By Rich Heidorn Jr. and Michael Kuser

ISO-NE asked for FERC approval of its two-stage capacity auction Monday following months of negotiations that left the RTO’s stakeholders split.

The RTO filed for approval of its Competitive Auctions with Sponsored Policy Resources (CASPR) proposal even though it fell short of the 60% support needed to win endorsement in a Participants Committee vote on Dec. 8 (ER18-619).

CASPR received a sector-weighted vote of 57.75%, with the strongest support coming from the Generation, Transmission and Supplier sectors and virtually no support from End Users. Publicly Owned Entities voted 45-0 in opposition.

‘Cash for Clunkers’

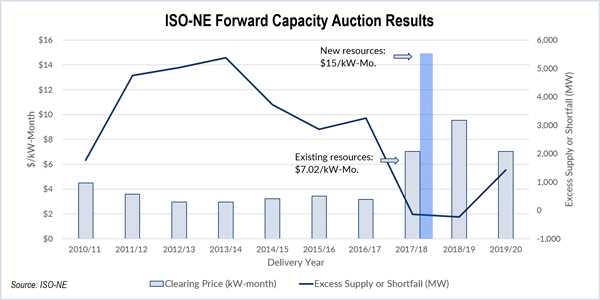

CASPR arose out of the New England Power Pool’s Integrating Markets and Public Policy (IMAPP) initiative, launched in August 2016 in response to state regulators’ concerns over funding of their procurements of renewable generation and generators’ fears that out-of-market resources will suppress capacity prices. Massachusetts, Connecticut and Rhode Island plan to procure more than 3,600 MW of nameplate renewable generation.

“The New England states have expressed concern that the [minimum offer price rule] may cause electricity consumers to ‘pay twice’: once for the cost of the capacity procured in the [Forward Capacity Market], and a second time for the additional generation capacity obtained through the out-of-market contracts with preferred policy resources,” the RTO explained in its filing. “In other words, the region could develop more generation resources than the ISO requires to operate the power system — at an unnecessarily high total cost to consumers.”

In the first stage, ISO-NE would clear the auction as it does today, applying the MOPR to new capacity offers to prevent price suppression. In the second Substitution Auction (SA), generators with retirement bids that cleared in the primary auction would transfer their obligations to subsidized new resources that did not clear because of the MOPR.

Because the SA will not use the MOPR, it will clear at lower prices than the primary auction, enabling existing resources to buy out their obligations at a lower cost in return for retiring. The savings would in effect be a “severance payment” to the retiring resources, ISO-NE said. The RTO has explained the SA as akin to a “‘cash for clunkers’ secondary market,” referring to the Obama administration’s 2009 program to encourage the retirement of older, gas-guzzling automobiles.

The proposal would phase out the current Renewable Technology Resource exemption, which has allowed ISO-NE to clear 200 MW of renewable generation in its capacity auction annually without regard for the MOPR.

The RTO asked that most of the CASPR rules become effective on March 9, 2018, when it will begin its planning for FCA 13 in 2019. “This auction is the first opportunity for FCM participation by up to 1,200 MW of nameplate clean energy supply to be procured by Massachusetts pursuant to statute,” the RTO said.

States Split

Although state regulators have no votes in NEPOOL, they were engaged in the negotiations — and split over the result.

Vermont, Connecticut and Rhode Island opposed the final proposal, while Massachusetts, New Hampshire and Maine supported it, according to the New England States Committee on Electricity (NESCOE).

Massachusetts, New Hampshire and Maine are supporting the CASPR proposal “primarily based on the view that CASPR is not expected to have an adverse impact on their ratepayers, and they don’t have the same requirement of state law to satisfy,” NESCOE said in a statement read at the Dec. 8 meeting.

For Vermont, Connecticut and Rhode Island, on the other hand, “the assertion ISO-NE made at the outset — that CASPR is better than what was in place — has not been proven out,” NESCOE said.

Change to Definition

ISO-NE upset many stakeholders when it agreed to a proposal by the Natural Resources Defense Council and Conservation Law Foundation to limit eligibility in the SA to renewable or clean energy resources receiving out-of-market revenue under state rules enacted before Jan. 1, 2018.

“We thought that the original SA supply definition was incommensurate with the goal of IMAPP, which was to integrate big purchases of low carbon/renewable purchases by states,” CLF’s David Ismay told RTO Insider. “As originally proposed, CASPR would have allowed any generation — including traditional fossil fuel generation — to qualify in the new, second auction (as SA supply) as long as it was deemed desirable for some/any reason by some/any public entity.”

But the change alienated the Public Power sector. In a memo to NEPOOL, Public Power representative Brian Forshaw said the revised definition abandoned ISO-NE’s pledge to be “technology-neutral,” which would have allowed it to cover resources meeting “broader policy objectives including fuel diversity, local area resiliency, maintaining competitive electric rates, and mitigating the volatility of capacity costs in addition to environmental stewardship objectives.”

Connecticut also opposed the change, according to meeting minutes, saying the RTO’s proposal did not “definitively allow” large-scale hydro the state may procure “through existing or future state law or regulations” to qualify for the SA.

Lack of ‘Backstop’

The dissenting states also said the RTO’s proposal was unacceptable without a proposed “backstop” provision that would have allowed up to 200 MW of state-procured renewables to enter the market annually even if there were no corresponding retirements in that year.