CAISO launched a two-part initiative Wednesday that would alter how Western Energy Imbalance Market (EIM) participants submit their base schedules.

The base schedule is the hourly forward energy plan that CAISO uses as a baseline to measure energy balance deviations for market settlements in the EIM. Rules set out three deadlines by which EIM entities must submit the resource plans behind their hourly base schedules.

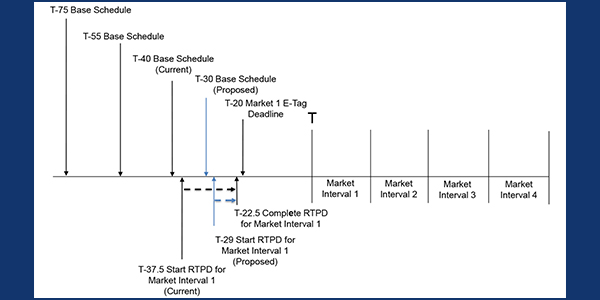

By the first deadline, at T-75 (75 minutes before the operating hour), all participating and nonparticipating resources must submit their base schedules, and participating resources must submit their energy bids. CAISO’s market software then evaluates each 15-minute interval within that hour for capacity and flexible ramping capability.

A second deadline follows at T-55 after CAISO validates initial base schedules. At that point, market entities can review and update their schedules, which is followed by another set of validations.

At T-40, entities are required to submit final, financially binding base schedules, used by CAISO to balance against the load forecast and set the baseline for determining imbalance energy for the operating hour.

CAISO’s proposal would push the financially binding base schedule deadline from T-40 to T-30, a move that would require the ISO to update its market software to shift the start of the EIM’s real-time pre-dispatch (RTPD) process from T-37.5 to T-29, while retaining the current RTPD completion time of T-22.5. CAISO’s final base schedule test would also be moved to after the T-30 deadline.

CAISO’s proposal would shift the EIM’s final base schedule deadline from T-40 to T-30, shortening the real-time pre-dispatch interval. | CAISO

The ISO committed to examining the change as part of its EIM implementation agreement with the Bonneville Power Administration. A portion of BPA’s customers operate under “slice of system” contracts that provide them with a percentage of the output from the federal Columbia River Power System rather than a fixed volume of energy. Slice nominations can be updated after T-40, potentially exposing BPA to imbalance charges under the existing rules once it begins transacting in the EIM in 2022.

“It would create the ability for EIM entities to submit more accurate final base schedules as the deadline is simply closer to the operating hour,” Danny Johnson, CAISO lead market design developer, said during a call to discuss the proposal Wednesday. “Ideally this reduces the financial impact of imbalance settlement, and it would provide more accurate base schedules to the RSE [resource sufficiency evaluation].”

Johnson added that while the proposal “was precipitated by the EIM implementation agreement, I do want to clearly point out that this change is available to all EIM participants.”

John Walker, an analyst with Portland General Electric, asked whether CAISO would consider moving any of the other base schedule submission timelines in light of the T-30 change.

“Right now, all we’re proposing is that T-40 to T-30 [shift]. I think maybe at some future date we’d think about moving around the other timelines associated with the base schedule submission process, but not within the scope of this initiative,” Johnson responded.

Accounting for Start-up Energy

The second part of the straw proposal would allow EIM participants to factor start-up energy into their hourly resource plans and base schedules. The ISO’s Tariff currently prohibits those participants from submitting base schedules that show energy above zero but below a resource’s minimum load (Pmin).

The proposal notes that some EIM resources have multi-hour start times and minimum loads in the hundreds of megawatts, but existing rules prevent those resources from accounting for start-up energy in their base schedules for the EIM’s RSE ahead of an operating hour.

“This leaves the EIM entity with two options: either exclude this energy from the base schedule, which results in no inclusion in the RSE, or reallocate this energy to other online resources,” the proposal says. “Neither of these options allows the EIM entity to accurately capture a potentially significant amount of energy produced while a resource is starting.”

The proposed plan would entail CAISO altering the logic of its base schedule aggregation portal and the RSE to allow entities to include start-up energy in their base schedule submissions.

“This will allow EIM entities to capture start-up energy in their schedules. The start-up energy will not be hit with uninstructed imbalance energy” charges, Johnson explained.

While the energy will be counted as part of the EIM entity’s RSE for the balancing test, CAISO clarified it would make no changes to the EIM’s capacity, flexible ramp and transmission feasibility tests. A resource operating below its minimum load will still be prohibited from providing ancillary services.

CAISO acknowledges that the changes would create a discrepancy between how start-up energy is treated for EIM and ISO resources. But the ISO noted that it already creates balanced day-ahead schedules through its Integrated Forward Market (IFM) while EIM entities produce their own balanced schedules, allowing the latter to include start-up information in the submission of their base schedules.

“To achieve similar treatment for the CAISO, the IFM would need to include this start-up energy within its optimization. Any after-the-fact inclusion of this energy to balanced day-ahead schedules would potentially create upward flexibility, at the expense of downward flexibility,” CAISO said. “As the CAISO schedules are already balanced, the CAISO does not believe this additional upward flexibility is worth the potential risk of failing the RSE in the downward direction.”

CAISO said it believes inclusion of start-up energy in the day-ahead market should be addressed “holistically” either through its existing extended day-ahead market initiative or some other future effort. (See CAISO Proposal Sets Course for EIM Day-ahead.)

The ISO additionally proposes to implement “after-the-fact” monitoring criteria to ensure participants don’t abuse the market based on the change, including looking for a non-monotonically increasing pattern of base schedules below Pmin over consecutive hours; the lack of a base schedule in an hour following an interval with a base schedule below Pmin; and base schedules remaining below Pmin for an “unreasonably” long period based on the resource’s technology and start-up profile.

Brian Holmes, a director with Utilicast, asked whether resource owners would be given an after-the-fact opportunity to explain why a resource might have been flagged under the criteria, such as a failure to start up.

“I don’t think we want this to be unnecessarily punitive,” Johnson said.

CAISO Senior Manager Brad Cooper said the ISO hopes to implement the start-up energy portion of the proposal by next spring, with the T-30 slated to follow next fall.

Kristina Osborne, CAISO stakeholder engagement and policy specialist, said the proposal will likely fall under the EIM Governing Body’s primary approval authority. She said stakeholders should provide feedback on the proposal and the RTO’s proposed classification by Oct. 14.

The proposal will go before the Governing Body on Dec. 3 and the ISO’s Board of Governors later that month.