MISO, SPP to Conduct Targeted Transmission Study.)

SPP Vice President of Engineering Antoine Lucas described the study as a “vehicle” that offers a different approach than previous joint transmission studies. The RTOs have conducted four joint studies in six years but have yet to agree on a single interregional project after being frustrated by differences in metric thresholds and cost estimates. (See MISO, SPP Close to Ruling out Joint Projects Again.)

“We’re looking to have a little more flexibility in this process and approach it differently and see if we can get a little different result,” Lucas said during the SSC’s meeting Thursday. “We want to focus and consider issues arising from our interconnection processes. We want to identify solutions to the issues we’ve seen that we believe if we can resolve, both RTOs’ customers can create some benefits and opportunities … that are worth pursuing.”

Aubrey Johnson, MISO’s executive director of system planning and competitive transmission, stressed that much work needs to be done “to frame up what needs to take place and get us going.” The study is planned to begin in December.

“We’re not suggesting this become the solution to all of the interregional planning processes. We see this as an opportunity to have a focus on some collaboration that, hopefully, will inform those processes moving forward,” Johnson said. “We’ll move forward with the existing interconnection processes and keep the trains running in some of those areas. Where we learn things out of this study and to the extent that they have any impact on those studies, we’ll do something downstream.”

GridLiance High Plains’ Bary Warren, the SSC’s vice chair, reminded Lucas and Johnson that the committee has seen four joint studies come up empty over cost-allocation issues and encouraged them to place cost allocation on the table.

“We thought it was important to almost stay away from any of the named processes we already have,” Johnson said. “To the extent that we can, we really want the planning teams to focus on identifying the issues and figure out what the solutions might be and that they work out for stakeholders in both RTOs. We’re just doing a study. We want to keep it openminded around the concepts that offers us the best return.”

Debrief on MISO, AECI Joint Studies

Neil Robertson, SPP interregional relations senior engineer, said the latest failed attempt to find joint projects stemmed from “significant differences” with MISO in cost estimates.

“The cost estimates generated by MISO were significantly higher than cost estimates generated by SPP,” Robertson told the committee. “We haven’t really achieved a great deal of consistency on cost estimates. We continue to identify areas for improvement.”

Robertson noted that MISO has a more “thoroughly defined cost-estimation process” than SPP, with a team of staffers working on detailed estimates.

“We attempted to rectify some of the differences in this cycle,” he said. “We’ve tried to come together when we initially started comparing costs estimates. There are some areas where I think we need to continue the discussion and come to a consensus on a consistent approach to cost estimation in the planning cycles.”

Robertson said MISO’s estimates provide benefit-to-cost ratios that were “unattractive,” with initial projections about 150 to 250% above SPP’s.

“We were able to close the gap after some refinements, but there was still a gap at the end of the day,” he said.

The RTOs have scheduled a Sept. 25 meeting of their interregional Planning Stakeholder Advisory Committee to discuss next steps.

A cost-of-use agreement between SPP and Associated Electric Cooperative Inc. (AECI) for a 345-kV competitive project and filed with FERC has passed the comment period without protests, staff said. David Kelley, SPP’s director of seams and market design, noted that the RTO’s Board of Directors will meet Tuesday and could decide to issue a request for proposals before the commission issues an order (ER20-2708).

The board suspended the project in April while awaiting the completed agreement with AECI.

“There could be a decision to advance the project through the process, even while that order is pending,” Kelley said.

AECI will build the 105-mile Wolf Creek-Blackberry line in Kansas and Missouri at a projected cost of $152 million. SPP cannot allocate funds to the cooperative without FERC approval. (See “AECI Wolf Creek Agreement Filed with FERC,” SPP Seams Steering Committee Briefs: Aug. 20, 2020.)

Robertson also said SPP and AECI have posted a final report on their recent joint and coordinated system planning (JCSP). The study did not find any potential jointly funded transmission projects, but it also didn’t find reliability effects from the Wolf Creek-Blackberry project.

The SPP-AECI joint operating agreement requires a JCSP study be performed every other year to “assure the reliable, efficient and effective operation of the transmission system” around the organizations’ seam.

Patton Shares Thoughts on Interface Pricing

MISO Independent Market Monitor David Patton made a guest appearance at the meeting to discuss interface pricing and market-to-market coordination. Both topics are being considered by a group of state regulators studying seams coordination between SPP and MISO, with the RTOs’ monitors providing much of the analysis. (See MISO, SPP Respond to Monitors’ Seams Studies.)

Patton explained some of the finer details of interface pricing, which he labeled “essential” because it is the only way to facilitate efficient power flows between RTOs. Poor interface pricing can lead to significant uplift costs and other inefficiencies, he said. The interface price’s congestion component becomes critical because it reflects the estimated effect of transactions on any binding constraints in an RTO’s market, he said.

“If MISO can produce power for $20/MWh on the margin, and prices in SPP are $30/MWh, we want somebody to schedule an export from MISO to SPP that will reduce the overall cost of serving load in SPP,” he said. “If there’s a transaction from SPP to MISO, then SPP charges the exporter its interface price and MISO pays the same person for the import on its side of the interface. At the end of the day, it’s the difference in interface prices.”

Committee members peppered Patton with questions and engaged him in discussion. He shared his thoughts on market-to-market (M2M) operations, which SPP and MISO have been coordinating since 2015.

“When there’s a market-to-market constraint, we both model it and we both make payments for the same transaction, because we’re both activating that constraint in the dispatch models,” he said. “We both activate the MISO constraint, because you can move the SPP generators to provide relief and you get paid by MISO to provide that relief. It’s a win-win for everybody, because it lowers the cost of congestion. You’re paying the SPP generators to provide relief, and MISO is paying the generators to provide relief, so it makes sense.”

Except, that is, at the interface.

“You’re both calculating the effect of the generators on the constraint, and you’re both paying for it. You’re both paying what you pretty much expect the full benefit of the transaction is,” Patton said. “When a market-to-market constraint is binding, we’re either overpaying or overcharging all of the transactions at the interface. We’re not giving people good incentive to schedule exports and imports. That’s an efficiency problem.”

Committee Tweaks its Scope

The committee, soon to become the Seams Advisory Group, agreed to tweaks to its scope in preparation for its new role.

The scope says the SAG will be responsible for “providing direction, guidance, and advice” to SPP and its staff regarding issues involving seams agreements, JOAs or arrangements with neighboring transmission providers, transmission owners or customers.

Staff said SPP was “uneasy” over original wording that the SAG would be “directing” action. The group will still be able to identify seams coordination issues between SPP and adjacent transmission providers.

The SAG will consist of no more than 15 representatives from member companies, up two from its current makeup.

The change is a result of the reorganization of the Markets and Operations Policy Committee stakeholder groups. The MOPC endorsed the proposed changes in July. (See “Members OK MOPC Reorg, Strategic Roadmap,” SPP MOPC Briefs: July 15-16, 2020.)

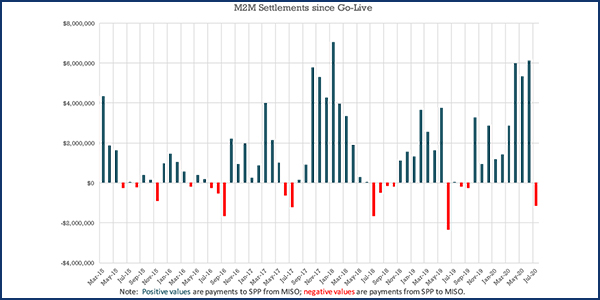

M2M Payments in MISO’s Favor

M2M payments during July were settled in MISO’s favor for the first time in 10 months.

SPP staff said MISO accrued $1.13 million in M2M settlements for 686 hours of binding temporary and permanent flowgates. SPP still has the overall edge, having piled up $92.71 million in accruals since the two seam neighbors began the process in March 2015.

Settlements have been in SPP’s favor for 48 of 65 months.