By Rory D. Sweeney

Duke Energy and Old Dominion Electric Cooperative have likely struck out on trying to recoup millions of dollars in “stranded” gas costs they say PJM forced them to incur during the 2014 polar vortex.

The D.C. Circuit Court of Appeals on Friday ruled that FERC was justified when it denied the companies’ reimbursement requests in 2015, rejecting separate petitions for review (16-1133, 16-1111). (See Duke, ODEC Denied ‘Stranded’ Gas Compensation.)

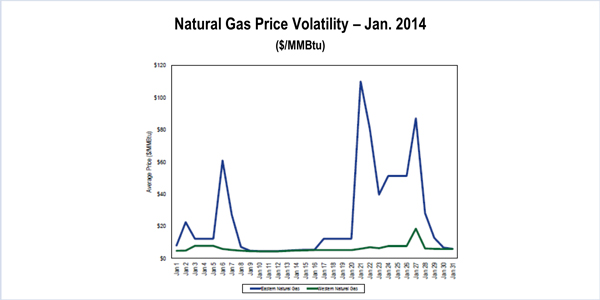

Duke and ODEC had argued to FERC that they were owed compensation when PJM ordered them to be ready to run even as the cold snap sent gas prices soaring. Duke purchased $12.5 million worth of natural gas for its Lee plant in Illinois, only to have it not called on in real time. The company was able to resell some of its gas and sought $9.8 million in restitution.

ODEC complained that it was due nearly $15 million because PJM canceled multiple dispatches that left gas it had purchased for its plants unused. It also said its plants’ operating costs on Jan. 23, 2014, exceeded what it could recover in the day-ahead market because of the $1,000/MWh offer cap at the time. The co-op asked the commission to extend to Jan. 23 the waiver FERC granted PJM on Jan. 24, which allowed capacity resources to receive make-whole payments if their costs exceeded the offer cap.

FERC denied the request, saying PJM’s Tariff didn’t allow it and that ODEC’s ratepayers lacked sufficient notice that the approved rate was subject to change. The court upheld FERC’s decision, dismissing ODEC’s arguments that it could charge a market-variable formula rate and that customers received sufficient notice from an announcement PJM posted that it would seek commission approval for certain generators to exceed the rate cap.

“Close, but no cigar,” the court said of the formula rate argument. ODEC failed to identify Tariff provisions specifying such a rate or an instance in which utilities refunded overbillings back to customers, a bidirectional condition that would exist under formula rates. Additionally, “to toss that [$1,000/MWh rate] cap aside after the fact just because it did exactly what a cap is supposed to do — serve as a firm ceiling on market prices — would retroactively rewrite the terms of the filed rate,” the court said.

ODEC’s argument that PJM’s announcement qualified as sufficient notice “fails at every step,” the court said, noting that it wasn’t filed at FERC as required for rate changes.

The court also sided with FERC on Duke’s request, in which the commission concluded that PJM’s conversations with the company did not constitute an order to purchase expensive gas.

FERC determined that PJM operators told the generators “to do whatever needed to be done to fulfill its Tariff obligation” but “said nothing about when to purchase natural gas, at what price to purchase the gas, how to bid into the market or to take any action beyond that which Duke is otherwise obligated to take under the Tariff: to purchase natural gas to be prepared to run its units.”

The court conceded that “the record may well be subject to other interpretations,” including those preferred by Duke.

“But our task is not to assess whether Duke’s interpretation of the record is fair,” the court said. “Just the opposite: We must accept FERC’s interpretation unless unsupported by substantial evidence. And Duke has given us no basis for believing that a ‘reasonable mind’ would not find the evidence here ‘adequate to support [FERC’s] conclusion.’”