MISO and SPP appear to have come up empty once again after a fourth interregional study failed to detect a joint transmission project that could pass the RTOs’ benefit criteria.

After wrapping a coordinated system plan (CSP) study that began in March, the seam neighbors concluded no projects would pass the requisite 1.25:1 benefit-to-cost ratio. The two used transmission owners’ planning-level cost estimates to evaluate project candidates.

This is MISO and SPP’s fourth CSP in six years, all of which have failed to spot a beneficial project. (See MISO, SPP Empty-handed After 3rd Project Study.) Their joint operating agreement requires a CSP study be conducted at least every other year; the grid operators last performed one in 2019.

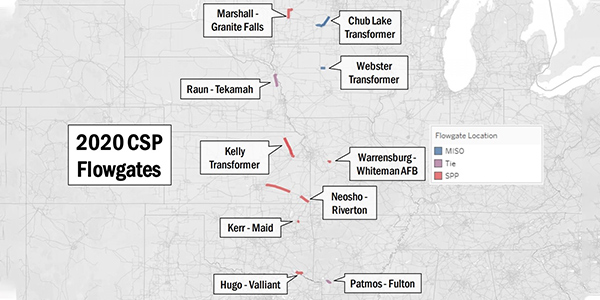

Speaking during a special MISO conference call Wednesday, economic planner Gavin Christenson said the RTOs evaluated about 200 stakeholder-submitted needs that focused on 10 flowgates in Minnesota, Iowa, Nebraska, Kansas, Missouri, Oklahoma and Arkansas. He said that while MISO is still verifying some planning-level cost estimates with TOs, he doesn’t expect the decision against an interregional project to change.

SPP Director of System Planning Casey Cathey has been optimistic about finding a joint project this year. He noted staff still need to assess cost estimates for projects and that the RTOs’ seam includes a “number of transmission opportunities.”

“We will continue to look at those opportunities with the next coordinated planning study with MISO,” Cathey said.

The RTOs will present final CSP results during their Interregional Planning Stakeholder Advisory Committee (IPSAC) meeting in September, Christenson said.

A plan to use a transformer providing a parallel path for the Marshall-Granite Falls flowgate in Minnesota proved to be one of the study’s better-performing projects. However, the $13 million line could only show a 1.08 B/C, despite eliminating the flowgate’s congestion.

Another promising project would have eased congestion on the 161-kV Raun-Tekamah flowgate on the wind-rich Iowa-Nebraska border. A new $356 million, 345-kV line would have run parallel to the flowgate and eliminated nearly all its congestion, but it would have had a 0.69 B/C.

The study also included the chronically congested 161-kV Neosho-Riverton flowgate on the eastern Kansas-Nebraska border. The flowgate is a repeat visitor on the RTOs’ joint planning studies and has accrued $32.6 million in market-to-market settlements in SPP’s favor, more than four times the next nearest flowgate.

MISO said potential projects tested for the area “saw low or negative benefits to MISO despite clearing congestion.” SPP, however, appeared to benefit considerably “for almost all projects studied on this flowgate,” MISO said.

Several project candidates along the seam showed negative benefits to SPP, where MISO would shift some of its congestion to its neighbor.

Some stakeholders sounded deflated that the RTOs would spend another year without an interregional project on the horizon and asked for more details around the evaluation process.

WPPI Energy’s Steve Leovy found it odd that so many new projects showed negative benefits.

“Benefits can get a little bit hairy when you have a project between two pools. It’s not unlikely that [the modeling software] would sacrifice the benefits on one pool to optimize overall system benefits,” Christenson said.

He added that the RTOs will have more details on the study methodology during the IPSAC call. They each conduct the study using different models and adjusted production costs savings calculations.

Clean Grid Alliance’s Natalie McIntire asked if some of the more promising projects could be restudied using the RTOs’ soon-to-be-updated transmission planning futures.

“Do we need to go through the same process next year to argue for another CSP, or is it possible that MISO and SPP could have an automatic redo on some of the projects that show stronger benefits?” she said.

MISO staff said they would have to discuss and coordinate with SPP before they could commit to any restudies.

“We really like to look at the full gamut of issues. That’s pretty much the first step of the study,” MISO Economic and Policy Planning Adviser Ben Stearney said.

“It just seems like we should take another look if these issues aren’t going away,” McIntire responded.