MISO’s ninth annual capacity auction cleared MISO South zones — two months removed from emergency load shed orders — at just a penny/MW-day Thursday.

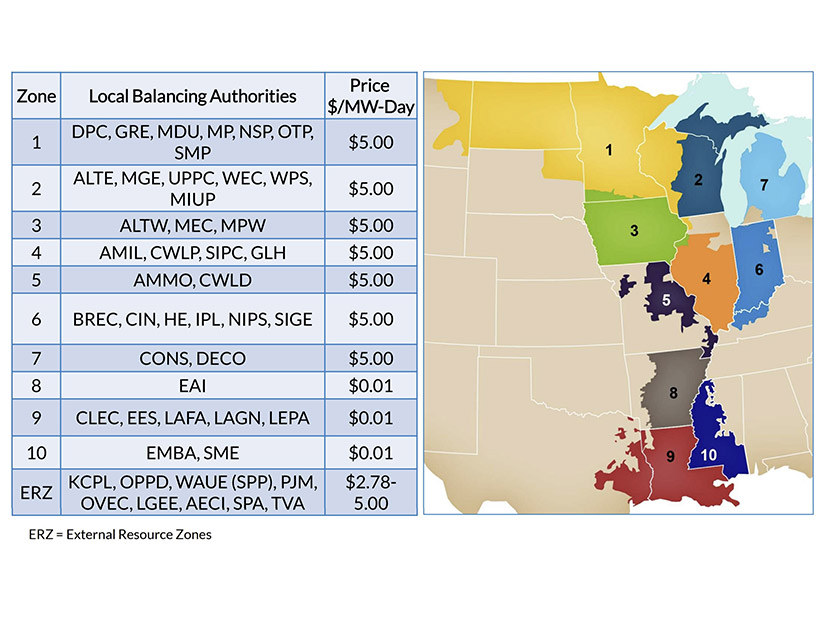

Southern zones 8-10 — Arkansas, Louisiana, Mississippi and Texas — cleared at an all-time low of 1 cent/MW-day while Midwestern zones 1-7 — Illinois, Indiana, Iowa, Michigan, Minnesota, Missouri, Montana and Wisconsin — cleared at $5/MW-day.

Last year, Michigan’s Zone 7 became MISO’s first local resource zone to clear at the $257.53/MW-day cost of new entry, signaling a need to build new generation. Most other zones cleared around $5/MW-day. (See Michigan Prices Soar in 8th MISO Capacity Auction.)

MISO said the low clearing prices in the 2021/22 Planning Resource Auction, especially in MISO South, are because of increased supply and lower peak demand forecasts. MISO’s South-to-Midwest capacity transfer limit bound during the auction, causing the $4.99 price separation.

2021/22 PRA clearing prices |MISOSpeaking at a conference call to discuss results Thursday, MISO Manager of Capacity Market Administration Eric Thoms said zones 8-10 experienced an average 2.5% decrease in demand forecasts.

MISO’s Independent Market Monitor has reviewed and certified the auction results.

The grid operator said all zones’ capacity volumes exceeded their respective local clearing requirements. MISO prepped for the auction with a 120-GW systemwide coincident peak and a 134-GW planning reserve margin requirement. (See MISO Preps for Capacity Auction, Spring Peak.)

MISO cleared a total 133.9 GW of capacity. Natural gas generation provided most of the capacity at 40%, while coal generation followed at 34%. Nuclear generation held steady at about 9%. Wind and solar furnished 3% and 1%, respectively. While still a small share of total capacity, MISO said the 3,590 MW of wind cleared was a 10% increase compared to last year, and the 1,426 MW of solar represented a 68% rise.

Thoms said this year, no energy efficiency resource registrations qualified for auction participation.

MISO leadership acknowledged the incongruity of the South’s low clearing prices and recent maximum generation events that required load shedding after both the February freeze and 2020’s Hurricane Laura.

“The continued frequency of emergency events, including what MISO experienced in February, reinforce that the summer-focused resource adequacy construct will need to be modified to ensure resource availability, particularly with the continued evolution of the resource portfolio,” Executive Director of Market Operations and Resource Adequacy Shawn McFarlane said in a press release.

Most MISO emergencies occur outside of summertime, Thoms said, providing more confirmation that MISO should rethink its summer peak reliability emphasis.

“That will be more support for these ongoing reforms,” he told stakeholders.

MISO said it wants to transition away from summer peak planning and hold four independent seasonal auctions by the 2023/24 planning year. It also wants to impose a tougher capacity accreditation on planning resources, though that proposal is being redeveloped after criticism from stakeholders. (See MISO, Stakeholders Disagree on Post-storm Accreditation.)

MISO plans to go into greater detail on the auction results at its Resource Adequacy Subcommittee teleconference May 12.