RENSSELAER, N.Y. — NYISO energy prices averaged $33.83/MWh in February, down sharply from their cold snap average of $99.55 in January but up 9.3% from the same month a year ago, Rob Pike, director of market design, told the ISO’s Business Issues Committee on Thursday.

The ISO’s year-to-date monthly energy prices averaged $72.85/MWh in February, up 92% from a year earlier. Average sendout was 426 GWh/day, compared with 463 GWh/day in January and 418 GWh/day a year ago.

New York natural gas prices for the month averaged $3.14/MMBtu at the Transco Z6 hub, down from $17.94 in January. Prices were up 11.1% from a year ago.

Distillate prices gained 19.3% year over year, with Jet Kerosene Gulf Coast averaging $13.72/MMBtu. Ultra Low Sulfur No. 2 Diesel NY Harbor averaged $13.86/MMBtu, compared with $14.83 in January.

The ISO’s local reliability share was 14 cents/MWh, lower than 59 cents the previous month, while the statewide share of -64 cents/MWh was higher than -$1.52 in January. Total uplift costs also rose from January.

Broader Regional Markets

Reviewing the Broader Regional Markets report, Pike highlighted NYISO’s ongoing work to clarify the minimum requirements for delivering external capacity into the Installed Capacity (ICAP) market. The BIC in January approved ICAP Manual revisions covering deliverability requirements for capacity imports from NYISO Business Issues Committee Briefs: Jan. 17, 2018.)

Pike also noted that NYISO last month urged FERC to deny a complaint by the New Jersey Board of Public Utilities against the ISO, PJM, Consolidated Edison, Linden VFT, Hudson Transmission Partners and the New York Power Authority. The complaint challenges the implementation of the mutual benefits provisions in the NYISO-PJM Joint Operating Agreement and requests amendments to it.

“First, the complaint was an impermissible collateral attack on prior FERC orders, attempting to reopen matters that have been addressed or are being addressed in other proceedings,” the ISO said in its FERC filing. “Additionally, the complaint is inconsistent with an Order No. 1000 cost allocation principle requiring voluntary agreement for the NYISO to be allocated costs.”

The ISO further argued that the complaint is inconsistent with the provisions of the JOA and tariffs that address cross-border cost allocation. The BPU also misinterpreted provisions of the JOA spelling out that NYISO and PJM not charge each other for mutual benefits, the ISO said.

External Deliverability Rights

The BIC recommended that the Management Committee approve Tariff revisions that would create external-to-Rest of State (ROS) deliverability rights, which would improve the ability for transfer capability into ROS to participate in the capacity market.

Ethan D. Avallone, senior market design specialist, said Hydro-Quebec US (HQUS) proposed that the ISO develop a method for awarding capacity resource interconnection service (CRIS) to entities that create increased transfer capability through transmission upgrades over external interfaces.

FERC in January 2017 granted HQUS a waiver (ER17-505) making it eligible to receive CRIS corresponding to the incremental transfer capability created by its Cedars Rapids Transmission intertie project. The commission noted that the issue was not addressed earlier because of other priorities and not because of objections from the ISO or other stakeholders.

2017 Congestion Assessment and Resource Integration Study

The BIC also voted to recommend that the Management Committee ask the Board of Directors to approve the ISO’s 2017 Congestion Assessment and Resource Integration Study (CARIS) Phase 1 report.

Tim Duffy, economic planning manager, presented the draft report, which he said provides analysis of the potential costs and benefits of relieving congestion on the New York grid by using generic transmission, generation, demand response and energy-efficiency solutions.

One stakeholder expressed skepticism about the rationality of the projected resource mix used to theoretically meet the state’s goals to get 50% of its energy from renewables by 2030.

“We certainly recognize that any of these numbers could be argued with, but the objective was to get to the 2030 goals,” Duffy said.

The study presents a series of metrics for a wide range of potential futures and scenarios. One set of results can be viewed as a “business as usual” case, incorporating incremental resource changes based on the ISO’s study inclusion rules, Duffy said.

Some results identify limited opportunities for transmission build-out based solely on production cost reductions. A second set of results is more forward-looking and captures impacts of changes on the grid through large-scale growth in renewable resources and implementation of energy-efficiency programs.

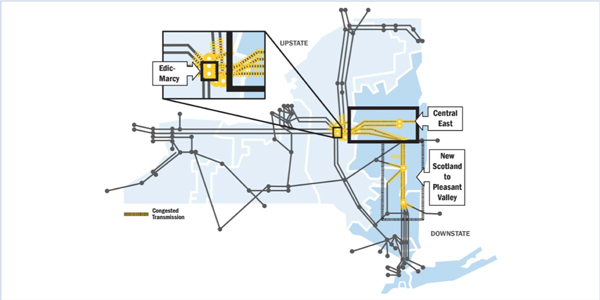

The ISO identified the three transmission elements — or groups of elements — where congestion was most prevalent in the New York Control Area based on an analysis of historic and projected congestion, and potential production cost savings.

Manual Update on Fuel Swap Testing

The BIC approved sending the Operations Committee a proposed update to the Ancillary Services Manual covering automatic fuel swap capability testing.

Harris Miller, associate operations engineer, said automatic fuel swap tests are required each capability period by combined cycle generating units that participate in Con Ed’s minimum oil burn program and are equipped to automatically switch from gas to oil.

Each applicable generating unit must demonstrate a swap from natural gas to oil after an actual loss of gas pressure, a simulated loss of pressure, or an operator-initiated swap.

The swap must occur within a time frame consistent with the design parameters of the unit, must not exceed 60 seconds and should occur during stable operation while the unit remains synchronized to the transmission system. Each unit must coordinate real-time automatic swap tests with both the ISO and Con Ed.

In the event of a failed test, the operator must identify the cause of failure, undertake remedial action, and keep Con Ed and the ISO informed about its progress fixing the problem.

— Michael Kuser