In my last column I suggested that Texas pass on Berkshire Hathaway’s offer to give Texas 10 GW of new emergency generation to be fueled by liquefied natural gas, at a cost of $8.3 billion, in exchange for a guaranteed return on that $8.3 billion. BH had billed this as a “TOTAL SOLUTION” to the tragedy this winter in Texas.

I pointed out that the 10 GW would not have avoided load shed, and how impossible it would be for new facilities with winterizing to cost more than winterizing existing facilities. I gave an example of the South Texas Nuclear Unit 1 that could have been winterized for a pittance relative to what BH wants for equivalent capacity, $1.1 billion.

And I discussed some low-hanging fruit that Texas ought to pursue before throwing billions at BH.

BH has responded to my column, and here I address some of its claims.

No Load Shed if Existing Thermal Units Had Run

Perhaps most egregious of the BH claims is that “even if 100% of the thermal units were operating at full load during winter storm Uri there still would have been load shedding, as there was not sufficient dispatchable capacity to meet demand.”

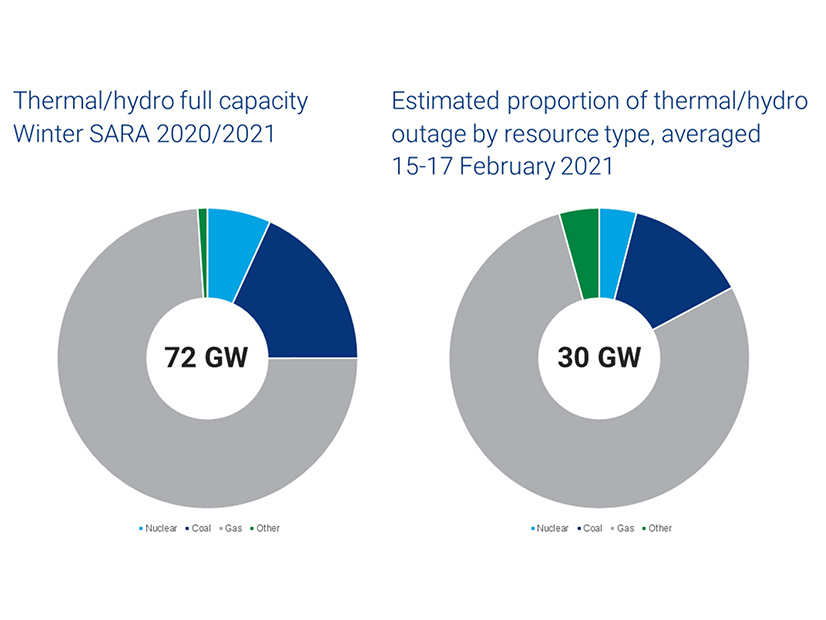

The numbers simply belie this. As these pie charts from Wood Mackenzie show, ERCOT had 72 GW of thermal capacity, and an average of 30 GW were out during the storm.[1] Maximum load shed during the storm was 20 GW.[2]

Thus, if all thermal units had been operating at full load, ERCOT would have had at least 10 GW of extra capacity during the storm. Obviously, no load shed would have occurred. As many have said, the problem wasn’t lack of steel in the ground; it was steel in the ground that didn’t run.

Lifetime Cost No Bargain

On to the BH claim that the true lifetime cost of the 10 GW isn’t $8.3 billion but really is $3.55 billion because of revenue from two weeks of annual testing over 40 years, which revenue “flows back to customers.”

I don’t know how BH gets this $4.75 billion of revenue credits (difference between $8.3 billion and $3.55 billion), but if two weeks of testing covers more than half the cost of 10 GW, why not test for four weeks a year and make the 10 GW free? That’s of course impossible, and the reason is that the hypothetical $4.75 billion is billed to customers in the first instance. So the revenue credits are simply returning monies that customers pay.

Same, by the way, if the 10 GW had been around for Uri. BH says the 10 GW could have generated $9 billion in revenue, “fully paying for the entire cost of the facilities.” But again, customers would pay that $9 billion in the first instance, so BH would just be returning what customers pay. No free lunch.

Dual-fuel Capability

As for the option of adding dual-fuel capability at existing generation, BH says a generator is unlikely to add, say, a diesel fuel tank “with the expectation to never or rarely use it.” Of course, the BH proposal would reduce any incentive to do that by reducing energy prices.

And while conceding that the incentive may be insufficient in an energy-only market — with or without the BH proposal — my suggestion was that if Texas decides that some amount of dual-fuel capability is worthwhile, that it conduct a descending clock auction to add that to existing generation in a cost-effective way.

Subsidies Are Contagious

Let me close by observing that subsidized resources tend to crowd out unsubsidized resources in a kind of Gresham’s Law. The ERCOT Market Monitor aptly states, “As an energy-only market, ERCOT relies heavily on high real-time prices that occur during shortage conditions to provide key economic signals that incentivize development of new resources and retention of existing resources.”[3]

Adding 10 GW of subsidized resources in ERCOT would disrupt and crush those economic signals, discouraging new market-driven resources and inevitably leading to a need for more subsidized resources. As the PJM Market Monitor says, “subsidies are contagious.”[4]

Is that the path that Texas wants to start down?

[1] https://www.woodmac.com/news/editorial/breaking-down-the-texas-winter-blackouts/full-report/ (Figure 3).

[2] http://www.ercot.com/content/wcm/key_documents_lists/225373/2.2_REVISED_ERCOT_Presentation.pdf (slides 15 and 16) (“20,000 MW peak load shed”).