FERC last week sent ISO-NE a deficiency notice regarding the RTO’s proposed rule revisions on cost of new entry (CONE), net CONE and the performance payment rate (PPR) for the Forward Capacity Auction, NEPOOL Participants Committee members heard last week.

In a memo to the committee, the RTO said it understood the notice “may cause uncertainty for participants about how the FCA 16 qualification process will proceed in the meantime.”

The notice gives ISO-NE 30 days to furnish an example of a potential site for the CONE reference unit in or near New London County, Conn., 2 miles from both a central natural gas line and the point of interconnection to the electric grid. The RTO must also provide an estimate of emissions limits and whether those limits affect the reference unit’s revenue and offer additional support for the assumption in the dispatch model that the reference unit always runs on natural gas rather than oil. Submission of that information will reset the deadline for FERC action on the filing.

The RTO said the current schedule of qualification activities for FCA 16 would continue as planned, and it will apply CONE, net CONE and PPR values for FCA 16 filed with FERC in December.

Dynamic delist bid threshold (DDBT) calculations were due last Friday, and the deadline for retirement and permanent delist bids is this Friday. ISO-NE said participants should adhere to the currently filed FCA 16 CONE values and published DDBT value for their bids.

FERC recently approved tariff revisions developed by the RTO and stakeholders on recalculating DDBT for the FCA. DDBT, which was previously updated every three years, will now be calculated annually using a tariff-based “recalibration method.” Values for each auction will be updated based on recently available supply conditions and up-to-date projected demand conditions using the estimated systemwide demand curve for the FCA. (See related story, FERC Approves ISO-NE’s New Method for Calculating DDBT.)

ISO-NE plans to respond to the deficiency notice by Thursday. The RTO added that with the limited nature of the deficiency requests, it will request expedited review to receive an order on the FCA 16 CONE filing by mid-April. FERC’s order would be issued in mid-May if it chooses to use the full 60 days available to it.

Action on ORTP Deferred

The PC had been scheduled to discuss and vote on amendments for offer review trigger prices (ORTPs) used for Forward Capacity Market (FCM) parameters for the 2025/26 capacity commitment period, which accommodate recent changes and extensions to the federal investment tax credit for solar and wind developers.

ISO-NE requested the PC postpone action on the issue until a later date in March. The RTO’s ORTP proposal, created in concert with consultants Concentric Energy Advisors and Mott MacDonald, did not receive any support from stakeholders at a recent Markets Committee meeting. It would create two new ORTP categories: solar and solar plus lithium-ion batteries.

Tariff revisions include ORTP values of $0/kW-month for solar and $6.964/kW for solar-plus-batteries, down from its initially proposed $9.371/kW. Another tariff revision clarifies that the weighted-average calculation is used only when an ORTP for the combination of technology types is not specified. New tariff language details the values for solar-plus-batteries in future Forward Capacity Auctions.

Boreas Renewables presented three amendments, which all passed with at least 73% support from stakeholders, regarding ORTP values for FCA 16, annual ORTP updates for FCA 17-18 and maintaining existing ORTP determinations for resources with a shared point of interconnection for FCA 16. Like the RTO’s proposal, the first would change the ORTP for solar to $0. The second amendment would allow for an ITC assumption of 26% for FCA 17 and 22% for FCA 18 if the tax law remains unchanged for solar developers. Should the law change again in the next two years, it would be reflected in the final assumption used for the FCA 17-18 updates. (See Revised Stakeholder Amendments on ORTPs Gain Support.)

The original timeline called for a filing at FERC by the end of March. ISO-NE’s Internal Market Monitor said in a memo to the MC that the RTO will file a proposal for ORTP values under Section 205 of the Federal Power Act, “which will include a ‘jump ball’ alternate proposal of ORTP values from NEPOOL.” The Monitor added that ISO-NE would request FERC’s decision by May.

Energy Market Valuation Rises Dramatically

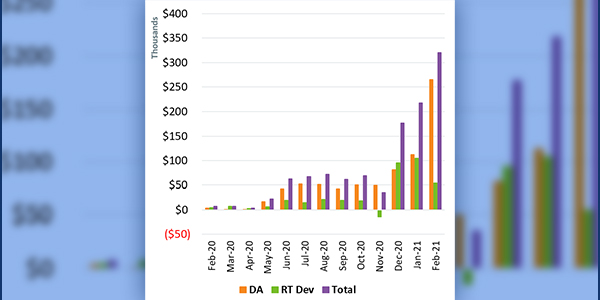

ISO-NE’s energy market value for February was $716 million (through Feb. 24), up $228 million from the updated January valuation and $483 million higher than the same month in 2020, according to the monthly report from COO Vamsi Chadalavada.

The ISO-NE energy market value in February was $716 million, which was a significant rise from January and nearly $500 million higher than February 2020. | ISO-NE

Natural gas prices were up 92% from January, which spiked average real-time hub LMPs by 77% to $77.42/MWh. Average natural gas prices and real-time hub LMPs were up 320% and 281%, respectively, from the same period last year.

Average day-ahead cleared physical energy during peak hours as a percentage of the forecasted load was 99.2% during February, up from 98.4% during January, with the minimum value for the month of 94.4% posted Feb. 1.

Daily uplift or net commitment period compensation (NCPC) payments totaled $2.3 million over the period, down $1.2 million from the adjusted January value and up $1.3 million from February 2020. NCPC payments were 0.3% of the energy market value.

Chadalavada added that seven new PV projects totaling 493 MW applied for an interconnection study, with in-service dates ranging from 2022 to 2024. There are 265 generation projects currently being tracked by the RTO, totaling about 24,600 MW.