Cooperative (CMEEC).

ISO-NE currently lacks a Forward Capacity Market pricing model for planning studies, which can often make it more challenging to interpret study results, the presentation said.

CMEEC recommended development of a capacity optimization tool to reflect the current market construct and develop estimates of what capacity market prices would be under various scenarios, he said.

Caitlin Marquis of Advanced Energy Economy presented input that asked whether the markets, as designed today, meet future needs in a technology-neutral way. She said that AEE views analysis of the transition to the future and discussion of potential market reforms as being just as important as the planned operational and reliability assessment.

With respect to the reliability analysis, “we’re really most interested in understanding what grid services and operational tools are needed to address reliability gaps,” Marquis said. “We see the resources of the future as requiring more flexibility, see the heightened importance of resource availability and not just adequacy, and certainly a different range of reliability services.”

One side of that assessment should be looking at whether markets are equipped to make full use of demand flexibility and demand-side resource participation, she said.

Peter Fuller of Autumn Lane Energy presented further thoughts on the evolving grid study, made with the endorsement of NEPOOL members NRG Energy and Sunrun.

Today’s markets do not include a value for carbon commensurate with the value that state policies imply for it, the presentation said. It also asks where system inertia and stability will come from in a system with more distributed, digital and inverter-based resources.

The presentation asked what other aspects of system operability and reliability are being taken for granted that will need to be explicitly valued in the future and said the sponsors hope to address that and other questions at the August joint meeting.