The NEPOOL Markets Committee continued its discussion last week on Forward Capacity Market (FCM) parameters for the 2025/26 capacity commitment period.

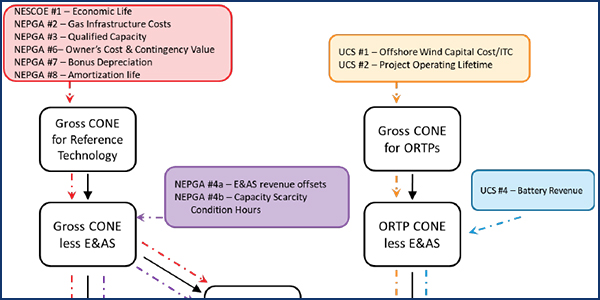

Concentric Energy Advisors (CEA) and Mott MacDonald, two consulting firms hired by ISO-NE, presented updates to their analyses from the previous meeting on the net cost of new entry (CONE) and offer review trigger prices (ORTPs). ISO-NE also presented its input assumptions and updated values for CONE, OTRPs and the performance payment rate while proposing a smoothing mechanism for the peak load scarcity hour estimates used to calculate those values.

The Oct. 26 meeting preceded Friday’s FERC Rejects ESI Proposal from ISO-NE.)

Proposed Smoothing Mechanism

Expected capacity scarcity condition (CSC) hours are based on three sources: peak load scarcity hours, transient scarcity hours, and winter scarcity hours. ISO-NE updates the peak load scarcity hours estimate annually after its update to the installed capacity requirement.

ISO-NE said the estimated CSC hours for Forward Capacity Auctions 11 through 15 ranged from a low of 7.9 to a high of 14.1, with considerable volatility in recent year-over-year changes. The RTO said it wants to use a four-year moving average to establish the expected peak load scarcity hours for FCM parameters. It said four years aligns with the load forecast horizon and that the current four-year average (10.1 hours) differs little from the three- and five-year averages. In the net CONE calculation for FCA 16, total expected annual scarcity hours, including transient (0.8 hours) and winter (0.4 hours), becomes 11.3 hours with the smoothing mechanism, down from 15.3 hours.

ISO-NE also summarized its reasons for updates to the net CONE, performance payment rate (PPR) and ORTP proposed values. The RTO is also proposing changes to the PPR because of the revised peak load scarcity hours and reference technology assumptions.

Capacity values and energy and ancillary services revenues were adjusted to reflect degradation over the net CONE reference unit’s life in response to stakeholder feedback, affecting gross CONE, net CONE and PPR.

Operations and maintenance costs for net CONE reference technology were revised to reflect decreased dispatch activity consistent with the unit’s low heat value, and bonus depreciation was removed, impacting gross CONE and PPR.

The RTO also revised the site leasing rate for the battery technology that impacts only battery ORTP.

NEPGA Memo

The New England Power Generators Association (NEPGA) presented several amendments at the Markets Committee meeting Oct. 6-8. (See “NEPGA Proposes Amendments on Amortization Period, Owner’s Cost,” NEPOOL Debates Parameters for 2025/26.) In a memo to the committee for this meeting, NEPGA’s Bruce Anderson wrote that several NEPOOL stakeholders asked the group to estimate the impact each of its potential amendments would have on net CONE value.

NEPGA posted a modified version of the discounted cash flow model used by CEA in the current net CONE recalculation process to show the numerical inputs it proposes as amendments to the bonus depreciation line item. These inputs derive from analysis and conclusions drawn by Advantage for Analysts on behalf of NEPGA. Stakeholders cannot reproduce the calculation of the inputs, so NEPGA provided them and their impact on net CONE to stakeholders who want to reproduce any of its analyses.

Impact Assessment

ISO-NE said the interdependencies among the FCM parameters present unique challenges when calculating the combined effect of more than one amendment on CONE, net CONE, ORTP and PPR values, as many amendments will impact more than one parameter. For example, a change in gross CONE for the reference technology has downstream impacts on the PPR and all ORTP values, according to the RTO.

ISO-NE said it would attempt to validate the impact of individual amendments before next week’s committee meeting, but given “the numerous permutations required to assess all combinations, the ISO cannot determine the impact of hypothetical combinations of amendments ahead of the November MC meeting nor calculate results in real time at that meeting.”

If any amendments pass at the MC meeting, the RTO will calculate their combined impacts on CONE, net CONE, ORTP and PPR and publish them before the Participants Committee vote Dec. 3.