PJM stakeholders endorsed an issue charge regarding the allocation of capacity transfer rights (CTRs) after delaying the vote last month when stakeholders raised questions about the initiative’s scope and potential impact.

The vote on the issue charge, originally advanced by Buckeye Power, was endorsed with 79% support at last week’s Market Implementation Committee meeting.

Kevin Zemanek, director of system operations for Buckeye Power, reviewed the problem statement and issue charge, saying current rules are exposing his cooperative to price separation. Zemanek said the issue charge was changed after stakeholder feedback received last month at the MIC. (See “RPM Capacity Transfer Rights,” PJM MIC Briefs: Feb. 10, 2021.)

“We think we’ve modified our issue charge to account for all the comments we’ve received,” Zemanek said.

Under the Reliability Pricing Model (RPM), Zemanek said, CTRs return to load-serving entities capacity market congestion revenues occurring when there’s a difference between the prices paid by load and market revenue received by cleared resources. CTRs permit LSEs with load inside a constrained locational delivery area (LDA) to receive a credit for the import of capacity from a lower-priced region.

Zemanek said PJM does not have a way to allocate CTRs to an LSE that will correspond to the network load identified in the RTO’s network integration transmission service agreement. Instead, Zemanek said, PJM allocates CTRs pro rata to each LSE serving load in the LDA or zone based on the LSE’s share of the zonal unforced capacity obligation.

Although an LSE may have resources that are deliverable to load inside the constrained LDA, current rules do not allocate an equivalent number of megawatts, Zemanek said.

The key work activities presented by Buckeye included education on the current capacity market rules regarding how CTRs are allocated to LSEs in a constrained LDA. It also sought to explore potential enhancements to the allocation of CTRs to recognize designated historic network resources and network load identified in a network integration transmission service agreement (NITSA), without changing the total amount of available CTRs or the incremental capacity transfer right (ICTR) allocation.

Zemanek said Buckeye is looking for two months of education followed by discussion and exploration of enhancements to CTR allocation rules, with an objective for PJM to make a Section 205 FERC filing by the end of the year.

Independent Market Monitor Joe Bowring said the revised issue charge seemed to be “moving in exactly the wrong direction” from the one presented in February. Bowring said he objected to the added language “without changing the total amount of available CTRs or the ICTR allocation” in the second key work activity.

“It’s clearly only considering only one option and recognizing that it’s a zero-sum game,” Bowring said. “If the allocation changes, some people will be helped and some people will be hurt.”

Gary Greiner, director of market policy for Public Service Enterprise Group, said he agreed with Bowring’s objection to the issue charge language. Greiner said he thinks the second key work activity “presupposes” that stakeholders want to recognize the designated historic network resources and load identified in the NITSA.

Greiner suggested adding a work activity to determine whether the historic resources should be accounted for in the determination of CTR allocations.

“I think it needs to retreat back some in its words and context,” Greiner said.

Stakeholders also suggested adding ICTR allocation to an out-of-scope section in the issue charge.

The changes were made in a revised issue charge and endorsed by members.

PJM said education on the issue should begin at the April MIC meeting.

5-Minute Dispatch Plan Endorsed

Stakeholders unanimously endorsed a proposal by PJM and the Monitor on the long-term five-minute dispatch evaluation under consideration for several months.

Aaron Baizman, senior engineer for PJM, reviewed the solution proposal matrix for the long-term five-minute dispatch and pricing issue worked on in MIC special session meetings. The endorsement vote on the PJM/IMM proposal was delayed last month. (See “Long-term Five-minute Dispatch,” PJM MIC Briefs: Feb. 10, 2021.)

Stakeholders approved the short-term proposal to resolve five-minute dispatch and pricing at the Markets and Reliability Committee meeting in July. PJM said it expects to continue evaluating long-term solutions late into this year, with a quantitative analysis of the pros and cons of different approaches. (See PJM Stakeholders OK 5-Minute Dispatch Proposal.)

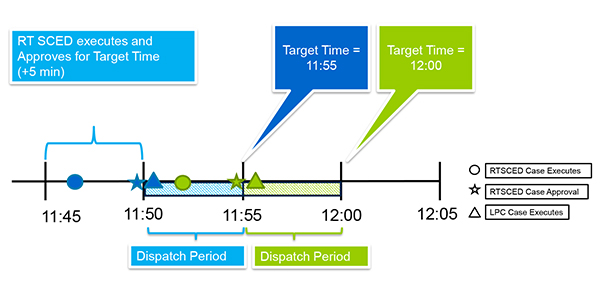

Baizman said highlights of the long-term package include creating new real-time security-constrained economic dispatch (RT SCED) instructions utilizing previous ones. PJM dispatchers will also be provided flexibility for exceptions for case-by-case approval caused by unanticipated conditions or application issues.

PJM is also discontinuing use of degree of generator performance (DGP), a software logic used to determine how well a unit is following the dispatch signal. Baizman said DGP is being replaced with a less complex and more efficient software program.

Baizman said the current long-term timeline calls for software development until April, testing from May to June, parallel operations and evaluation from July to September, and a pilot evaluation and implementation by Nov. 1.

A first read of the proposed tariff language is scheduled for the March 24 MRC meeting.

Capital Recovery Factor Endorsed

An issue charge aimed at updating the value of capital recovery factors (CRFs) was unanimously endorsed by members.

Jeff Bastian, PJM senior consultant of market operations, provided an overview of the problem statement and issue charge designed to regularly update the value of CRFs based on current federal tax rates. CRFs are a component of the net avoidable cost rate (ACR) of a resource, which determines its market seller offer cap or minimum offer price rule (MOPR) floor price, depending on which is applicable.

The issue has been under review since the IMM notified PJM in a Dec. 4 letter that the CRF values, which were originally set in 2007, do not reflect the current 2017 reduction in federal corporate tax rates. (See “Capital Recovery Factors Discussion,” PJM MIC Briefs: Feb. 10, 2021.)

The Monitor said the tables should have been updated in 2018 and must be changed before the next capacity market auction, for the 2022/23 delivery year, takes place in May. PJM said it was concerned that seeking an earlier effective date would further delay the auction, which was originally scheduled for 2019. (See PJM Sets BRA for May 2021.)

PJM proposed that after the upcoming auction, the table of CRF values be posted on the PJM website no later than 150 days before the beginning of the offer period of each auction. Bastian said the values would reflect federal income tax laws in effect for the relevant delivery year at the time of the determination.

Erik Heinle of the D.C. Office of the People’s Counsel thanked PJM for its work to correct the CRF table and ensure it be updated along with tax laws in the future.

“Hopefully we can move forward on this,” Heinle said.

Reactive Supply Compensation

Jim Davis, regulatory and market policy strategic adviser for Dominion Energy, provided a first read of a problem statement and issue charge to address compensation for reactive supply and voltage control service.

Davis said Dominion has looked at the growing number of projects in the interconnection queue and determined that the proliferation of renewable resources on the system are going to create issues.

“We think that the timing is right for this, and we need to address this going forward,” Davis said.

Davis said reactive power is a “critical component” for operating the alternating current electricity system and controlling system voltage for reliable operation of transmission. He said reactive power allows for transmission of real power across transmission lines.

The transmission lines dissipate reactive power more quickly than real power, Davis said, resulting in a condition where reactive power cannot be efficiently transferred over long distances. Because of this, PJM needs localized resources to provide reactive power.

Transmission customers pay for reactive power as an ancillary service under Schedule 2 of the tariff, Davis said, and the charges collected from customers are paid to resources in the zone where the customers and resources are located. Under the tariff, generation owners must submit a Section 205 filing to FERC to seek compensation.

Davis said the existing rate mechanism is “time-consuming and onerous” for generation owners, developers and transmission customers. He said it exposes generators, developers and customers to significant litigation costs in either defending or contesting the requested rates.

To solve the problem, Dominion has proposed several key work activities, including providing education on topics such as the existing reactive rate filing process, a review of the inputs for the determination of reactive revenues and an examination of the reactive rate recovery mechanism in other RTOs/ISOs, including ISO-NE.

Davis said the issue charge also requests the discussion of improvements to the reactive power cost recovery process and examination of alternative reactive power cost recovery mechanisms.

Carl Johnson of the PJM Public Power Coalition said now is an important time for stakeholders to examine issues related to reactive power, calling the issue a “black box” and difficult for people to understand.

Johnson questioned Davis about an out-of-scope issue denoted in the issue charge that bars discussion of any existing FERC-approved reactive service revenue requirements. Johnson said he wanted to hear PJM’s opinion at the next MIC meeting whether the reactive service rates on file in the RTO are considered contractual.

Questions about whether black start unit arrangements constitute contracts nearly derailed stakeholder discussions on the issue last year. (See Vote on PJM Black Start Compensation Deferred.)

Davis said the problem statement and issue charge seek to create rules “prospectively” and not affect existing FERC-approved decisions.

The committee will be asked to approve the issue charge at the April MIC meeting.

New Load Behind-the-meter

Bastian provided a first read of the problem statement and issue charge addressing new load locating behind the meter of an existing generation resource. Bastian said PJM has received inquiries from several generation owners seeking direction on the RTO’s rules related to locating new load behind the meter of an existing generator’s point of interconnection.

The proposed arrangements envision the new load, including facilities such as data centers, being directly served by an existing generation resource that has capability exceeding the new load amount.

Bastian said the tariff contains several provisions that address generation added behind the meter with the existing load of a network service customer, but there is no existing tariff or PJM manual provisions addressing a scenario where new load is added behind the meter of an existing generation resource.

PJM is proposing key work activities in the issue charge, including education on the existing tariff and manual provisions around locating new BTM generation with the existing load of a network service customer.

Bastian said PJM also wants to assess whether the existing provisions can be equally applied to a case where new load is proposed to be added behind the meter of an existing generation resource for two different proposed arrangements: new load to be served from the system when the generation is not operating, and new load solely served by the generation but never from the system.

Several stakeholders questioned what would constitute a “new load.” Bastian said PJM would work to “better articulate” what the issue charge is seeking to address at next month’s MIC meeting.

Manual 11 Revisions

Stakeholders unanimously endorsed minor manual updates as part of the biennial cover-to-cover review.

Nikki Militello, PJM senior engineer of real-time market operations, reviewed updates to Manual 11: Energy & Ancillary Service Market Operations. Militello said the updates included providing additional clarification of existing processes, removing outdated rules and terminology and correcting spelling and grammar mistakes. The updates will be voted on at the March 29 MRC meeting.