By Steve Huntoon

As you may have read, the nuclear industry is promoting a new “study” by the consultancy ICF, purporting to show that failure to bail out nuclear plants would cause widespread blackouts in the Mid-Atlantic region of PJM.[1]

There are glaring fatal flaws. Let me offer just 10 (please email me with stuff I missed):

- The Nuclear Energy Institute — not ICF — came up with the study assumptions, thus giving us the classic GIGO — garbage in, garbage out — problem. The study admits this: “NEI specified the scenarios for the analysis and the key assumptions for those scenarios” (page 1). So when you read below about all the unrealistic scenarios and assumptions, please keep in mind that they are the self-serving creations of the nuclear industry.

- The study assumes that all the nuclear units (13 GW) in the PJM Mid-Atlantic region will retire if not bailed out (see App. A). No analysis supports this assumption. It is directly contradicted by PJM’s Independent Market Monitor, which has demonstrated, using NEI’s own cost data, that all these nuclear units except one cover their going-forward costs.[2] In other words, instead of 13 GW retiring, 1 GW retires.

- The study assumes that retiring nuclear capacity is not fully replaced by other capacity resources, such that PJM overall suffers a capacity reduction of 10 GW (page 36, going from 152 GW to 142 GW). No analysis supports this assumption. It is directly contradicted by experience with PJM’s capacity market, which is designed to, and does, replace retiring capacity with new, more reliable capacity. In the last capacity auction, 67 GW cleared in the PJM Mid-Atlantic region, and there were another 6 GW that offered but didn’t clear — meaning they are available at a higher price if, for example, more nuclear units were to retire (which they won’t, as discussed in #2 above).[3]

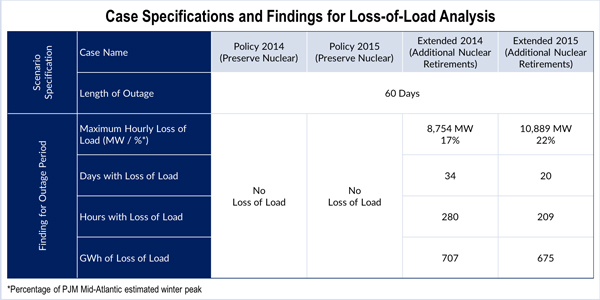

- The study assumes two gas pipeline incidents happen to occur at the same time, happen to occur during the highest winter demands in history and happen to affect only gas-fired generation (no other pipeline customers), causing the sudden loss of 13 GW of generation, and the outage persists for 60 days. Please note how absurd this scenario is: (a) two incredibly rare incidents happen at the same time; (b) during the highest winter demands in history; (c) only gas-fired generation is curtailed (despite the study’s premise that this curtailment is causing power blackouts); and (d) nothing is restored for 60 days (again, despite the study’s premise that there are blackouts). There is no legitimate basis for these wild assumptions, or for cobbling them together.

- The study assumes that all demand response resources fail to perform. No analysis supports this assumption. It is simply buried in a footnote (fn. 22) questioning whether DR would perform, despite enormous penalties for failure to do so.

- The study assumes that no oil inventories at dual-fuel gas generators could be restocked over a 60-day period. There is a half-hearted effort to support this assumption with statements about how difficult it might be (page 33). Given enormous penalties for failure to perform, generators would move heaven and earth to resume gas delivery and to restock oil inventories. And, of course, if oil inventory levels are problematic, adding a few more oil tanks would be an infinitesimal cost relative to the subsidies demanded by the nuclear industry.

- The study assumes no gas pipeline expansion projects are built, despite the many projects underway like Transco’s Atlantic Sunrise project (1.7 Bcfd) and the PennEast Pipeline (1.1 Bcfd).[4] The study makes an argument that increased pipeline capacity somehow doesn’t increase pipeline capacity (pages 34-35).

- The study implicitly assumes zero capability to transmit electric generation from the western and southern regions of PJM into the Mid-Atlantic region. There are 4 GW of such capability in the summer, and more in the winter when circuit ratings are higher because of lower temperatures.

- The study implicitly assumes PJM has no tools to mitigate a temporary generation shortfall other than customer outages. No analysis supports this assumption. In a potential emergency, PJM has tools like maximum emergency generation, load management, imports, voluntary conservation and voltage reduction.[5]

- I saved the best for last. The nuclear industry is claiming that without a bailout there will be hundreds of hours of blackouts. You would think that if this claim had a shred of credibility that customers facing this prospect would be screaming for a nuclear bailout. Instead, customers are diametrically opposed.[6] Why? Maybe it’s #1 through 9, above.

Let me give you a realistic take on the PJM Mid-Atlantic region. Seventy-three gigawatts offered in the last capacity auction, and there is a conservative 4 GW of transfer capability from western and southern regions of PJM, for a total of 77 GW of resources. The PJM Monitor says 1 GW of nuclear is expected to retire, for 76 GW of resources. Now let’s take the totally unrealistic scenario (see #4 above) of suddenly losing 13 GW of gas-fired generation at the worst possible time. That would leave us with 63 GW, 13 GW more than ICF’s historic peak-hour demand of 50 GW depicted on Figure 6.4 of its study. And that’s before considering pipeline expansion projects, PJM’s emergency tools, etc.

There are plenty of things in this world to worry about. Blackouts from not bailing out nuclear plants? No, those pigs aren’t flying.

- https://www.nei.org/CorporateSite/media/filefolder/resources/reports-and-briefs/icf-study-fuel-security-grid-resilience-201806.pdf. ↑

- http://monitoringanalytics.com/reports/PJM_State_of_the_Market/2018/2018q1-som-pjm-sec7.pdf (page 324) (Please note that of the four plants shown as uneconomic, Oyster Creek is committed to retire and is no longer included as a potential resource, and the Davis-Besse and Perry plants are not in the PJM Mid-Atlantic region.) ↑

- http://www.pjm.com/-/media/markets-ops/rpm/rpm-auction-info/2021-2022/2021-2022-base-residual-auction-report.ashx?la=en (page 15). ↑

- A complete list of FERC-approved pipeline expansion projects is here, https://www.ferc.gov/industries/gas/indus-act/pipelines/approved-projects.asp. ↑

- See PJM Manual 13, http://pjm.com/-/media/documents/manuals/m13.ashx. ↑

- e.g., https://elcon.org/letter-congressman-greg-walden-seeking-oversight-hearing-doe-nopr-grid-resiliency-pricing/; https://states.aarp.org/dont-bamboozled-just-say-no-special-nuclear-subsidies-higher-electric-bills/; https://www.standunited.org/petition/no-nuclear-bailout-for-pennsylvania-nuclear-companies. ↑