By Amanda Durish Cook

MISO’s Independent Market Monitor is seeking to use the RTO’s recent refiling of its resource adequacy construct to force a FERC ruling on changing its capacity demand curve.

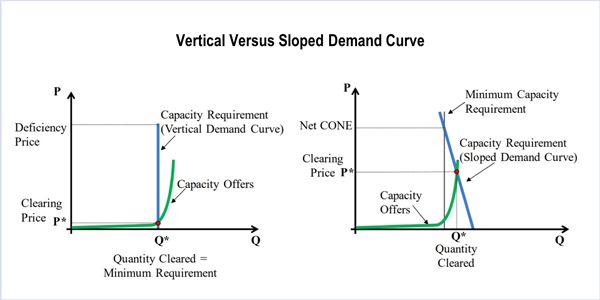

In an out-of-time Feb. 8 protest, the Monitor contends MISO’s use of a vertical demand curve in its annual Planning Resource Auction is a “critical design flaw” that results in “inefficient, unjust and unreasonable prices” (ER18-462).

On Dec. 15, MISO pre-emptively refiled its entire resource adequacy construct — Module E of its Tariff — following a D.C. Circuit Court of Appeals ruling that FERC overstepped its jurisdiction when prescribing revisions to PJM’s minimum offer price rule. MISO made the filing out of concern that a future ruling could undo some of its resource adequacy rules that were enacted in response to FERC’s suggestions. (See MISO Seeks FERC Reapproval to Keep RA Rules Intact.)

The filing provided the IMM a venue for forcing a FERC ruling on the sloped demand curve, a change Monitor David Patton has been unable to persuade MISO officials to adopt. Patton asked the commission to accept MISO’s filing for the 2018/19 PRA while initiating a proceeding under Federal Power Act Section 206 to force the RTO to make the changes for the 2019/20 PRA.

In 2011, FERC accepted MISO’s current resource adequacy rules, which replaced a monthly capacity auction with an annual auction using coincident peak demand forecasts to establish planning reserve requirements (ER11-4081).

FERC directed MISO in 2011 to remove proposed MOPR provisions from its capacity auction construct and instead use a peak load contribution methodology as its default for assigning capacity obligations.

The Monitor said that had MISO relied on sloped demand curve in its 2017/18 PRA, the auction would have cleared at about $115/MW-day instead of the $1.50/MW-day price in all zones. (See All Zones at $1.50/MW-day in 5th MISO Capacity Auction.) The higher price would have properly valued the reliability of the capacity, the Monitor claims.

The Monitor said the $1.50/MW-day clearing price offers suppliers less than 1% of revenues needed to break even on investment in a new peaking resource in MISO. The auction’s unreasonably low prices, Patton said, cannot support new investment “at levels that would satisfy the one-day-in-10-years reliability standard.”

“The commission relies on well-designed competitive markets to produce prices and market outcomes that are just and reasonable. No objective analysis of the MISO capacity market could demonstrate that the outcomes under the current Module E are just and reasonable by any appropriate standard. In fact, the flawed design of the market precludes it from producing just and reasonable prices. … Further, MISO made no attempt to provide evidence that its capacity market has produced reasonable outcomes or that it is an economically sound market design,” the Monitor wrote.

The Monitor also pointed to MISO’s unsuccessful 2017 filing to implement a partial forward market and downward-sloping demand curve for its retail choice areas — in which the RTO admitted that its capacity market has not produced efficient prices. During stakeholder meetings on the design proposal, Patton often repeated the need for a systemwide sloped demand curve. (See MISO Won’t Seek Rehearing on Auction Redesign.)

The Monitor’s protest came almost four weeks after the Jan. 12 deadline for filing responses to the RTO’s refiling. It said the commission should permit its out-of-time filing, contending it will not prejudice any party in the proceeding because it has not yet acted on MISO’s refiling.

In early January, the Electric Power Supply Association also protested MISO’s refiling, claiming that the RTO’s existing construct is “fundamentally flawed and has failed to support resource adequacy in the region because it lacks critical capacity market elements the commission has approved (or required) for other ISOs/RTOs.” EPSA said MISO should require capacity auction participation by all supply and demand resources, implement a downward-sloping demand curve with auctions held at least three years ahead of time and enforce a MOPR. Those three elements, EPSA argued, would create a “sustainable forward capacity market” in the footprint.