PJM moved a step closer to restarting its capacity auctions with FERC’s approval on Thursday of the RTO’s new energy and ancillary services (E&AS) offset calculation (EL19-58-002).

FERC approved most of PJM’s revisions, filed in August to comply with the commission’s approval of major changes to its reserve market in May. The commission had acknowledged that the changes would increase the amount of reserves the RTO procures and, thus, the revenue resources receive, affecting the capacity market’s E&AS offset. (See FERC Approves PJM Reserve Market Overhaul.)

The offset is a key variable in calculating the net cost of new entry (CONE) for resources in the capacity market. It is calculated using energy market results from the three calendar years prior to the Base Residual Auction.

PJM’s revisions change the offset to be forward-looking and included in its filing indicative E&AS and net CONE values for various resource types. These values are “based on the latest published and publicly available forward prices at that time,” FERC said, and would be revised using updated forward prices prior to the upcoming Base Residual Auction for the 2022/23 delivery year.

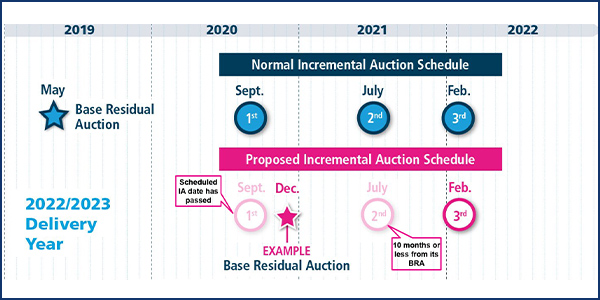

PJM has yet to set an exact date to run the BRA. It has been paused since June 2018, when FERC determined that the RTO needed to revamp its minimum offer price rule to address price suppression by state-subsidized resources.

FERC agreed with PJM using “publicly available” forward energy prices at liquid trading hubs and mapping the hubs to specific zones, “due to the high correlations in historic prices between each hub.”

“Prices from liquid futures markets (i.e., those with many buyers and sellers, as determined by open interest) produce forward prices that reflect expectations about future conditions,” the commission said.

But it ordered PJM to make a compliance filing within 15 days to use the average equivalent ability factor of all the nuclear resources in the RTO to represent a projected refueling outage. Several stakeholders had argued that using individual anticipated refueling schedules when determining nuclear resources’ availability was inadequate.

“Using an average equivalent availability factor instead of a resource-specific anticipated refueling schedule not only may avoid yearly variations in expected E&AS revenues but also may result in more accurate refueling outage projections,” the commission said.

Commissioner Richard Glick dissented in part, saying he agreed with the commission’s decision to require PJM to move to a forward-looking E&AS offset because it helps to ensure the RTO’s various markets “work in concert” and that expected increases in E&AS revenues are reflected in the capacity market.

“While PJM’s E&AS offset is by no means perfect, I believe that it is good enough to remove this issue from the list of roadblocks standing between PJM and, finally, running its auction,” Glick said.

But he scolded his colleagues for forcing PJM to complete an “unprecedented, highly technical exercise in an impossibly short period of time.”

“The reason for that rush is readily apparent: Implementing the forward-looking E&AS offset is a necessary prerequisite to running PJM’s much delayed capacity auction for the 2022/23 delivery year,” Glick said. “The responsibility for that delay lies squarely at the feet of this commission, and we owe it to all stakeholders to proceed with running that auction as soon as reasonably possible.”