By Rory D. Sweeney

VALLEY FORGE, Pa. — PJM staff are still working on how to respond to GreenHat Energy’s default in the financial transmission rights market, CFO Suzanne Daugherty told stakeholders at last week’s Market Implementation Committee meeting.

Daugherty announced at the June meeting of the Markets and Reliability Committee that GreenHat was likely to default on payments for a sizable FTR portfolio that was proving unprofitable. After the company defaulted, PJM staff realized that their current rules for attempting to mitigate the financial burden to members might instead exacerbate the situation and requested a waiver from FERC to find a more effective solution (ER18-2068).

The Tariff requires PJM to liquidate the FTRs of a defaulted member by offering for sale “all” current planning period FTR positions in the next monthly balance of planning period FTR auction “at an offer price designed to maximize the likelihood of liquidation of those positions.”

PJM said a waiver is required “given the market impact by the liquidation of GreenHat’s large FTR portfolio and observed low levels of market liquidity more than one month forward (i.e., non-prompt months).” Staff found that the bids offered to take the portfolio’s positions would have been approximately four times the pre-default auction clearing prices on the affected paths. Instead of being forced to liquidate the entire portfolio at once and potentially suppress the holdings’ return in an illiquid market, PJM asked FERC on July 26 to allow it to not liquidate each FTR position until the month it becomes due in the market. FERC has not yet responded. (See “ Default Details,” PJM MRC/MC Briefs: July 26, 2018.)

At the same time, PJM also requested a waiver of its requirement to return collateral posted by Orange Avenue, another FTR market participant that is affiliated with GreenHat (ER18-1972). Orange has challenged that request, but PJM argued that it may become necessary to sue Andrew Kittell, who oversees both firms, and that Orange’s collateral would be included among Kittell’s assets.

When GreenHat acquired most of its positions starting in 2015 long-term FTR auctions, both historical congestion and the FTR auction clearing prices indicated that the portfolio would be profitable, so it had a low credit requirement. However, by April 2017, PJM staff realized the portfolio, consisting primarily of prevailing-flow FTRs, were on paths where transmission upgrades were expected to reduce future congestion.

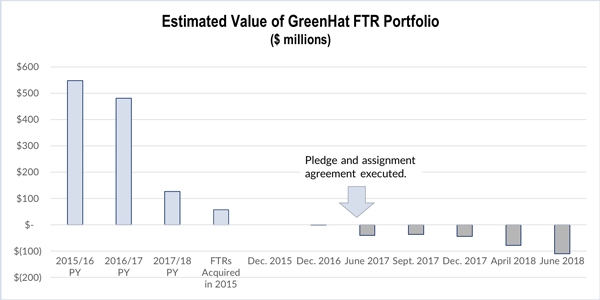

According to PJM, GreenHat’s portfolio was estimated at $57 million based on the auction clearing prices when the positions were taken. In the 2015-16 planning year, the same portfolio would have netted $548 million. It dropped slightly in the next planning year to $481 million. However, the following year the value dropped precipitously to $126 million and continued falling in subsequent auctions. By June 2018’s auction, the portfolio would have lost $110 million.

After realizing GreenHat’s exposure, staff approached Kittell, who offered to mitigate some of the potential risk by signing over what he told PJM were the rights to receive $62 million in proceeds from several bilateral FTR contracts. PJM accepted the agreement in June 2017 and opened a bank account for the expected proceeds, but the other company in the contract, whose name was redacted from the public filings in the docket, says it paid what it owed to GreenHat well before Kittell signed the agreement with PJM. The RTO wants FERC to allow it to keep the collateral from Orange while it investigates “whether Mr. Kittell and GreenHat fraudulently induced PJM to enter into the pledge agreement.” FERC hasn’t responded to that request yet either. Kittell did not respond to a request for comment.

His attorney, David Gerger, also declined to comment but pointed to Orange’s July 27 protest, in which it told PJM it “was not making any representations or warranties about the value of the additional collateral … and that PJM must make its own valuation.”

Orange said “PJM was uniquely poised to [establish the value of the collateral] because the [$62 million] number came from applying the PJM Tariff to amounts entered into PJM’s FTRCenter System.”

In the wake of the GreenHat default, PJM received stakeholder endorsement to enhance its credit policy for FTR traders. The new rules, to be implemented on Sept. 3, will institute a 10-cent/MWh minimum monthly credit requirement for FTR bids submitted in auctions and cleared positions held in FTR portfolios. (See “Credit Requirements,” PJM Market Implementation Committee Briefs: July 11, 2018.)

However, Daugherty confirmed at the MIC meeting that GreenHat remained compliant with the credit requirements existing at the time until it failed to post a collateral call in April. Stakeholders grilled her on why PJM hadn’t previously attempted any regulatory action or policy changes if it knew about the concern nearly a year and a half ago.

“There was nothing specific in the credit policy that would have allowed PJM to make a collateral call” sooner, she said, noting that the agreement with Kittell was signed in June 2017.

Additionally, staff said that FERC lacked a quorum of commissioners at the time and that stakeholders had not yet agreed on revisions on how to analyze predicted congestion. Daugherty said staff made a “good faith effort” to bring GreenHat and Kittell to heel.

Several stakeholders pushed PJM to provide even a rough estimate of the expected losses. One, Vitol’s Joe Wadsworth, said he used recent market results to determine that it could be upward of $145 million.

“It is getting worse,” he said.

If accurate, the result would be almost triple the $52 million credit default by Tower Research Capital’s Power Edge hedge fund in 2007, which also triggered credit policy revisions. (See PJM Credit Adder Fails upon Heightened Review.)

Daugherty resisted the requests, saying that it would be impossible to accurately predict.

“We will not know the dollars until they play out or they are liquidated because we may have to pay to liquidate them,” Daugherty said.

“There’s urgency here. We can’t just let this ride on the market,” Wadsworth said. He said engaging with GreenHat once the risk was identified was “clearly the right thing to do,” but he asked why the company was allowed to continue participating in the auctions.

“These numbers are kind of scary. We’re trying to find out … how big this is going to be,” Old Dominion Electric Cooperative’s Adrien Ford said. “I’d appreciate some sort of take on it so I can go back to the home office and say ‘roughly we think it’s about this size.’”

“I don’t think you should expect that PJM’s going to project a number,” Daugherty said.

Stakeholders also debated the best strategy for how to liquidate the portfolio if FERC approves PJM’s waiver request. Some, including Wadsworth, called for immediate action, as auction results have shown a continuing downward trend. Others, including Direct Energy’s Marji Philips, argued it might be better to wait to see if something materializes that’s better than the current guaranteed loss.

“Do you liquidate today and have a fixed number, or do you want to not liquidate today, and the number might come in lower,” she said.

PJM is working with its members to agree upon a strategy at the August MRC meeting and targeting a final approval vote at the September MRC meeting.

According to PJM’s rules, all members will be on the hook for at least some of the losses. Of the final amount, 10% will be allocated on a per capita basis to the 992 members, including affiliates, as of June 21. The per capita assessments are capped at $10,000 per year, though Daugherty confirmed the rule’s intention was for the cap to count per default event and that the language may need to be clarified.

The remaining losses will be allocated according to each member’s gross PJM activity over the three months preceding the default. The RTO said the total activity for the period was $24 billion.

So far, PJM has sent, or plans to send, bills for $42.5 million, about 18% of GreenHat’s portfolio.

Daugherty confirmed “there is no other situation like [GreenHat’s exposure] related to credit requirements.” She said PJM is working with external consultants from trading exchanges, clearing houses, other consultants and its Independent Market Monitor “to review factors that can affect future congestion levels and [perform a] gap analysis against how FTR credit requirements would address those factors.” The talks are excluding members to avoid potential conflicts of interest.

DC Energy’s Bruce Bleiweis said the incident was not a failure of the FTR market or structure but “clearly a significant failure of the credit policy.”

However, he expressed concern that PJM’s presentation indicated staff might agree with the IMM’s position that the benefits of long-term FTRs are outweighed by their risks.

In June, stakeholders endorsed changes to the long-term FTR auction construct to prohibit participants from obtaining the rights to congestion on transmission paths before the owners of the underlying auction revenue rights. The Monitor has said the revisions are improvements but don’t go far enough. (See “Long-term FTRs Undercut Annual FTRs,” PJM Market Implementation Committee Briefs: June 6, 2018.)

Kittell worked as an energy trader for JPMorgan Venture Energy Corp. when FERC fined the company $285 million and ordered it to disgorge $125 million for “manipulative bidding strategies” from September 2010 through November 2012. Kittell and two other employees named by the commission were not charged.