By Rich Heidorn Jr.

The NYISO Board of Directors has rejected two appeals of Management Committee votes on capacity zones and locational capacity requirements.

The board declined to override the committee’s Feb. 28 vote that fell short of the threshold for authorizing a Tariff change to create rules for establishing and eliminating capacity zones. The committee had voted 54.1% in favor, short of the 58% required. (See “MC Rejects On Ramp/Off Ramp Changes” in NYISO Management Committee Briefs: Feb. 28, 2018.)

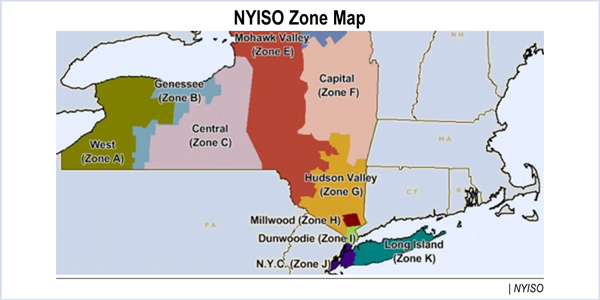

The issue arose from Tariff revisions approved by FERC in 2012, setting rules for creating new capacity zones in the New York Control Area. The changes led the ISO to create a new capacity zone for the G, H, I and J load zones in the Lower Hudson Valley and New York City.

In 2017, ISO staff launched the “On Ramps and Off Ramps” project to consider rules for eliminating zones and concluded the deliverability-based approach used for creating zones was inappropriate for cancelling them. Staff said a reliability-based transmission security approach would be better for both creating and eliminating zones.

IPPNY said the change would distort market price signals and create uncertainty. Although it opposed the appeal, LIPA said it favors changes to the capacity zone rules.

“While we acknowledge the considerable time and effort NYISO staff and stakeholders spent developing the proposal, we deny appellants’ request that the NYISO take the extraordinary measure of filing the proposal pursuant to [Federal Power Act] Section 206,” the board said, calling “unpersuasive” the appellants’ contention that current rules are unjust and unreasonable.

“The NYISO has filed Tariff amendments pursuant to Section 206 only a few times in its history. The facts and circumstances presented here do not warrant that approach. Even if the board were so inclined, we do not believe the NYISO could satisfy the significant burden of proof required to implement the proposal pursuant to a Section 206 filing.”

The appellants’ arguments regarding price impacts on customers were not persuasive, the board said.

“Appellants assert that retaining a locality longer than needed causes undue price separation and would result in ‘excess costs’ for Zone J and Zones G-I customers. However, they calculate potential excess costs to consumers based on current system conditions in which there exists a continued reliability need for the G-J Locality to remain in place. Under system conditions that might support elimination of the zone, the cost impact of retaining the zone — if any — would be much lower,” the board continued. “We note that NYISO staff performed an analysis that illustrated, among other scenarios, the potential for adverse consumer impacts of prematurely eliminating a capacity zone. Appellants’ papers are silent on the NYISO’s consumer impact analysis, offering instead a conclusory economic assessment that is based upon incorrect assumptions.”

The board declined to remand the issue for further work but said stakeholders could consider it during the annual issue prioritization process.

Locational Capacity Requirements

In a related matter, the board also rejected an appeal from LIPA, NRG Energy and Helix Ravenswood, which asked the board to override the Management Committee’s Feb. 28 vote approving a change in how the ISO calculates locational capacity requirements (LCRs). The measure passed with a 77.55% vote. (See “Alternative Methods for Determining LCRs” in NYISO Management Committee Briefs: Feb. 28, 2018.)

NYISO calculates the LCRs to maintain the statewide installed reserve margin (IRM) set by the New York State Reliability Council (NYSRC) based on the one-day-in-10 years loss-of-load expectation (LOLE).

The LCR rule change replaces the “TAN 45” methodology adopted for the 2006/07 capacity year, before the creation of zones G-J. Loads in the Lower Hudson Valley complained that TAN 45 increases their local requirement while reducing requirements for New York City and Long Island.

The new rules, originating from an economic approach recommended by Independent Market Monitor David Patton, are based on the lowest cost-to-supply capacity.

Opponents of the change called for more study of the issue. LIPA contends that the new method underestimates the capacity costs for a new unit in its zone and that it is being forced it to subsidize New York City, noting that its LCR is expected to increase to more than 100% of peak load, while the city is expected at less than 80%.

New York City and 60 large industrial, commercial and institutional energy consumers opposed the appeal of the rule change.

In rejecting the appeal, the board said the rule change was a “significant improvement” that had been “carefully developed, thoroughly vetted and received widespread support from market participants.”

“Contrary to appellants’ assertions that the new approach would introduce volatility, analysis indicates that the alternative LCR methodology will provide results that are more stable than the current approach,” the board said.

The board also turned aside arguments that the new methodology is flawed because it does not optimize the IRM calculation along with the LCR calculations, saying it “ignores the fact that the IRM is set by the NYSRC — not the NYISO.” The board said the ISO will work with the Reliability Council to explore a co-optimized approach but the new rules should not be delayed by that effort.

The board said, “Concerns over ‘rate shock’ are unpersuasive.”

“The NYISO is open to further discussion on [subsidization concerns and] … alternative approaches to cost allocation,” it said. “Such discussion is outside the scope of the instant proposal, however, and should not delay [its] implementation.”