Efficient development of offshore wind transmission will require changes to current planning, interconnection and cost allocation procedures, speakers told FERC Tuesday in a daylong technical conference (AD20-18).

RTO officials agreed with wind developers and others that while the first few OSW projects are progressing through interconnection queues, the current process does not allow the coordinated planning needed to maximize the limited number of good interconnection points on shore.

Speakers also said cost allocation rules don’t properly assign costs to parties that will benefit from the additional offshore and onshore transmission that will be required for states to meet their clean energy goals and OSW targets.

Transmission Queue Process

“The current RTO/ISO planning and cost allocation methods generally hinder the integration of offshore wind on a large scale,” said Anne Marie McShea of Ocean Winds North America, a joint venture of EDP Renewables and ENGIE, which has a 50% stake in the Mayflower Wind project off Massachusetts.

McShea, head of offshore wind business development for New York and the MidAtlantic region, said that PJM, NYISO and ISO-NE are overly reliant on the interconnection queue to determine transmission needs, and that they evaluate transmission needed for reliability, market efficiency, resilience and public policy “in an unintegrated manner.”

PJM’s Regional Transmission Expansion Plan (RTEP), she noted, uses a 15-year planning horizon and considers changes to the generation mix based on the interconnection queue. “This analysis does not reflect the true mix of resources that will be relied upon by, say, 2030,” she said, adding that FERC should require RTOs to reflect state OSW procurement targets and solicitation schedules in their transmission plans.

“The interconnection process is a very incremental process that cannot efficiently identify low-cost interconnection points nor identify low-cost transmission solutions that work for this scale,” said The Brattle Group’s Johannes Pfeifenberger. “One project at a time simply won’t get that kind of transmission built.”

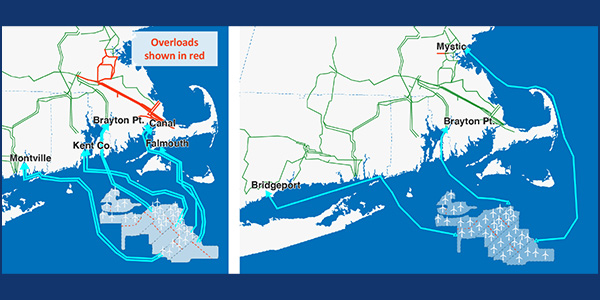

Pfeifenberger estimated PJM, ISO-NE and NYISO will have to spend about $10 billion in onshore transmission upgrades to accommodate the 15-20 GWs of renewables that their states already require.

“If you look at the PJM interconnection queue, after the first couple thousand megawatts, you hit $1-2-3 billion in already identified onshore upgrades. … We might find that we have to upgrade all the medium voltage transmission lines along the coast to 500 kV. … I’m afraid that the onshore bottlenecks will create the biggest uncertainty and the biggest risk for cost-effective offshore wind,” he said.

“We cannot afford to develop the offshore transmission grid in piecemeal,” agreed Judy Chang, Massachusetts’ undersecretary of energy, saying the load growth expected from decarbonizing the economy and electrifying buildings and transportation calls for “a paradigm shift” in transmission planning.

“The old principles are not valid anymore. The changes that our electric grid [needs] blur the lines between what is reliability needs versus … congestion relief and public policy needs,” she said.

James Cotter of Shell New Energies, which has investments in the Mayflower and Atlantic Shores offshore projects, said he fears that the current approach to transmission may limit offshore wind installations to 4-5 GW on the East Coast and prevent development on the West Coast.

PJM and ISO-NE officials agreed on the need to make changes to accommodate OSW.

“To date, PJM’s existing interconnection queue process has provided a useful tool for helping begin to achieve the states’ renewable targets through onshore renewables and provide a path for some offshore projects,” said Ken Seiler, PJM’s vice president of planning. “However, PJM anticipates that as the scale of offshore wind projects increases — and the scope of the transmission upgrades necessary to integrate offshore wind generation grows in complexity and cost — the traditional interconnection queue construct may not be sufficient, and PJM may need to develop alternative mechanisms to accomplish the required transmission buildout.”

He cited limited points of entry from the ocean and limited transfer capability to reach load centers.

Abe Silverman, general counsel for the New Jersey Board of Public Utilities, noted that PJM’s transmission planning has generally assumed West-to-East flows of power. As a result, he said, transmission near New Jersey’s shore is less robust than it is in more inland areas, and the state’s 500-kV generally runs North-South, about 40 miles inland. “The fact is that large portions of the existing grid along the coast are not designed to accommodate injections associated with a large amount of offshore wind, and so we need to find a way to efficiently get the power from shore to the backbone of the PJM system,” he said.

Silverman called for a “bold vision” to rethink OSW planning, citing as examples the Competitive Renewable Energy Zone project in Texas and the Tehachapi transmission line in California. New Jersey hopes to have 7,500 MW of OSW by 2035, with solicitations every 18 months to two years between now and 2028.

Robert Ethier, vice president of system planning for ISO-NE, said the RTO’s planning process is functioning “pretty well” with system impact studies complete for more than 3,900 MW of offshore wind. He said interconnection agreements are ready to be signed with TOs and construction can start on projects.

“As we reach the limits of the current system and have to start building out the onshore infrastructure to accommodate the new offshore infrastructure, almost certainly it’s going to make sense to do big projects that would facilitate lots of interconnection at one time,” Ethier said.

He also noted that the region will need to align its short-term transmission needs with its longer-term goals. “I think it’s important that these two processes become one process or at the very least talk to one another.”

Zachary Smith, vice president of system and resource planning for NYISO, cited the “flexibility” in the ISO’s planning process. “Once solutions come forward, we have many ways to look at them, not just in a single silo of reliability, economic and public policy,” he said. “That approach has served us quite well in New York.”

Don’t Move the Goal Posts

Gabe Tabak, counsel for the American Wind Energy Association (AWEA), called for flexible planning and interconnection policies so they can react to the rapidly evolving “policy drivers, economic imperatives and technological innovations.”

Policy should balance the needs of projects in various stages of development, he said. “The commission should ensure that changes in transmission planning or interconnection rules allow projects that are currently well underway to proceed without shifting the goal posts. This principle also means that any longer-term planned offshore transmission system — which most members agree would be needed to attain the 29 GW of Eastern state goals — should have adequate lead time, to ensure that later projects are not subject to excessive upgrade costs.”

Tabak called on FERC to conduct “a holistic examination of renewable energy integration strategies,” citing the interplay between offshore and onshore integration policies.

“Many of the topics discussed today — including the role of state policies, the potential role of a ‘transmission first’ model, the benefits of transmission, modeling of inverter-based generation and transmission approaches from other jurisdictions — are not confined to the offshore context. The rapid growth and potential of offshore wind provides an opportunity for fresh evaluation of transmission planning, cost allocation and interconnection rules in other contexts.”

‘Transmission First’ Model, Merchant Transmission

McShea also called for continuity, saying projects already underway using radial interconnection should not be delayed by the adoption of other models. But she said the “transmission first” model — in which large-scale transmission facilities are built for anticipated generation to achieve economies of scale — will be needed for future projects.

The commission said its current regulations do not include a transmission first approach “except perhaps the merchant transmission framework.”

A transmission first model also would require changes to cost allocation rules, McShea said, noting that PJM’s “state agreement” approach assigns all transmission costs to the sponsoring state even when the transmission may also benefit its neighbors. She called for cost allocation based on a broader set of criteria including contributions of the project to system reliability, operational performance, economics and resiliency in addition to “public policy” goals.

Former FERC Chair Jon Wellinghoff, now a consultant, said merchant transmission development is not well suited for OSW because developers will have difficulty raising financing without guarantees that generators will support their project. He cited the failure of the Atlantic Wind Connection, a proposed HVDC offshore transmission backbone from the Carolinas to New York and New England.

“Calculations provided to me as chairman of FERC at the time by the project developers indicated that the project was ‘profitable’ simply with energy interchanges between the Southeast and New York and New England,” Wellinghoff said. “Although initial development costs were backed by Google and Japanese investors, the project was unable to secure funding to proceed with building actual transmission infrastructure.”

Seiler also discussed challenges to the merchant model, noting that a radial merchant line that extends the PJM grid without connecting to another RTO or an identified generation project is not eligible to receive interconnection rights under PJM’s Tariff. (See FERC Rules Against Anbaric in OSW Tx Order.)

He said the RTO and its stakeholders have discussed alternative approaches but have not reached consensus. He said the issue was the generation not being connected at the time of the request for the merchant transmission line. “The concerns at that time were really the locking up of the transmission capability for the offshore wind, when there may be competing needs with onshore generation at the time, and stakeholders could not come to any agreement in that space.”

Silverman also expressed doubts about current rules, saying New Jersey’s phased procurements make it impossible to “‘broadly solicit interest in the project from potential customers or conduct a meaningful open season” as required by FERC’s 2013 policy statement on merchant and participant-funded transmission. He said FERC should consider a “hybrid merchant” investment model that includes merchant features such as absorbing cost overruns and building facilities on a fixed-fee basis.

Lead Line vs. Network

Wellinghoff endorsed The Brattle Group’s proposed planned mesh network (PMN), saying it is “clearly superior in every single respect to the” radial generator lead line (RGL) model.

The PMN would be an HVDC backbone network that gathers power for multiple wind projects. Brattle proposed one each for ISO-NE and the NYISO. Although Brattle did not do a study for PJM, “a unified single network could be created along the entire Eastern Seaboard from ISO-NE through PJM,” Wellinghoff said.

He also called on FERC to issue a policy statement declaring PMN as the “preferred” OSW transmission infrastructure and convening a joint process involving ISO-NE, NYISO and PJM to develop a transmission infrastructure needs assessment and procurement process resulting in solicitations approved by the grid operators’ boards.

Wellinghoff told RTO Insider he disagrees with a recommendation by the Business Network for Offshore Wind that the Department of Energy provide technical research and support for stakeholder engagement. (See OSW Group Seeks Changes on Tx Planning, Cost Allocation.) “FERC is the agency to do this job,” he said.

Larry Gasteiger, former FERC chief of staff and now executive director of the WIRES trade group, agreed with the need for “a holistic planning process” to ensure cost-effective transmission development and said some of his members are eager to pursue OSW transmission projects. “But we also have members who … are in the middle of the country and have real concerns about being allocated costs for projects from which they’re not seeing benefits,” he said.