Despite a large influx of new resources, California could experience capacity shortfalls this summer during severe heat waves because of limited imports and low hydroelectric production, CAISO said in a report Wednesday.

CAISO expects supply in 2021 to be better than in 2020, with similar demand under normal circumstances, but “a second year of significantly lower-than-normal hydro [generation] and an increased possibility of extreme weather events indicate the ISO may still face challenges in meeting load this summer,” the Summer Loads and Resource Assessment said.

If that happens, it could cause a repeat of the rolling blackouts of Aug. 14-15 or the close calls over Labor Day weekend when demand for air conditioning remained high in the evenings as solar dropped offline and temperatures stayed high.

The state has been struggling to make the switch from fossil fuels to renewable resources under hotter, drier conditions in recent years. Last year’s shortfalls triggered a more urgent response by CAISO, the California Public Utilities Commission and the state Energy Commission, which examined what went wrong and adopted measures meant to correct resource adequacy problems. (See CPUC, CAISO Take Major Steps for Summer Reliability.)

Summer Outlook

CAISO’s summer 2021 assessment looked at supply and demand conditions across its balancing authority area and, to a lesser extent, the rest of the Western Interconnection.

A positive difference this summer is the anticipated addition of nearly 4,000 MW of new capacity in CAISO between June and September, including about 2,000 MW of solar generation and 1,500 MW of batteries to store excess solar power. The batteries will help “meet system needs during the net peak period, when solar production ramps down and is no longer available,” the ISO said.

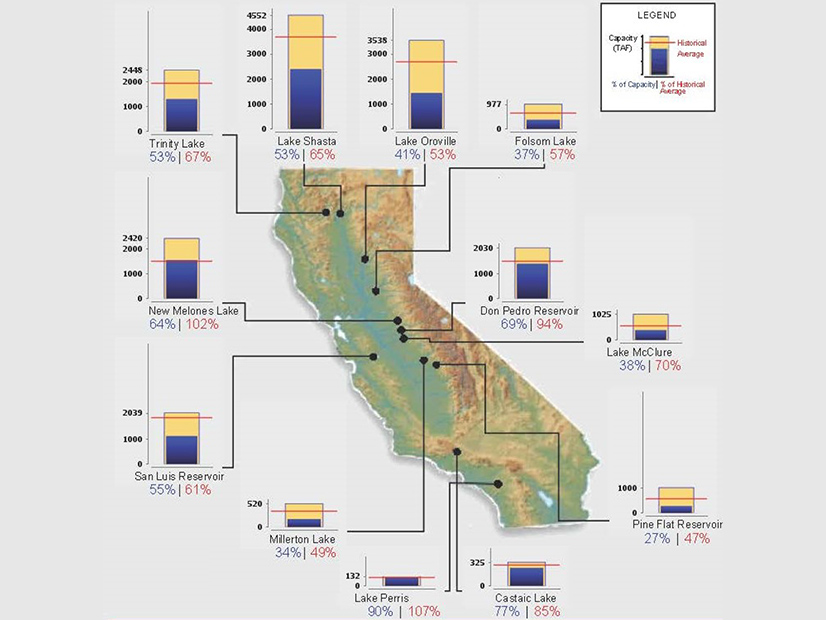

However, “California hydro energy supply will be significantly lower than normal during 2021,” the assessment said. “California is in a second consecutive year of below-normal precipitation statewide. Snow water content for 2021 peaked at 60% of normal, similar to the 63% level for 2020.”

In addition, “2021 runoff from snowmelt has occurred earlier than in 2020, which was earlier than normal itself, and the average water levels of large reservoirs for 2021 was 70% of normal, which compared to 101% of normal in 2020,” it said.

CAISO used Northwest River Forecast Center projections to assess hydropower imports this summer from the Pacific Northwest. NRFC predicted reservoir storage at The Dalles Dam on the Columbia River, a key indicator, will be 89% of average from April to September.

Hydropower accounts for about 14% of California’s summer peak capacity, making it the second largest generation source after natural gas, which fills 57% of the state’s resource needs. Solar makes up 10.6% of the summer resource mix.

Extreme Heat Risks

Last year’s triple-digit temperatures across the West also raised forecasted peak demand levels in extreme heat, CAISO said.

“The 1-in-2 and 1-in-5 forecast levels are virtually unchanged for 2021, [but] the 1-in-10 forecast is significantly higher than the 2020 forecast,” CAISO said. “The higher loads associated with a 1-in-10 weather event are attributable to including last year’s extreme weather events in the historical weather database that is used to develop the range of load forecasts. This changed the high temperature end of the weather distribution profile such that the probability of the historical extreme heat events are now within the range of a 1-in-10 weather event.”

CAISO’s highest risk demand forecast is now 50,968 MW, 6% higher than in 2020, which could potentially strain the ISO’s grid. Projected system capacity in September, for example, falls well below that figure at 47,385 MW because of waning hydro and solar generation.

One forecast model showed CAISO’s system has a 6.4% probability of reaching a stage 2 emergency and a 4.8% probability of reaching stage 3, both of which occurred on multiple days last summer.

If demand in neighboring states limits imports during Western heat waves, CAISO’s system has a 14% probability of operating at a stage 2 emergency, a 12.5% chance of reaching stage 3 and a 12.4% chance of having unserved load, a sensitivity case study showed.

That could lead to more rolling blackouts in late summer.

“If the ISO is limited to the more conservative net import levels of the sensitivity case, the probability of having to shed firm load to maintain required operating reserves is significantly increased,” the assessment said. “This indicates that the ISO will be at the greatest operational risk during a late summer widespread heat wave that results in high ISO loads and low net imports due to high peak demands in its neighboring balancing authority areas, concurrent with the diminishing effective load carrying capability of solar resources and the wane of hydro generation.”

CAISO said it has taken steps to address that scenario through load reduction protocols. Additional blackouts were avoided last summer by consumer conservation and measures that included removing U.S. Navy ships from shore power. (See CAISO Provides More Details on Blackouts.)

“Capacity shortfalls this summer may be mitigated by additional extraordinary measures accessed under extreme or emergency conditions to limit the risk of actual firm load shedding,” it said. “The ISO will continue to find and act on such opportunities … but is guardedly optimistic regarding its operations this summer given the measures already taken, including greater coordination [with other state entities].”