SPP’s seven different transmission planning processes “makes for an interesting mix of different ways to solve difficult transmission challenges,” staff said of the stakeholder team re-engineering the processes during last week’s Seams Steering Committee.

“None [of the seven] are perfect, and [they] will benefit from continual improvement,” communications strategist Russell Carey said.

Enter then, the Strategic and Creative Re-engineering of Integrated Planning Team (SCRIPT), which will analyze the interconnected processes and applicable cost-allocation methods. The team will also consider and evaluate options to strategically re-engineer those processes, delivering a final report with high-level recommendations to the Board of Directors and Members Committee next October. (See “SPC Takes Look at Tx Planning,” SPP Briefs: Week of Aug. 31, 2020.)

The recommendations are expected to consolidate the processes, improve responsiveness and certainty, reduce dependence on interconnection queue-driven analyses, improve decision quality, facilitate beneficial exports and improve cost-sharing.

SPP’s planning processes are either stakeholder-driven and member-funded (Integrated Transmission Planning, high priority, balanced portfolio and interregional projects) or customer-initiated and funded (transmission services, generation interconnection service and sponsored upgrades). Costs can be allocated through the RTO’s highway/byway methodology, sometimes subject to a safe-harbor limit, or directly assigned.

“A lot has changed since those processes were implemented,” Carey said, noting wind energy’s growth and the need to export its excess as one example. “We might need to see some efficient structures developed for exports.

“We have all these studies running in parallel. Sometimes, they’re looking at similar solutions to accomplish different goals. That has created uncertainty around the long-term viability of some of those projects,” he said.”

As if to add emphasis to Carey’s comments, SPP upped its record for wind energy with a new peak of 18,442 MW Nov. 14 at 6:20 p.m. The previous mark of 18,343 MW was set in July.

The SCRIPT will add sub-teams in early 2021 to begin digging into the different proposals.

One of stakeholders’ chief concerns is the backlog of interconnection requests. Staff said the queue might not be cleared of old requests until 2023 or 2024.

“More needs to be done to address our current backlog,” Carey said.

David Kelley, SPP’s director of seams and Tariff services, said staff are working on a separate strategy to reduce and “eventually eliminate” the queue’s backlog.

“We’re doing that in parallel with what the SCRIPT is already working on,” he said. “We’re hoping to bring something to the January round of meetings.”

Tx Study Briefing for SPP, MISO Stakeholders

SPP staff said they have been meeting with MISO, SPP to Conduct Targeted Transmission Study.)

The effort, which has been described as a “vehicle” offering a different approach than previous joint transmission studies, will begin in earnest with a joint stakeholder briefing on Dec. 11. The RTOs have conducted four joint studies in six years but have yet to agree on a single interregional project.

“It’s fully intended to be a project that results in meaningful [transmission] projects,” Kelley said.

The RTOs’ state regulators are also working on seams issues, but they’re “kind of in a waiting pattern right now,” said Adam McKinnie, an economist with the Missouri Public Service Commission.

The Seams Liaison Committee — comprising regulators from SPP’s Regional State Committee and the Organization of MISO States — met Nov. 9. OMS members came with a prioritized list of recommendations, but the RSC was “not quite there with their list,” McKinnie said.

The committee canceled a scheduled December meeting and will get together again in January.

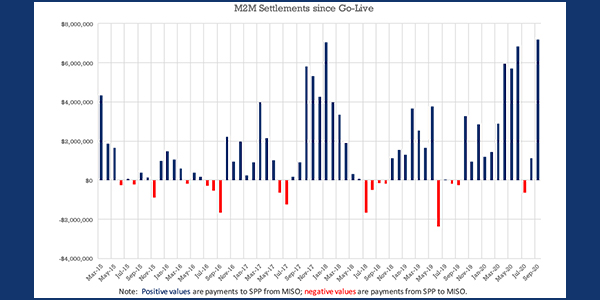

M2M Settlements Crack $100M Barrier

A monthly record of $7.19 million in market-to-market (M2M) settlements with MISO in September pushed the accrued amount due to SPP to $102.57 million.

More than three dozen temporary flowgates were binding for 951 hours during the month, accounting for $6.16 million of the settlements. Permanent flowgates bound for 216 hours.

Staff attributed the record settlements to increased loading caused by outages, high winds and a lack of cheap fast-ramping generation, resulting in high shadow prices.

It was the 11th month in the last 12 and the 50th overall in 67 months since the RTOs began the M2M process in March 2015.