Installed Reserve Margin Study Results

PJM stakeholders last week unanimously endorsed an installed reserve margin (IRM) of 14.4%, down from 14.8% required in 2019, along with new winter weekly reserve targets.

During the Oct. 6 Planning Committee meeting, PJM’s Patricio Rocha Garrido reviewed the 2020 Reserve Requirement Study (RRS) results, which determined the IRM and forecast pool requirement (FPR) for 2021/22 through 2023/24 and establishes the initial IRM and FPR for 2024/25. The results are based on the 2020 capacity model, load model and capacity benefit of ties (CBOT).

The 2020 capacity model is putting downward pressure on the IRM, Garrido said, with the average effective equivalent demand forced outage rate (EEFORd) of 5.78%, compared to 6.03% in the 2019 RRS. Garrido said the lower average EEFORd was caused by the increased representation of combined cycle units and gas turbines.

The CBOT — the help PJM can expect from imports during peak loads — is estimated to increase pressure on the IRM. Garrido said imports from neighboring RTOs have decreased from 1.6% in 2019 to 1.5% in 2020.

“We’re getting a little less help from our neighbors,” Garrido said.

The FPR is essentially the same as 2019, Garrido said, coming in at 1.0865 (8.65%) instead of 1.086 the previous year.

Garrido said the study results will also be used in the 2022/23, 2023/24 and 2024/25 Base Residual Auctions (BRA). He said delays in the 2019 BRA for 2022/23 necessitated the use of data from the 2020 study.

The PJM and world load models used are based on the 2002-2014 period that were approved at the August PC meeting. (See “Load Model Selection,” PJM PC/TEAC Briefs: July 7, 2020.) Analysis from the 2020 PJM Load Forecast Report released in January was also used.

Erik Heinle of the D.C. Office of the People’s Counsel asked if the IRM and FPR would be updated after the first BRA was conducted to make sure the modeling is kept accurate.

Garrido said the driver of FPR is load uncertainty, so the results of the BRA wouldn’t matter for the FPR and does not necessitate a recalculation. Garrido said the recalculation is triggered by a new load forecast, which will be released in January.

Garrido also won a same-day endorsement after conducting a first read of the 2020/21 winter weekly reserve targets, which are slightly changed from last winter.

The targets for December, January and February are 23%, 27% and 23%, respectively, compared to 22%, 28% and 24% last year.

Part of the reserve requirement study, the targets help staff coordinate planned generator maintenance scheduling and cover against uncertainties by ensuring that the loss-of-load expectation (LOLE) for winter is “practically zero,” according to the study. For the entire year, PJM sets the LOLE at one occurrence in 10 years.

Interconnection Queue Initiative

Ken Seiler, vice president of planning, discussed PJM’s plan for a series of workshops to explore ways to improve the efficiency and effectiveness of its interconnection queue process.

Seiler said more than 660,000 MW of generation requests has been studied since the inception of the interconnection process in 1999. More than 70,000 MW has been energized in that time.

“The process has served us well, but the process continues to change,” Seiler said. “We believe it’s time to take a look at some changes within the queue.”

Seiler said the interconnection process has seen many improvements over the years, including automation of tools and additional staffing. PJM currently has 122,000 MW in the interconnection queue with 88% of the megawatts made up of renewable generation sources.

The most recent queue that closed at the end of September has more than 560 projects, Seiler said, with more than 40,000 MW of energy requesting to be interconnected. Of the 560 projects, he said, 500 are either solar or storage.

Based on feedback from stakeholders and the increasing volume and size of the interconnection requests, Seiler said PJM decided it was time to take a “fresh look” at the interconnection process. Four workshops are proposed, including a review of the interconnection process, stakeholder presentations, PJM’s response to the stakeholder presentations and paths forward.

Seiler said the construct for the workshops would be based on federal policy and FERC Orders Indemnification Provision for PJM Tariff.) The first two workshops would take place before the end of the year.

Adrien Ford of Old Dominion Electric Cooperative asked if PJM is looking for feedback on how stakeholders should proceed at looking at the interconnection process or on things that need to be changed in the process.

Seiler said PJM is looking for both things that need to be changed and a process forward to make the changes. He said the RTO has already identified things that need to be changed, but there are also hidden problems that can be identified by stakeholders.

“We want to hear what everyone has to say and what objectives are there and what the end goal is,” Seiler said. “We want to hear everything before locking down a plan to move forward.”

Sharon Segner, vice president of LS Power, said she appreciated the idea of having the workshops but wondered why the RTO hadn’t drafted a problem statement and issue charge to start an official stakeholder process. Segner said it costs time and resources for members to address issues, but with a formal stakeholder process there’s an opportunity to change rules instead of simply having discussions.

Seiler said there hasn’t been a defined problem that would necessitate a solution, so PJM wanted to identify problems through a workshop first before initiating the stakeholder process.

Dave Anders of PJM said a similar workshop method was conducted when stakeholders began looking at the energy price formation issue in 2017. (See PJM Stakeholders Explore Price Formation, Seek Transparency.) Anders said the workshops are designed to expose areas of interest for members to address in the stakeholder process.

ELCC Data Submission

Andrew Levitt of PJM’s market design and economics department provided an overview of the effective load-carrying capability (ELCC) data submission requirements and the applicable deadlines for intermittent and limited duration resources.

ELCC, which is already used by MISO, NYISO and CAISO, evaluates reliability in each hour of a simulated year and compares a resource mix with limited resources against one with unlimited resources.

Members endorsed a joint stakeholder proposal at the September Markets and Reliability and Members committee meetings to use the ELCC method to calculate the capacity value of limited-duration, intermittent and combination (limited-duration plus intermittent) resources. The proposal was endorsed over the objections of the Independent Market Monitor and other stakeholders who said the proposal was flawed and could have profound and unforeseen effects on the capacity market. (See ELCC Method Endorsed by PJM Stakeholders.)

PJM is attempting to make a FERC filing by Oct. 30 to satisfy a paper hearing procedure started last year to investigate whether the RTO’s 10-hour minimum run-time requirement for capacity storage resources is unjust and unreasonable. (See FERC Partially OKs PJM, SPP Order 841 Filings.)

Levitt said PJM needs data submittals from certain resource types by Nov. 1 to release ELCC results by December, the soonest FERC is likely to approve the October filing. Levitt said ELCC could be in place for the 2022/23 BRA.

Under the new rules:

- “Immature” and planned solar and onshore wind projects that intend to deliver capacity in 2022/23 must provide estimates of hourly historical production back to June 1, 2012, based on site conditions and historical weather. PJM defines an “immature” resource as solar and onshore wind projects that came into service after June 1, 2012.

- Immature and planned offshore wind, landfill gas and hydro without storage that intend to deliver capacity in 2022/23 must provide estimates of hourly historical production back to June 1, 2012.

- All energy storage resources, hybrids and hydropower with non-pumped storage must provide relevant physical parameters, including MWh of storage.

Manual 14C Update

Mark Sims, PJM’s manager of infrastructure coordination, provided a first read of changes to Manual 14C: Generation and Transmission Interconnection Facility Construction.

Sims said minor changes are being proposed to Manual 14C as part of the biennial cover-to-cover review. Some of the changes include an update of the with the latest Tariff provisions clarifying the filing process for title transfers and associated title documentation in Section 5.

New sections on cost tracking for baseline projects and another for supplemental cost tracking are also being proposed, Sims said.

PJM will seek approval of the changes at the Nov. 4 PC meeting.

Transmission Expansion Advisory Committee

IEC Project Status

Questions over the status of the controversial Independence Energy Connection (IEC) transmission project were raised during a market efficiency presentation at the Oct. 6 TEAC meeting.

Nick Dumitriu, senior lead engineer for PJM, provided an update on the 2020/21 long-term market efficiency window. Dumitriu said the 2020 Market Efficiency Analysis Assumptions whitepaper was shared with the PJM Board of Managers for consideration at their Sept. 15 meeting.

Dumitriu said a preliminary market efficiency base case was posted Sept. 4, and a retooled base case is expected to be posted by the end of October. The final base case and congestion drivers will be posted in December before the start of the 2020/21 long-term window.

LS Power’s Sharon Segner asked if Transource Energy’s Independence Energy Connection running between Maryland and Pennsylvania will be examined by PJM during the reevaluation analysis scheduled to be completed between October and December as part of the Regional Transmission Expansion Plan (RTEP).

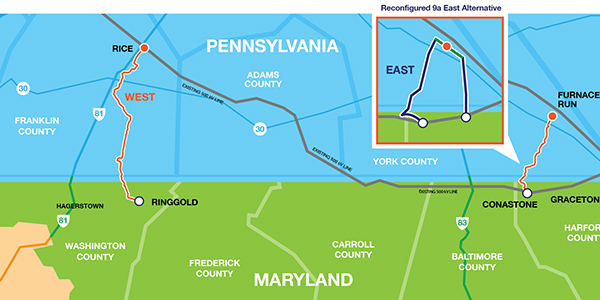

PJM selected the $383 million IEC — its largest market efficiency project to date — during the 2013/14 long-term planning window to address congestion in the AP South interface. The RTO has since reviewed its benefits to the grid several times, determining in each round that the project remains the most effective way to reduce load costs. (See Updated: Transource Files Reconfigured Tx Project.)

Tim Horger of PJM said the RTO has continued to look at the status of the project and is “taking seriously” the project review.

The project received a certificate of public convenience and necessity (CPCN) from Maryland in July. (See Md. PSC OKs Independence Energy Connection Deal.)

Horger said PJM is deferring a review of the project pending a ruling from the Pennsylvania Public Utility Commission. Transource is seeking the PUC’s approval of land acquisition, siting and construction for a 230-kV line in Franklin and York counties. The record closed with the filing of reply briefs in late September (Docket # A-2017-2640200).

Horger said an update on the project will be provided at the November TEAC meeting.

Segner said PJM has an Operating Agreement requirement to continue reevaluating projects until all required permits have been received.

Horger said the project is in a unique situation where a CPCN has been issued by one of the states involved in the permitting process. He said there are “a lot of moving parts” involved in the project, including reliability impacts.

“LS Power would maintain the position that you have an obligation to follow your Operating Agreement under all circumstances,” Segner said.