By Michael Brooks

WASHINGTON — RTOs and ISOs will be required to submit monthly reports detailing their uplift payments and operator-initiated commitments under a rule that FERC said would increase transparency in the wholesale markets (Order 844, RM17-2).

But the commission’s order Thursday withdrew a requirement that grid operators categorize real-time uplift costs based on their causes and allocate them only to market participants “whose transactions are reasonably expected to have caused” the uplift.

FERC made both proposals in a 2017 Notice of Proposed Rulemaking the commission issued in January 2017 as part of a larger price formation initiative it began in 2014. (See FERC Seeks More Transparency, Cost Causation on Uplift.) Thursday’s order marked the last “generic” action it took as part of that initiative, FERC said.

Under the new rule, RTOs and ISOs will be required to report:

- total uplift payments for each transmission zone, separated by day and uplift category;

- total uplift payments for each resource monthly; and

- megawatts of operator-initiated commitments in or near real time and after the close of the day-ahead market, broken out by transmission zone and the reason for the commitment.

Generators receive uplift payments when their production costs exceed their energy and ancillary services revenues. Operator-initiated commitments refer to when a generator operates at the direction of the grid operator at a loss for reliability reasons.

Penalty Factors

Grid operators will also be required to revise their tariffs to include the transmission constraint penalty factors used in their market software, the circumstances under which those factors can set LMPs and any processes by which they can be changed. Penalty factors are the maximum prices RTOs pay to redispatch resources before allowing power flow to exceed their maximum operating levels.

FERC found that although all RTOs/ISOs report some information about uplift payments and their causes, their disclosures usually lack detail and are inconsistent across markets. No RTO or ISO reports uplift on a resource-specific basis.

“A lack of transparency regarding uplift payments and operator-initiated commitments can mask system conditions, particularly in times of system stress,” Adam Cornelius, of FERC’s Office of Energy Policy and Innovation, said at Thursday’s open meeting. “The result is that market participants may not fully understand the needs of the system or recognize the resource attributes that are required to meet those needs. … Therefore, current reporting practices may not provide sufficient transparency for market participants to plan for and respond to system needs in a cost-effective manner, resulting in rates that are unjust and unreasonable.”

The increased transparency will help market participants invest in new infrastructure more efficiently and facilitate more informed stakeholder discussions, he said.

Compliance filings for the rule are due 135 days after its publication in the Federal Register, and the grid operators have another 120 days to implement it.

“Uplift isn’t the sexiest topic … even compared to FERC topics,” Commissioner Cheryl LaFleur joked. “And sometimes it’s get a bad name, as if it’s a bad thing. But commitment actions that lead to uplift are important” for reliability. The reports will “provide additional information to the marketplace so the marketplace can solve the problems that they reveal,” she said.

Commissioner Neil Chatterjee agreed. “It is no secret that transparency in RTO and ISO price formation is not the most riveting subject,” he said. “I haven’t seen a lot of headlines calling for better reports on uplift, and I wouldn’t expect these topics to be trending on Twitter any time soon. …

“But that doesn’t mean today’s action isn’t significant. The final rule is a win for all stakeholders participating in these markets, as they will benefit from the added transparency it will bring to each RTO’s commitment, dispatch and settlement processes.”

Cost Allocation Proposal Dropped

FERC had proposed that grid operators categorize deviations between the day-ahead and real-time markets, one of the main causes of uplift, as either “helping” (reducing the need for uplift) or “harming” (increasing the need) and that they allocate uplift costs to generators based on the net of their harming deviations.

However, many commenters, while agreeing with the rule’s general principle, questioned its feasibility.

Exelon pointed to PJM and the 2014 polar vortex as an example. During the period of extremely cold weather, high natural gas prices led to high energy prices in PJM, and the RTO dispatched high-cost generators to maintain reliability. At the same time, generators in neighboring regions self-scheduled imports into PJM, “chasing” the high prices, which led prices to drop. Thus, the PJM generators’ operating costs exceeded their revenues, leading to high uplift payments.

“While the large volume of self-scheduled imports may have ‘helped’ PJM meet system needs, and would ostensibly qualify as ‘helping’ deviations as contemplated in the NOPR, these self-scheduled imports nevertheless directly caused the system uplift payments,” Exelon said.

“Given the complexity of this issue and the varying practices among RTOs, the NOPR’s preliminary finding that someexisting RTO practices may be unjust and unreasonable does not justify standardizing this aspect of the various RTOs’ market design,” the Transmission Access Policy Study Group (TAPS) said in its comments.

“If the commission proceeds to a final rule, TAPS generally supports netting of helpful and harmful deviations as consistent with cost-causation principles,” the group said. “However, the commission should allow each RTO to propose specific criteria for determining whether a deviation is helpful or harmful and should recognize that in certain circumstances, a deviation’s ‘helpfulness’ or ‘harmfulness’ may be difficult to establish.”

Most commenters, however, expressed “broad” support for the transparency proposal. The lone dissenter was CAISO, who argued that its existing reporting provides enough transparency and that the new requirements — specifically the deadlines for filing the new reports — would be overly burdensome.

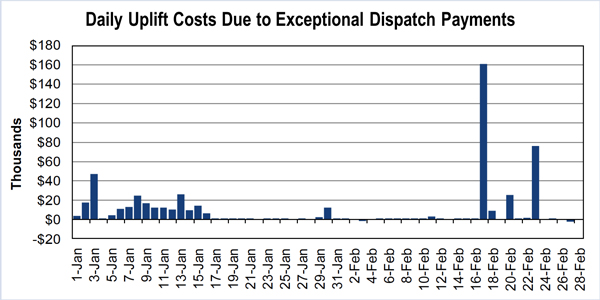

FERC disagreed that CAISO was sufficiently transparent. The ISO aggregates uplift data to its 10 local capacity requirement areas and reports daily total uplift costs for each month by market and type of cost. (See graph.) It also reports the daily aggregated megawatt-hours of “exceptional dispatches.” But it does not specify which of those resulted from operator-initiated commitments.

To address CAISO’s concerns, the commission said it would consider extending the filing deadline for the monthly zonal report (20 days after the end of the month) if the ISO can show in its compliance filing that 20 days is not enough time. FERC also extended the deadline for the monthly resource-specific report from 20 days after month-end to 90.

Several commenters argued that resource-specific uplift data should only be obtainable through a password-protected page on the grid operators’ websites, an idea FERC rejected. “Providing data only to certain market participants does not achieve the goals of this final rule,” the commission said. “Transparency into resource-specific uplift payments can highlight potential instances of gaming and collusion for other market participants, and allow them to advocate for solutions and call attention to such issues more quickly and efficiently.”