NYISO told stakeholders last week that its fuel and energy security (FES) metrics remain “well aligned” with the assumptions of Analysis Group’s November 2019 study, which concluded that the state’s grid is “currently well equipped to maintain reliability in the winter, even under adverse winter system conditions.”

Although the report concluded “only fairly severe and relatively low probability conditions or events would create meaningful reliability challenges,” it said the ISO should continue monitoring because of the transition of its resource fleet and the increasing reliance on natural gas and renewables.

In April, NYISO pledged to update the metrics at least twice a year and said the study will be “refreshed” if the ISO observes large deviations between actual conditions and the conditions assessed in the study. A refresh also could result from large differences between the study’s assumptions and actual conditions that could adversely affect reliability. (See NYISO Launches Fuel Security Effort.)

An example of enhanced monitoring tools shows stored energy and required storage draw and margin (MWh). | NYISO

The ISO uses 23 metrics to monitor fuel security, including the deployment of new renewable and clean energy resources; the impact of the state Department of Environmental Conservation peaker rule; gas-only generator outages because of lack of fuel; and the status of transmission upgrades such as the AC Transmission Projects and Western NY Public Policy Transmission Need.

“We were aiming to enhance monitoring by adding some elements related to fuel security to both the Winter Capacity Assessment and the cold-weather operations presentations, those occurring in the fall and the spring,” market design specialist Amanda Myott told the Installed Capacity/Market Issues Working Group.

The ISO also is working to improve the accuracy of its generator fuel and emissions reporting (GFER) surveys, which inform internal FES assessments.

The fuel security monitoring “is focused on severe cold-weather conditions and being able to meet winter peaks in those conditions,” Vice President of Operations Wes Yeomans said.

On compensating for the intermittency of renewable resources, Yeomans said, “At other times of the year, we might have a duration of low wind or clouds; we are certainly aware of that and have other processes we’re trying to enhance with market designs and even some good work setting up the [installed reserve margin] with” the New York State Reliability Council.

In response to a recommendation that the ISO consider comparing actual conditions and operating experience to the conditions assumed in the FES study, Yeomans noted that winter 2019/20 was “extremely mild.”

“But if there is a cold snap this upcoming winter, it will be very important to look at what we assumed about gas availability for the generator fleet and the actual availability experienced,” he added.

CMR Project Treads Water

NYISO is pausing its Comprehensive Mitigation Review (CMR) project until it receives further clarity from FERC, which rejected the ISO’s proposal to make it easier for public policy resources to clear its capacity market, Michael DeSocio, director for market design, said in an update.

The project’s objective is to modify the capacity market framework while preserving competitive signals and facilitating the state’s ambitious clean energy goals. CMR efforts this year included the ISO’s proposed renewable exemption limit and changes to the Part A test for exempting resources from market mitigation.

In July, FERC approved the renewable exemption limit formula for calculating a megawatt cap of renewable resources exempt from buyer-side market power mitigation (BSM) specific to each mitigated zone. (See NYISO BSM Mitigation Ruling Sparks Glick Rebuke.)

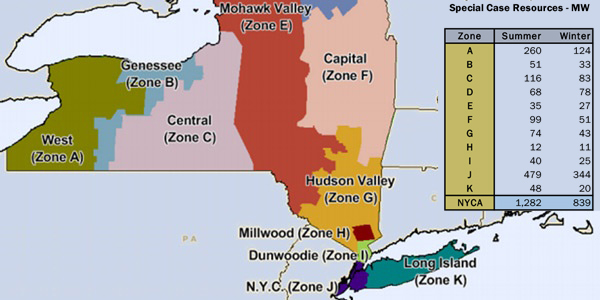

NYISO’s buyer-side mitigation rules cover New York City and zones G-I. | NYISO

But the commission rejected the Part A changes on Sept. 4, prompting a dissent from Commissioner Richard Glick and an Oct. 5 rehearing request by the ISO (ER20-1718-002). (See FERC Rejects NYISO Bid to Aid Public Policy Resources.) Rehearing requests were also filed by Equinox, New York Transmission Owners and jointly by the New York State Energy Research and Development Authority and Public Service Commission.

“The ISO still thinks that the proposal is an excellent one that makes a whole lot of sense,” DeSocio said. “FERC unfortunately didn’t see it exactly the same way.”

The ISO’s BSM rules require new ICAP resources in New York City and zones G-I to offer at or above the default offer floor. To win an exemption from mitigation, a new entrant must pass one of two exemption tests. Part A allows exemptions if the forecast of capacity prices in the first year of a new entrant’s operation is higher than the default offer floor. Part B permits exemptions if the forecast of capacity prices in the first three years of a new entrant’s operation is higher than its net cost of new entry (CONE).

DeSocio said ISO officials are considering a suite of options, the first being contractual models such as CAISO’s, with an energy-only market and fixed resource requirement.

The second option is enhancements to the capacity market such as to BSM, available capacity transfers and a future clean capacity requirement. The third option is a redesign of the capacity market, with possibilities such as a “multiple value pricing” model that co-optimizes over several variables (e.g. specific to resource type, zero-carbon resources, etc.) and a Forward Clean Energy Market to procure a certain percentage of generation from qualifying renewable resources.

The combination of the renewable exemption limit and the BSM proposals addressed many of the concepts being considered in the proposal for available capacity transfer (ACT) — expanding the use of the renewable exemption bank — and CRIS+, the pairing of transferable capacity resource interconnection service (CRIS) rights with an existing resource’s BSM exemption.

“We’re recommending to put [ACT and CRIS+] on the shelf until we get clarity on the Part A revisions that we filed earlier this year,” DeSocio said.

In the meantime, the ISO wants stakeholder feedback on capacity market changes and any other ideas before moving into 2021, he said.

“As we add more renewable resources and more limited-duration resources in the future, that will change how we approach reliability, and that does have an impact on the role of the capacity market,” DeSocio said.

The ISO will likely be more focused on BSM and how that impacts state policies and the design of the capacity market, and how the capacity market supports resource adequacy, he said.

“It’s a broad conversation, and if folks have ideas on how to structure that, I would certainly be willing to listen, because these markets are pretty complex, and as you tug on one area, it affects another area,” DeSocio said.