RTOs will need uniform interconnection processes if hybrid and co-located resources are to provide the flexible, cost-effective service its proponents say they will.

That was the consensus among developers during one of four virtual panels FERC staff facilitated last week as part of a technical conference on such resources (AD20-9).

“The types of supply resources that participate in wholesale electricity markets in the U.S., and the technologies they use, are evolving dramatically,” Adam Stern, research and analytics manager for the American Wind Energy Association, said during Thursday’s panels. “As technology evolves, so too must the policies and procedures of wholesale electricity market operators to effectively integrate new resource technologies and fully realize the benefits they provide.”

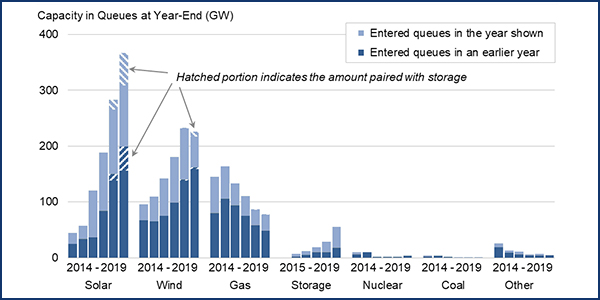

According to a Lawrence Berkeley National Laboratory study, 125 hybrid or co-located projects of various configurations — wind and storage, solar and storage, fossil and storage, wind and fossil among wind and solar, wind and fossil, solar and fossil — were providing 13.4 GW of generating capacity and almost 1 GW of storage capacity by the end of 2019.

Grid operators’ interconnection queues included another 50 GW of standalone storage and 113 GW of storage paired with wind and solar at the end of last year. Much of that proposed capacity can be found in the West, thanks to state renewable portfolio standards and clean-energy legislation.

CAISO’s Deb LeVine, director of infrastructure contracts and management, said grid operators are facing a “tsunamic wave” of storage.

The ISO has determined storage can use existing processes to interconnect to the grid,” LeVine said. “It can apply through the existing interconnection process, or by pairing the energy storage with an existing resource and using [our] modification process.”

Thanks to that process, existing resources in CAISO can add storage in some circumstances and avoid being sent back to the end of the queue or restudied. LeVine said the ISO’s interconnection study process generally takes two years, but a modification can be done in about three months.

“CAISO been working on this for many years. Some are just catching up,” said Patrick Tan, senior director of transmission and interconnection for 8minute Solar Energy. “Demand [for hybrid resources] has been increasing over the last two years, faster than we can get through the interconnection process. [That’s] the bottleneck. Developers wish we could get our generation agreement in a couple of months and change anything we want to maximize customer demands.”

Stern pointed out that FERC Order 845, designed to increase the interconnection process’s transparency and timeliness, allowed for the addition of “permissible technological advancements” to an interconnection customer’s requested service. (See FERC Order Seeks to Reduce Time, Uncertainty on Interconnections.)

“However, it is not clear whether the addition of energy storage to an existing renewable interconnection request would constitute a ‘permissible technological advancement’ or a ‘material modification,’” he said. “This uncertainty may prevent the potential increase in dispatchability and flexibility in projects [that] are already enqueued.”

The modification process was one of five suggested areas of focus for FERC, Stern said. He urged the commission to explore four other issues regarding interconnecting hybrid and co-located resources, all of which align with Order 845’s reforms:

- Interconnection agreements: Direct all RTOs to allow all of the hybrid resources’ components to execute a single interconnection agreement. Not all grid operators allow single agreements even if the resource will be operated, bid and dispatched as a single resource.

- Study requirements: Because RTOs have “widely varying methods” for studying hybrid resources, particular interconnection study assumptions “directly affect the need for network upgrades” and can “significantly affect” hybrid projects’ viability.

- Injection points: RTOs have not adopted a consistent methodology for considering the capacity of hybrid resource components or how a storage component could serve to limit a particular resource’s maximum injection.

- Surplus capacity: Use Order 845’s “surplus interconnection service,” the portion of interconnection capacity not being fully used, to add energy storage resources to existing renewable projects. That would create a pathway for new hybrid and co-located resources without requiring new upgrades, Stern said.

LeVine threw a note of caution into the discussion.

“We need to get some more operations under our belt before we start changing the rules,” she said.

Panelists: Technology’s Changes will Continue

The technical conference began with FERC Chairman Neil Chatterjee encouraging participants to “get down into the weeds” — they did — and Commissioner Richard Glick asking whether grid operators’ market rules are acting as barriers and how they can be eliminated.

“This is the most important step the commission can take to ensure a smooth transition to a clean-energy future,” Chatterjee said. “What can we do to accommodate the next wave of resources?”

Panelists suggested addressing market mitigation and ensuring the correct participation model. There are two primary configurations for hybrids: a 1R configuration, in which storage and generation are co-controlled and share a resource ID, and 2R, in which storage and generation are co-located as two independent resource IDs.

“All RTOs should allow hybrid resources, if they wish to do so, to use an existing market participation model,” Mark Ahlstrom, president of the Energy Systems Integration Group and vice president of renewable energy policy for NextEra Energy Resources, said in his written testimony. “Just as a conventional plant provides its parameters for start-up time and minimum run time, a hybrid could provide its own parameters. This may not be the optimal way to extract the full value from a hybrid resource, but I see no logical reason why we would prevent a hybrid that can emulate a gas plant (but with no start-up cost, no start-up time, no minimum run time and a faster ramp rate) from participating in this way.”

Jason Burwen, vice president of policy for the Energy Storage Association, said one of the keys will be the “extent of response for the efficient use of hybrid resources” as the world continues to change around the grid.

“It’s worth considering [that] we are focusing on today’s technology and today’s offers,” he said. “The future will continue to come at us. We would do well to keep other technologies in mind. Removing barriers is going to be a continuing game of making sure [the grid] is keeping up with the technologies.”

Berkeley Lab researcher Will Gorman said hybrid technology costs’ “dramatic decline” have led to the resources’ popularity. He said costs fell from $40 to $70/MWh in 2017 to $20 to $30/MWh last year.

“Solar is now seen as the cheapest form of generation in many parts of the country. We’re seeing that many utilities are asking for hybrids,” said John Sterling, First Solar’s director of market and policy affairs.

He said two “interesting things” are happening. “We’re hearing a lot of questions about renewables needing to be dispatchable, so how do we encourage that activity? The other thing we’re getting is how storage can be coupled with solar projects … and shift [its energy] to more valuable times of the day.”

Sterling encouraged FERC not to limit itself to think about just hybrid resources.

“All inverter-based resources have the capability to provide [flexibility],” he said. “We should be thinking about in 10 years, when the grid is fully hybridized, about what we want to be asking these resources to do.”

Increasing Complexity

A panel discussion in the afternoon revealed that needed market rule changes will be even more complex than those developed in response to FERC Order 841, the commission’s landmark rulemaking to remove market barriers for energy storage resources.

Ted Ko, vice president of policy and regulatory affairs at storage systems developer Stem, said Order 841’s “problem space” was “relatively small” compared with integrating hybrids because it dealt only with standalone storage resources in the three “domains” of transmission, distribution and behind-the-meter, resulting in just three “major configurations” that RTO market models had to accommodate.

Hybrids add new dimensions to that problem space through a larger number of potential resource configurations within the same three domains, Ko said.

“Now you have one resource versus two resources in the wholesale market — what I’m going to call ‘1R’ versus ‘2R’ — and then you have AC- versus DC-coupled in the solar-storage space.”

That leaves market designers to consider four different options for storage hybrids — “1R AC, 1R DC, 2R AC, 2R DC” — across each of the three domains, he said.

“Of those 12 different configurations, which one of them does the market design need to accommodate to provide a participation path for all of them? And then in each of those configurations, which of the market services … do those configurations need to be able to access?” Ko asked. “In the [Order] 841 case, the answers to those questions were ‘everything.’ … For hybrid, it should be the same ultimate answer, but because of the constraints of the technologies of the different wholesale markets and the software … it may take time to enable all of those.”

Rachel McMahon, senior manager of public policy at Sunrun, said her comments during the panel would focus “entirely” on enabling aggregations of BTM residential solar-plus-storage hybrids to provide local resource adequacy capacity and other services, particularly for the CAISO grid.

“The challenge before us is several-fold,” she said. “First, we need a consistent and equitable capacity valuation methodology … that accounts for the full value of the resources.

“Second, clear and consistent workable rules are necessary to ensure participation … of many, many small systems. So, from the perspective of providing wholesale services, such as energy, capacity and reliability services, it requires a different perspective than ISOs and public utilities typically have,” McMahon said.

She said Sunrun’s resource aggregations do not have a “clear, easy or economically viable path to provide” capacity or energy services in CAISO but do currently participate in the market under demand response rules, which prevent those aggregations from injecting power back into the system.

No Time to Wait

“As an industry, we can’t wait to develop new rules to facilitate hybrid and co-located resources … onto our grid,” said Gabe Murtagh, senior infrastructure and regulatory policy developer at CAISO. “In California, these resources are coming very quickly, and they’ll be on our grid very soon, and we need to have the right tools in place to be able to accommodate them when they get onto our market.”

Some of the urgency stems from the fact that state environmental regulations will force a large number of gas-fired generators to retire over the next three years.

“This means that we need the proper tools and infrastructure in order to manage and operate these [new] resources efficiently and effectively,” Murtagh said.

CAISO’s approach distinguishes between market models for co-located and hybrid resources. Co-located resources will consist of multiple resources modeled behind a single interconnection point, each subject to its own bid curves and market awards. True hybrids would have a single resource ID, bid curve and a single market award.

“The ISO would be seeing one resource behind one constraint, and we would be giving it one set of dispatch instructions,” Murtagh said.

RTOs and ISOs should implement both models and adapt rules as needed as technologies evolve, he said. CAISO’s Board of Governors last week approved Tariff revisions that would accommodate market participation of co-located resources. A similar proposal for hybrid resources is pending next year. (See related story, CAISO Adopts Co-located Resources Plan.)

NYISO Director of Market Design Mike DeSocio said about 700 MW of solar, wind and storage resources in the ISO’s queue could qualify as co-located resources and that his team is currently developing a proposal to accommodate such resources, with plans to develop an aggregated resources option next year.

But DeSocio cautioned that reliability must be a key factor in model design.

“We see ranges of storage-generation ratios ranging from 5 to 50%, and this difference in storage capability among co-located projects creates different operational scenarios where reliability implications of those scenarios must be considered,” DeSocio said.

“NYISO believes that it is important that the participation models account for the operational capabilities of the resource and enforce the reliability rules,” he said. “The NYISO, for example, must comply with reliability rules from three reliability organizations: NERC, Northeast Power Coordinating Council and New York State Reliability Council. This means that rules that may work in other regions may not adequately address rules that the NYISO is responsible to enforce.”

‘Wide Open’

From PJM’s perspective, the markets are already “wide open” to hybrid participation, said Andrew Levitt, the RTO’s senior business solution architect.

“Hybrids we see in the queue are different from the types of hybrids we’ve seen in the past,” which were located at the same point but typically configured to work independently from each other, he said.

New hybrids use storage to firm up the output of wind or solar during down times and charge during periods of surplus generation. That creates a “significant interaction” between the resources that is best managed by the plant operator — including managing state-of-charge, Levitt said.

“And it’s clear to us that the most straightforward way to do that is to model all those units as a single entity in the market so that it’s totally opaque to the grid operator,” he said.

PJM sees “a lot of potential benefits” from hybrid configurations because the storage component “can increase the resource adequacy of the variable energy component and it can actually support that resource adequacy value, which might decline in time as you see greater deployment of renewables in PJM.”

From a market perspective, “it really facilitates the flexibility that [a] resource needs [in order] to offer significant amounts of reserves to the system and also offers value in giving that resource the ability to produce more output at times of higher value when prices are higher,” Levitt said. Hybrid configurations also enable variable resources to relieve local reliability issues in ways they cannot without the addition of storage, he noted.

Levitt acknowledged McMahon’s concerns regarding market access for BTM aggregations, saying the treatment of wholesale distributed energy resources is still “a tough nut to crack.” But he expressed confidence that the sector is doing a “great job” addressing the problem, including ongoing DER efforts in CAISO and NYISO along with FERC’s outstanding Notice of Proposed Rulemaking on the issue.

FERC’s Matt McWhorter asked whether hybrid resources should be able to participate in markets as each of their technology types or just as a single resource.

“I think we need robust hybrid participation models [that] can simultaneously allow these resources to either be participating in the market as a separate resource or as a single resource, and I do believe that right now we don’t have such robust hybrid participation models throughout the nation,” said Mike Tabrizi, vice president and principal engineer at DNV GL.

Tabrizi advocated for a market framework that “relies on the pricing node to be able to direct asset owners and asset operators to make the decisions” about how to offer into the market.

“At the end of the day, asset owners and operators have better visibility on their assets, and so I think they’re in the best position to make financial decisions on how they want to operate their assets; but at the same time, we need to have some sort of improved centralized strategies to be able to kind of intervene when needed to [ensure] grid reliability,” Tabrizi said.

“We tend to agree there needs to be some option in models and having that capability,” DeSocio said, cautioning that markets must avoid providing too much flexibility for hybrids.

“When you think about capacity, capacity’s a future call on energy, so you need to be able to provide energy in order to provide capacity; the same is true for reserves. So, there are some linkages that we need to be careful and acknowledge before we just allow the a la carte [idea of] picking what service I want to provide at which time,” DeSocio said.

‘All Theoretical’

In a final panel on calculating the capacity value of hybrid resources in organized markets, Rob Gramlich, president of Grid Strategies, called for RTOs to decrease their reliance on capacity markets.

“The whole way of thinking about capacity markets may have to change, especially for these incredibly and highly controllable resources,” Gramlich said. “What really matters is not the crude estimate one makes in a capacity valuation three years ahead of time, but the accuracy of the real-time price signals by time, location and reliability service that are strictly necessary to achieve efficient and reliable operation when you get to real time. There’s no replacement for those efficient price signals.

“If you’re going to have a capacity market,” Gramlich said, the “most appropriate” methodology for estimating capacity valuations for hybrids is the effective load-carrying capability (ELCC) methodology, where capacity credits are awarded based on the ability of a resource to consistently deliver energy during periods of high demand.

Kelli Joseph, director of markets and regulatory policy for Clearway Energy Group, pointed to the challenge of pondering capacity valuations for hybrid resources when “we don’t even know yet what the full participation models are.”

Joseph questioned whether existing reliability metrics for measuring capacity — such as ELCC and loss-of-load expectation (LOLE) — will remain relevant in a system with increasing renewables. Peak periods are becoming much narrower, reliability events are shorter but coming more often, and peak periods — as measured by net load — are shifting from the daytime to morning and evening, she said.

NERC “has started to say that we really ought to be considering flexibility metrics in our planning models, but they did point out that if you actually try to incorporate these flexibility metrics, it’s going to be a really significant challenge,” Joseph said.

Erik Ela, senior technical leader with the Electric Power Research Institute, said the peak load period is no longer necessarily the most critical period for assessing capacity value.

“In reality, the real time where we have situations where there might be load shedding or large frequency deviations or other emergency criteria are happening because of other conditions, whether that’s outages or massive forecast errors,” Ela said.

Some resources may be better equipped to respond to those events than others, but that’s not currently captured in capacity valuation, he said.

“That’s very hard to quantify because it’s different from where we typically do our calculations for capacity and resource adequacy. … Extending that to standalone storage and hybrids just emphasizes that because the flexibility could be something that could avoid the potential situations that you might be planning for,” Ela said.

He offered another key point specific to estimating valuations for hybrid resources: “There’s not really any data. We don’t know how hybrid resources contribute, so it’s all theoretical.”