By Robert Mullin

A forecasting error is prompting CAISO to procure a large volume of out-of-market resources for September under a special measure not invoked since the emergency shutdown of the San Onofre Nuclear Generating Station in 2012.

CAISO will solicit up to 1,434 MW of resources under its Capacity Procurement Mechanism, stakeholders learned during a call Thursday.

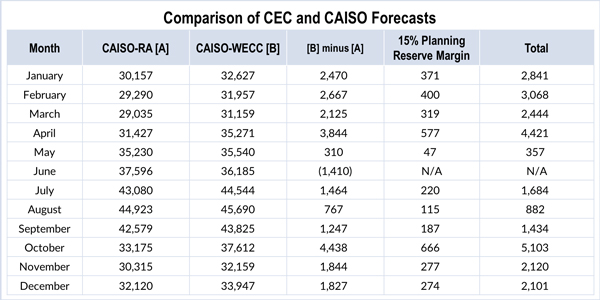

The procurement was prompted by the California Energy Commission’s July 10 publication of a revised load forecast showing the ISO’s balancing area will next month need 1,247 MW more in systemwide resource adequacy (RA) resources than originally projected, plus a 15% planning reserve margin.

Under CAISO’s Tariff, the ISO can invoke CPM in response to a “significant event,” defined as any “substantial event” or “combination of events” that “causes, or threatens to cause, a failure to meet reliability criteria absent the recurring use of a non-resource adequacy resource on a prospective basis.” A load forecasting error qualifies as such an event, Delphine Hou, the ISO’s manager of state regulatory affairs, said during the Aug. 2 call.

The CEC attributed the RA forecast error to its reliance on 2016 — rather than 2017 — energy demand data in its original 2018 monthly forecast. The forecast is provided to both CAISO and the California Public Utilities Commission for RA planning, which is managed by the commission.

The error was discovered because of discrepancies between the CEC forecast and the monthly peak forecast CAISO produces for Western Electricity Coordinating Council planning, which the ISO used this year for its flexible capacity needs assessment. The revised CEC forecast aligns with CAISO’s projections, which had been benchmarked to 2017 load figures.

October a ‘Concern’

While this month’s CPM solicitation will focus only on procuring resources for September, Hou said the ISO will continue to evaluate the need to procure resources for October, which the revised forecast indicates has an even bigger RA need: 5,103 MW. Under CAISO rules, a CPM procurement has an initial term of 30 days, which can be extended by another 60 days if the “significant event” is likely to persist.

Pointing to the much larger October deficiency, NRG Energy Director of Market Affairs Brian Theaker asked, “Can you elaborate on what the ISO will be looking for and what conditions it will impose before making a decision as to whether to CPM for October?”

While October load will be lower, the ISO is “sensitive” to the possible continuation of Santa Ana winds during the month, fire concerns in Southern California and the impact of drought, she said. She also pointed out that some generators may begin entering maintenance outages during that month.

“So we want to at least see how September goes. … It is likely we will extend the significant event through October, but we wanted at minimum to get the word out for September,” Hou said.

“Why are we hearing about [the error] now? It seems like we would’ve had this information back in January,” said Nuo Tang, principal energy policy strategist at San Diego Gas & Electric.

Hou was diplomatic in her response.

“It took some time because we were having a lot of discussions with the CEC and the CPUC about how to think about the difference between the forecasts, and it was eventually recognized that because the original RA forecast seemed somewhat low for September. … Out of an abundance of caution, we really should sunshine this other forecast for CAISO to use under significant events,” she said.

“I think what you’re highlighting is that we don’t vet the system RA forecasts,” leaving CAISO stakeholders unable to compare the forecasts used for system RA and flexible capacity, Tang said. “Would that be a fair characterization?”

“Yes, that is fair, and in fact you pre-empted my very [next] line … which is [that] for future coordination, we’re definitely working very closely with the CEC and CPUC to review the RA forecast for next year,” Hou said.

Credit Where it is Due

Tang also asked why CAISO chose to invoke a CPM significant event instead of relying on exceptional dispatch, a shorter-term out-of-market procurement mechanism.

Hou said that CAISO officials were concerned that if they delayed procuring resources, generators without RA designations could end up selling to other buyers, including those outside the ISO, or go out on maintenance outages.

“What we landed on was that we would prefer to notify the market earlier to get more bids into the competitive solicitation process [in order] to have a deeper pool for the operators to be able to pull from, because this is a system issue. It’s not going to be as a restrictive as a local issue,” she said.

Eric Little, manager of wholesale and GHG market design at Southern California Edison, asked if the ISO would reduce the 1,434-MW procurement if any LSEs show above their minimum RA requirements for the month.

Hou said the ISO had not yet performed that analysis, but that it would credit the system for any LSE overages.

“And then once you do that, when you start to cost allocate, will there be any reduction in bills for those LSEs that showed over, so they’re only getting allocated for their portion of the additional CPM procurement performed by the ISO?” Little asked.

“It would credit against the total required amounts … but it would not be a credit against the cost allocation,” Hou said.

“So all other LSEs get the benefit that the one LSE showed long?” Little asked.

“Yes,” Hou replied.

Resources owners have until Aug. 25 to submit their offers to the ISO. Bidding is open to any RA eligible resources internal to the ISO balancing authority area. External, or “intertie,” resources are excluded from participation.