By Amanda Durish Cook

CARMEL, Ind. — MISO’s supply picture for the next five years is less rosy — and less clear — than it was a year ago, according to an annual capacity survey released Friday in conjunction with the Organization of MISO States.

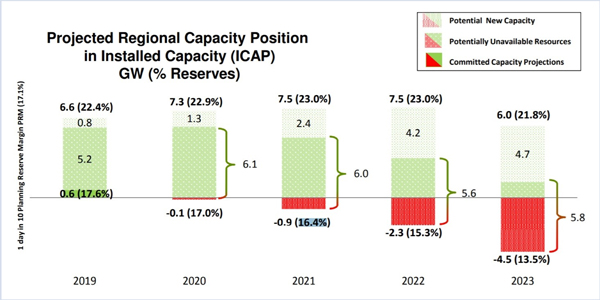

This year’s OMS-MISO resource adequacy survey projects that the RTO’s 2019 spare capacity will exceed its regional requirement by anywhere from 0.6 to 6.6 GW, yielding a reserve margin ranging from 17.6 to 22.4%.

But survey results show the volume of spare supply after next year is less certain, owing to expected decreases in resource commitments, although it’s still possible the RTO’s excess capacity could outpace the high end of its 2019 prediction through 2022. Using the current 17.1% planning reserve margin, over the next five years, MISO’s footprint could see anything from a 7.5-GW surplus to a 4.5-GW shortfall:

- In 2020, MISO could have anywhere from a 7.3-GW surplus (representing a 22.9% planning reserve margin) to a 0.1-GW shortfall (a 17% reserve margin).

- In 2021, the RTO could experience anywhere from a 7.5-GW surplus (23%) to a 0.9 shortfall (16.4%).

- In 2022, the chance of a shortfall increases, with a range between a 7.5-GW surplus (23%) and a 2.3-GW shortfall (15.3%).

- In 2023, MISO’s possible high-end capacity surplus drops to 6 GW (21.8%), while the possible shortfall could reach 4.5 GW (13.5%).

Last year’s survey showed MISO would have anywhere from 2.7 to 4.8 GW of excess resources from 2018 to 2022, translating into a 16 to 22% reserve margin because of lower demand forecasts and a lukewarm growth rate of 0.5%, down from 0.8% in 2016. (See Capacity Survey Shows MISO in the Black.) In this year’s five-year outlook, the regional growth rate again decreased from 0.5% to 0.3%. MISO said 97% of load responded to the survey.

“While we continue to see decreasing demand in the MISO footprint, the story continues to be the evolving generation portfolio,” MISO CEO John Bear said in a statement. “As the MISO footprint continues to transform, we must learn to adapt in areas such as our transmission planning studies, market-based solutions that focus on speed and flexibility and enhancing coordination with our neighboring seams partners.”

During a June 8 conference call to discuss results, MISO Executive Director of Resource Planning Patrick Brown acknowledged that this year’s survey shows more risk to resource adequacy than projected last year.

“The main driver of this resource adequacy risk are generation retirements,” Brown said, adding that more retirement announcements have occurred since MISO and OMS collaborated on the 2017 survey, resulting in about 4.6 GW of decreased resource availability. The RTO said the majority of potential deficits are concentrated in Illinois’ Zone 4 and Michigan’s Zone 7. Brown noted the resource adequacy risk is higher because the RTO predicts it will require higher future reserve margins because of its increasing forced outage rate.

But Brown also pointed out that the survey represents a “snapshot,” and that more capacity than currently expected could come online to offset retiring generation.

“MISO fully expects this forecast to change going forward,” he said.

Zones with surplus capacity can help neighboring zones with capacity deficits, Brown added.

“Zones with deficits do not automatically face a reliability risk,” he said.

But by 2023, zones enjoying surpluses may not be sufficient to entirely cover possible capacity deficits in three zones. By that year, the survey showed Zone 4 could face either a 1.1-GW capacity surplus or a 2.8-GW capacity shortfall, while Zone 6 in Indiana and Kentucky could experience anywhere from a 0.3-GW surplus to a 1.6-GW shortfall. Zone 7 faces the most certain shortfall, ranging between 0.8 and 1.8 GW.

Brown said MISO’s current 93-GW interconnection queue contains 80 GW of renewable energy, with just 580 MW of storage in the works to make renewable capacity more dependable. However, he said, MISO fully expects more storage to enter the queue in the future.

“It’s particularly import that we’re doing this in light of the evolving resource mix,” OMS Executive Director Tanya Paslawski said of the survey.

This year’s survey relied on a new calculation for estimating the volume of future new resources. MISO tallied projects not yet in the three-part definitive planning phase (DPP) of its interconnection queue (and those having entered the DPP’s first phase) at a 10% completion rate. Conventional and intermittent resources in phase two of the DPP were counted at 50% and 25%, respectively, which increased to 75% and 50% in phase 3. Projects still negotiating a generator interconnection agreement were tallied at 90% completion, while those with signed agreements were counted as new generation in the survey’s weighted averages. (See MISO RASC Briefs: Little Change to Capacity Forecasts.)

MISO staff will present a more detailed rundown of OMS-MISO survey results at the RTO’s July 11 Resource Adequacy Subcommittee meeting.