By Rory D. Sweeney and Rich Heidorn Jr.

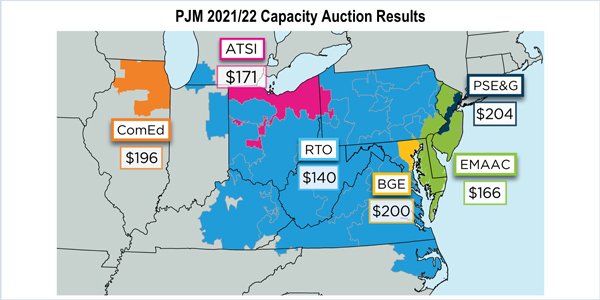

Capacity prices increased sharply in most of PJM for delivery year 2021/22, with prices for the RTO rising to $140/MW-day from $76.53 last year, an increase of 83%.

The ComEd zone increased $7 to $195.55/MW-day, while Eastern MAAC dropped to $165.73 from $187.87 last year (-12%). The PSE&G zone, which cleared as part of EMAAC last year, rose to $204.29.

The ATSI zone, which cleared along with the rest of the RTO last year, separated this year, jumping to $171.33. BGE, which was part of MAAC last year, separated at $200.30. MAAC cleared at $86.04 last year. (See Capacity Prices down in Most of PJM in 1st Year of 100% CP.)

The Base Residual Auction procured 163,627 MW for 2021/22, resulting in a 21.5% reserve margin. That was down from 165,109 MW last year and a reduction of almost 2 percentage points from last year’s 23.3% reserve margin. That was still substantially above PJM’s 15.8% reserve requirement. About 192,450 MW offered into the auction, an increase from 189,918 MW that offered in last year.

The RTO obtained 893 MW of capacity from new generation and 508 MW from uprates to existing or planned generation, a 50% drop from the new capacity acquired in the 2017 auction.

“We did see a decrease in offers from new capacity resources. That certainly was not unexpected given the trends we have seen in the last several years,” Stu Bresler, PJM’s senior vice president for operations and markets, said during a news conference Wednesday.

PJM said the higher prices in most locations reflected continued low energy market prices, which causes generators to make higher capacity offers; an increase in the net cost of new entry, reflecting depressed energy revenues; and a drop in cleared capacity and the number of new generators. Partially offsetting those factors was a lower reliability requirement reflecting lower demand forecasts.

The auction, the second under 100% Capacity Performance, also saw increases in cleared demand response, energy efficiency and renewable resources.

DR cleared 11,126 MW, up 3,305 MW, while EE cleared 2,832 MW, a jump of 1,100 MW.

Wind cleared 1,417 MW, an increase of 529 MW. Solar cleared 570 MW, more than quadrupling from 125 MW last year.

Coal generators increased their share by 500 MW, while gas rose by 1,000 MW, including one new combined cycle plant.

Cleared imports totaled 4,052 MW, most from west of the RTO. Deducting 1,320 MW in exports resulted in a net import of 3,405 MW.

Nuclear Decline

Cleared nuclear generation totaled 19,900 MW, a drop of 7,400 MW.

“I don’t think that came as much of a surprise to the market,” Bresler said, noting he had seen estimates of an even higher drop. “We continue to see a good amount of diversity across the system.”

Exelon announced afterward that its Three Mile Island and Dresden nuclear plants, and all but a small portion of the Byron plant, failed to clear in the auction. The company’s Oyster Creek plant, which is set to retire by October 2018, did not offer in the auction.

Robbie Orvis of the clean energy consulting firm Energy Innovation said the trend wasn’t consistent across all zones.

“Not only did a substantial amount of nuclear not clear (a 7.4-GW decline from last year), but capacity prices in regions with a lot of nuclear didn’t necessarily improve much, if at all. In EMAAC, which has roughly 25% of PJM’s nuclear capacity, prices actually dropped by $22.14/MW-day,” he said. “In ComEd, which has about 32% of PJM’s nuclear capacity, prices only increased by $7.43/MW-day. The remaining regions with nuclear capacity saw healthy price increases ranging from $53.96/MW-day to $94.80/MW-day.

“It’s unclear how units might have changed their bidding behavior in response to state nuclear subsidy programs, but given the economic hardships for many nuclear plants in PJM, these results don’t point to any kind of dramatic change in market conditions,” he said.

Jennifer Chen of the Natural Resources Defense Council pointed to a theory that Exelon might have “sacrificed” some nuclear megawatts, effectively holding them out of the auction to maintain a higher price.

Exelon and the Nuclear Energy Institute said the results pointed to the need for changes in market rules to recognize nuclear plants’ contributions to greenhouse gas reductions and grid resilience.

The company said it was the fourth consecutive year that TMI failed to clear, and that the plant, which it has threatened to close in October 2019, has not been profitable for six years.

It said its Quad Cities plant cleared “as a result of” Illinois’ zero-emission credit program.

Dresden and Byron, which have capacity obligations through May 2021 and May 2022, respectively, are not in immediate risk of retirement, the company said.

NEI CEO Maria Korsnick said the results “demonstrate the economic pressures facing well-run nuclear plants” because of “distorted market forces.”

“Energy Secretary [Rick] Perry has been ringing the warning bell that fuel security and resilience are critical to energy security and national security. Only by bringing the capacity and energy markets into better balance will we be able to realize the benefits of a diverse energy supply,” she said.

Coal Increases

Although coal’s share of cleared capacity increased by 500 MW, Bresler said the auction rewarded only some coal units.

“We did see some fairly large plants that had cleared last year that did not clear this year. On the other hand, we saw … increased cleared capability on a lot of existing units. I think what that may speak to is improvements in efficiency at those plants that are making them more competitive. I think they’re real close right now, in some cases, [to] natural gas. Coal plants that have larger capabilities, that can operate efficiently, that have made the environmental upgrades that are necessary … hung in there this year,” Bresler said.

“What this auction showed is — quoting a former colleague of mine — the death of coal has been greatly exaggerated,” he added.

Orvis said the outcome “indicates that these units are doing all right in PJM, and it certainly pours some cold water on arguments in favor of providing subsidies for coal units.”

End to Seasonal Concerns?

DR offered into this year’s auction increased almost 21% to 11,887 MW, nearly 94% of which cleared. Of the 11,126 MW of DR that cleared, 96% cleared as annual CP and 452 MW cleared as summer-only resources that were aggregated with other products to meet CP’s requirement for year-round commitment.

“I was a little bit surprised by the magnitude of the increase in annual demand response that was willing to commit to the [year-round] Capacity Performance requirements in this auction,” Bresler said.

“There’s been a lot of concern expressed in some parts of the stakeholder community about limiting demand response and not allowing that summer-only capability. Frankly, between the increase in aggregation we saw here and the amount of annual that was willing to commit to those Capacity Performance requirements, I have to question whether we still have an issue there.”

In total, 715.5 MW of seasonal capacity resources cleared as part of aggregated packages, an 80% increase from the 398 MW of seasonal resources that cleared last year. This year’s total included 452.3 MW of summer DR, 209.3 MW of summer EE and 53.9 MW of summer intermittent resources, which were packaged with 715.5 MW of winter resources — mostly wind.

Chen and Orvis questioned whether the higher-than-necessary reserve margin made seasonal resources less concerned about potential CP penalties and willing to take the risk to cash in on the auction revenue.

“There’s a structural issue and maybe PJM has a point that there’s always innovation … but the issue is if you have a structural issue, there is the potential for even more seasonal resources to participate and at lower clearing prices,” Chen said.

Orvis speculated that resources might have had trouble aggregating and bid in less megawatts than they have available to leave headroom if a CP assessment occurs in the winter.

“PJM should be careful not to imply that these results mean seasonality is not an important factor, and should think carefully about why the resources participated in the way they did, and how create a more efficient and optimized market down the road,” he said.

Katherine Hamilton, executive director of the Advanced Energy Management Alliance, attributed the increase in DR to “the more reasonable amount of time that providers had to work with their customers in preparation for the new capacity market rules; to improvements in customer-sited technologies; and to investments customers have made in their back-up generators to be compliant with an EPA rule.”

“We have yet to determine the real potential of consumer load response capability, which is expanding significantly this year,” she added. “Consumer participation and choice are critical for managing cost and reliability.”

DR provider EnerNOC said it will collect more than $180 million in capacity payments from the auction.

Vistra Energy said it will receive $559 million in capacity revenue after clearing almost 9,800 MW at a weighted average clearing price of $156.47, including 2,450 MW in ComEd and 6,435 MW in the rest of RTO.

Revenues Still Down

The increase in capacity prices won’t fully make up for lower energy prices, which account for the “vast majority” of wholesale costs, Bresler said. Capacity prices are perhaps 20 to 30% of wholesale costs, while energy revenues make up between 60 and 70%, he said.

“The increase in capacity prices certainly does not outstrip … the reduction in energy prices, however there is a relationship between the two,” he said.

Chen said she was “surprised that the prices increased so much given the oversupply.”

Orvis said the near doubling of prices for most of the RTO is good for generators in general but agreed with Bresler that they don’t represent large increases.

“For a 1-GW nuclear plant running at a 90% capacity factor, a $63.47/MW-day capacity market price increase is roughly equivalent to a $3/MWh increase in the average energy market price. For a 1-GW coal plant running at a 45% capacity factor, it’s roughly equivalent to a $6/MWh increase,” he wrote in an email. “Those are pretty small in the grand scheme of things, especially for nuclear plants.”

He said the “healthy” reserve margin, even with the reduction in nuclear, was “more evidence that Trump administration claims that losing generation will cause a grid disaster are complete nonsense.”