When Congress passed the Energy Act of 2020 in December, the bill included a two-year extension of the 26% investment tax credit (ITC) used by solar power generators, a one-year continuation for the production tax credit (PTC) used by wind developers and a new 30% ITC for offshore wind projects that begin construction by the end of 2025. (See Wind, Solar, EE, CO2 Storage Win Tax Breaks.)

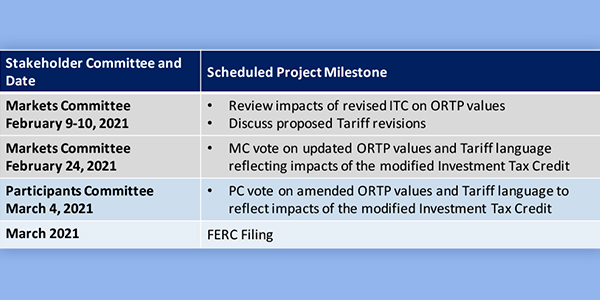

That legislative action brought ISO-NE and stakeholders back before the NEPOOL Markets Committee last week to discuss and vote on amendments that focused on offer review trigger prices (ORTPs), used for Forward Capacity Market (FCM) parameters for the 2025/26 capacity commitment period, to accommodate the changes.

No Support for ISO-NE Proposal

ISO-NE’s proposal, done in concert with consultants Concentric Energy Advisors (CEA) and Mott MacDonald (MM), would create two new ORTP categories: solar, and solar plus lithium-ion batteries. Tariff revisions would include ORTP values of $0/kW-month for solar and $6.964 for solar-batteries, down from its originally proposed $9.371. Another tariff revision would clarify that the weighted-average calculation is used only when an ORTP for the combination of technology types is not specified. New tariff language also detailed the values for solar-batteries in future Forward Capacity Auctions.

“In developing these ORTPs, [ISO-NE] has been responsive to stakeholder feedback and has revised its proposed ORTP for the combined solar-battery technology type to reflect the decoupled operation of the facility after five years, when the ITC benefit expires,” Deborah Cooke, ISO-NE’s principal analyst for market development, wrote in a memo.

The RTO’s responsiveness did not carry much weight when it came to the sector-weighted vote. The proposal did not garner any support.

Stakeholder Amendments Favored

Abigail Krich and Alex Worsley of Boreas Renewables presented three proposals regarding ORTP values for FCA 16, annual ORTP updates for FCA 17-18 and maintaining existing treatment of ORTP determinations for resources with a shared point of interconnection for FCA 16.

The first proposal would, like ISO-NE’s, change the ORTP for solar to $0. The second proposal said that if the tax law remains unchanged for solar developers, it would result in an ITC assumption of 26% for FCA 17 and 22% for FCA 18. Should the law change again in the next two years, it would be reflected in the final assumption used for the FCA 17-18 updates.

All three amendments passed with at least 73% support from stakeholders. The Participants Committee will vote on all proposals during its meeting Thursday. A filing at FERC is expected by the end of March.

IMM Memo

ISO-NE’s Internal Market Monitor said in a memo to the MC that the RTO will file a proposal for ORTP values under Section 205 of the Federal Power Act, “which will include a ‘jump ball’ alternate proposal of ORTP values from NEPOOL.” The Monitor added that ISO-NE would request FERC’s decision by May. Participants must submit retirement delist bids, permanent delist bids and test prices to the Monitor for FCA 16 by March 12.

“After reviewing these submissions, the IMM will issue its determinations on June 3,” the IMM wrote. “Given the close timing of the IMM determinations and the expected FERC order, there is insufficient time for participants to update their bids and for the IMM to perform additional review after issuance of the FERC order.”

The Monitor said participants would have two options for submitting delist bids and prices, and “as a threshold matter,” it assumes FERC will either:

- approve the RTO-proposed ORTP values;

- approve the NEPOOL-proposed ORTP values; or

- rejects the jump ball filing.

According to the Monitor, the three scenarios pose disparate risks for participants submitting delist bids and prices. “Depending on the ORTP values approved by FERC, participants’ expectations of the supply mix may change and, in turn, the change in supply mix may affect future capacity market prices and even future energy market prices.”

Participants can select one of two options for reflecting these risks in their bids and test price submissions. The first option is submitting one bid and supporting documentation that demonstrates one of the assumptions. The second option is that a participant submits one bid and all supporting documentation, reflecting the risks of the multiple possible outcomes. Pricing risk into one bid price is the Monitor’s preferred approach, as each year there is some uncertainty and regulatory risk associated with submitting bids well in advance of the auction.