SPP last week approved a new 138-kV transmission line to replace an aging line in Kansas, acknowledging that the action would immediately result in a restudy request by its owner, Evergy.

The Kansas City-based utility said the project would collide with regional needs and the company’s use of the existing right of way to begin replacing a 35-mile section of the old line, which was built in 1922 and has no shield wire. That work has already begun and is aligned with Evergy’s internal capital budget planning process, said Denise Buffington, the company’s director of federal regulatory affairs.

Evergy said that instead, staff should be directed to re-evaluate the need for the new line, given the company’s planned transmission system change to rebuilding part of the old line. Alternatively, Buffington said, the company would request a re-evaluation, as is its prerogative under SPP’s tariff, and request the Board of Directors suspend the request for proposals while the project is restudied.

“We don’t dispute there’s need for an upgrade in the area,” Buffington said during a meeting of SPP’s Board of Directors and Members Committee on Wednesday. “SPP staff is focused on economic needs. Evergy is focused on the age of the line, its condition, planning needs and regional needs.”

Members sided with Evergy and voted against approving staff’s recommendation, 9-4, with two members abstaining. The board ignored the committee’s advisory vote but did agree to meet as soon as possible after Evergy submits its restudy request, expected as soon as this week.

“It’s certainly my expectation that if there is a request for restudy, the board at that point would issue a suspension of the RFP until the restudy is completed,” board Chair Larry Altenbaumer said. “It’s important under any of these scenarios to get the ball rolling.”

The project was originally recommended as an economic project, at a cost of $135.7 million, within the 2020 Integrated Transmission Planning (ITP) assessment and required “wrecking out” the 99-year-old Butler-Altoona line. However, SPP removed the project from the assessment for “further refinement” after the Markets and Operations Planning Committee approved the proposed ITP portfolio in October. (See “Stakeholders Endorse $532M 10-year ITP Assessment,” SPP MOPC Briefs: Oct. 13-14, 2020.)

SPP’s refinement was limited to the project’s scope, not its need or value, and how to leverage the existing right of way. Staff determined it couldn’t build a new line directly between substations in Butler and Tioga and retire a portion of the aging Butler-Altoona line because it lacked regulatory authority to recommend the retirement. Instead, staff recommended an entirely new greenfield project that bypassed the original line.

“A multipronged project was new for us, and we needed time to refine the appropriate needs,” said Antoine Lucas, SPP’s vice president of engineering.

Buffington said staff’s new recommendation is more costly, less efficient and lacks accurate Evergy cost estimates. She also said the recommendation was not evaluated through the 2020 ITP assessment and has not been vetted through the stakeholder process.

“We are financially committed and ready to work on this project,” Buffington said, noting Evergy’s project is zonally funded and expected to be completed next year. “All of our cost estimates contemplated rebuilding the line. It would be the best use of everyone’s time and our resources to go through the [evaluation] process and determine if [Butler-Tioga] is still needed and incorporate what is already happening in that area.”

“Denise makes a point predicated on the outcome that SPP staff’s re-evaluation effort might find a need to rescind the [Butler-Tioga] project and make significant changes to it,” LS Power’s Pat Hayes said. “Staff might also find Evergy’s existing reliability project might be tied into the Butler-Tioga project. We used our stakeholder process to create these rules, and I think we should follow them.”

Lucas acknowledged staff’s restudy would determine whether the Butler-Tioga project retains its value and agreed it could be dropped. He said he doesn’t expect a full restudy of the entire ITP portfolio.

“The issue we have today is we have two alternatives to address [Butler-Tioga],” he said. “We will be evaluating whether or not there is still value in the regional project.”

During the lengthy discussion, several members expressed concern about the RFP “being on the street” and the delay costing developers time and money.

“These developers are smart people. They make those kinds of risk-based decisions all the time,” Altenbaumer said.

Sugg Proud of Wind Records

CEO Barbara Sugg said she was proud — “as we predicted through 2020” — that SPP became the first RTO using wind energy as its No. 1 fuel source last year. With 27.4 GW of capacity available to call on by year-end, wind served 31.3% of SPP’s load in 2020, outpacing coal (30.9%), natural gas (26.6%), nuclear (6.4%) and hydroelectric (4.5%).

“What’s more remarkable is our ability to maintain reliability,” Sugg said during her president’s report. “This couldn’t have happened without our robust transmission system, our diverse fuel mix and the whole energy market.”

SPP set a new wind peak record of 19.8 GW on Jan. 14. It also established a new wind-penetration mark in April when wind served 73.2% of load during one interval.

Membership Approves Directors’ Compensation Changes

During a special meeting before the board’s, SPP members approved the Corporate Governance Committee’s recommended changes to the board’s compensation structure to account for an increase in meetings and phone calls driven by the COVID-19 pandemic and the RTO’s corporate initiatives.

“The number of meetings SPP has is not for the faint of heart, and they increase every year,” Sugg said.

Board compensation has historically been activity-based on top of a base retainer. However, SPP said industry best practices for larger, more complex organizations are increasingly shifting to retainer-based compensation for specific board-level responsibilities.

Directors will be paid $95,000 retainers, with $40,000 and $20,000 premiums for the chair and vice chair, respectively. Board committee chairs will also earn $20,000 premiums, with members receiving $12,500. Each director serves on two committees.

Directors will also earn between $1,000 and $6,000 for various other meeting assignments, sometimes on a per-meeting basis. Compensation for special board assignments, such as the Holistic Integrated Tariff Team and other special projects, can reach as much as $10,000/quarter, depending on the number of meetings, complexity of issues and the director’s required engagement.

Sugg said board members would average about $137,000 in compensation this year, less than the $147,000 they earned in 2020.

SPP members also voted for Enel Green Power North America’s Betsy Beck for a seat on the Members Committee, more than a year after she lost a previous bid for the seat. (See Renewable, Utility Members Tangle over SPP Seat.) Beck will represent the independent power producer/marketer sector, the same seat she was nominated for in 2019. She replaces Holly Carias, who left NextEra Energy Resources late last year for another company.

Staff Calculating SPP’s Aggregate Value

The board and members granted staff’s recommendation to affirm their proposed methodology to annually calculate SPP’s aggregate value to members.

In a draft report, staff said they used both quantitative and qualitative estimated values of SPP’s various services to calculate the value provided to members through enhanced reliability; increased efficiencies and economics; consolidated functions that reduced resources; and improved environmental, public policy and local economic impacts.

“This methodology captures benefits both to SPP’s members and the region of the RTO’s bulk electric system produced by regional planning and operation,” the report said.

It did not provide any numbers, but members’ annual net benefits will be shared in average realized savings per 1,000 kWh. A 2016 transmission-value study indicated that for every $1 of transmission investment made in 2012-2014, members could expect at least a $3.50 benefit to ratepayers. (See SPP Begins Promotional Campaign to Tout Transmission Value.)

“It’s become apparent to many members that any value statement has to be credible; it has to be creative; it has to be useable in many different ways,” COO Lanny Nickell said.

The RTO creates value in key functions, he said: operations and reliability, markets, transmission and professional services. “We’re not comparing us to other options, except for the members’ option to perform what we do on a standalone basis.”

A final report is to be produced for the April board meeting.

“This can be helpful to regulators when we see the numbers,” Oklahoma Corporation Commissioner Dana Murphy said.

The board and members also approved the MOPC’s unanimous endorsement of the 2021 SPP Transmission Expansion Plan (STEP) report that lists the grid operator’s endorsed and approved transmission projects over a 20-year planning horizon. The $3.2 billion plan includes all ongoing network upgrades, as well as those that have been completed but whose closeout requirements have not been fulfilled.

MOPC Reorganization Approved

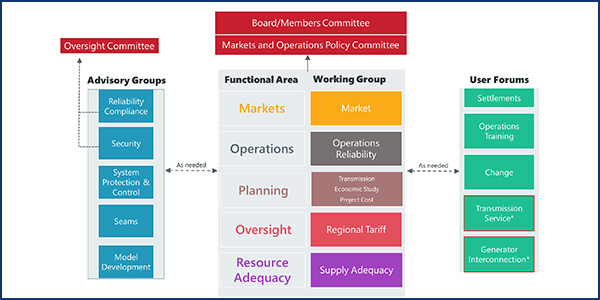

The board’s passage of its consent agenda resulted in a formal recognition of the MOPC’s revamped structure by approving the revised scopes for the committee’s various working groups, advisory groups and user forums.

The approval finishes an effort that began in 2019 to reduce the 16 working groups that once reported to the MOPC. Some of those groups have been converted into advisory groups and user forums, while others were retired. The seven working groups that remain will focus on SPP’s primary functional areas.

“Big changes are afoot,” Sugg said.

The consent agenda also included:

- staff’s recommendation to transfer the notification to construct for SPP’s competitive project in Oklahoma from Transource Missouri to Transource Oklahoma. The board in October approved an industry expert panel’s recommendation to award the 75-mile, 345-kV Sooner-Wekiwa project to Transource Missouri. (See Transource Tapped for SPP’s 2nd Competitive Tx Project.)

- the Corporate Governance Committee’s nominations of Al Tamimi (Sunflower Electric Power) and Matt Pawlowski (NextEra Energy Resources) to new seats on the Finance Committee; Scott Briggs (Oklahoma Gas & Electric) and Maria Smedley (Arkansas Electric Cooperative Corp.) to new seats on the Human Resources Committee; and Caleb Head (Northeast Texas Electric Cooperative) as chair of the Credit Practices Working Group.

- the Market Monitoring Unit’s report that the Western Energy Imbalance Service market will launch without frequently constrained areas. (See “MMU: No Frequent Constraints,” Stakeholders Approve WEIS Market Launch.)

- white papers stemming from the Holistic Integrated Tariff Team’s work on offer requirements for variable energy resources in the day-ahead market; continued support for dynamic line ratings’ implementation and use, as they remain voluntary at the transmission owner’s discretion; and a recommendation to raise the offer floor from -$500/MWh to -$100/MWh for injecting resources.

- a revision request (RR424) that removes duplicate language currently located in the system operating limit methodology.

- the Project Cost Working Group’s recommendation for a $25.6 million cost reduction to Southwest Public Service’s 345/230-kV Multi-Hobbs-Yoakum project in West Texas and a $5.1 million cost increase to an 230/115-kV SPS network upgrade north of Amarillo, Texas.