By Rory D. Sweeney, Amanda Durish Cook and Rich Heidorn Jr.

The first round of filings in FERC’s “paper hearing” on revisions to the PJM capacity market showed wide disagreement over the best way to address the impact of out-of-market subsidies on clearing prices.

Much of the debate in the dozens of filings focused on broadening the minimum offer price rule (MOPR) and modifying the fixed resource requirement (FRR), which were the basis of the hearing. But many stakeholders also proposed alternatives.

FERC ordered the hearing June 29 after concluding that increasing state subsidies for renewable and nuclear power were suppressing capacity prices. The commission’s 3-2 ruling required PJM to expand the MOPR to cover all new and existing capacity receiving out-of-market payments, including renewable energy credits (RECs) and zero-emission credits (ZECs) for nuclear plants. The MOPR currently covers only new gas-fired units.

The commission’s ruling rejected PJM’s April “jump ball” capacity filing (ER18-1314), granted in part a 2016 complaint led by Calpine (EL16-49) and initiated a Section 206 proceeding in a new docket (EL18-178). FERC also recommended creating an “FRR Alternative” allowing states to pull subsidized resources — and associated loads — from the capacity auction. (See FERC Orders PJM Capacity Market Revamp.)

PJM’s brief on Oct. 2 outlined its proposal for an “extended resource carve out” that builds on ideas it floated to stakeholders in August. (See PJM Unveils Capacity Proposal.)

The proposal would allow subsidized resources to obtain capacity commitments without clearing the capacity market, while creating a mechanism to restore prices to “the theoretically correct competitive level.”

The RTO said its proposal is intended to ensure both capacity offers and prices remain competitive and recognizes a bifurcated market will result in tradeoffs. “Making room, outside the auction, to accept subsidized generation as a PJM ‘capacity resource’ ineluctably will degrade auction prices. Unless the commission is prepared to accept a mechanism to adjust prices to their ‘correct’ level, this trade-off must be understood as an unavoidable consequence that comes once uneconomic resources are relieved from having to participate in the market.”

The Maryland Public Service Commission proposed what it called a “competitive carve-out approach” in which “a certain amount of load associated with the implementation of state policies is carved out of the existing capacity market and a separate competitive carve-out auction [is held] to meet the capacity needs associated with this amount of load.”

“This capacity would be provided by resources eligible to meet any state’s environmental policies,” the PSC wrote. “In effect, this proposed approach recognizes that, in the aggregate, resources eligible to meet states’ environmental policies and receive revenues for environmental attributes, may be capable of providing capacity to help meet the reliability requirements of all states and the region.”

It noted that the Organization of PJM States Inc. (OPSI) supported development of the idea.

‘Hokey Pokey’

The Electric Power Supply Association said the commission should prioritize protecting the capacity market from price suppression over accommodating state policies. It said the FRR Alternative would “effectively nullify” an expanded MOPR and could lead to the unraveling of the market.

“The FRR Alternative will actively push states towards the path of partial reregulation by letting them choose to be part in and part out of the [capacity] construct and, more importantly, away from reliance on competitive, organized markets,” EPSA said. It said the order would allow a state “to play the capacity market hokey pokey, putting its left foot into the [Reliability Pricing Model] market and pulling its right foot out.

“Even if the FRR Alternative provides greater transparency, that transparency does not make the resulting reregulation any more planned or any less damaging to what remains of the market,” EPSA said. “The only advantage of the transparency afforded by the FRR Alternative is that ‘investors, consumers and policymakers’ will have the opportunity to watch the collapse of the markets on the equivalent of a live-feed.”

Carbon Pricing

Eastern Generation, an EPSA member, filed a brief calling on the commission to treat the expanded MOPR as a “bridge” to PJM developing a mechanism for incorporating carbon pricing into its markets. “Carbon pricing is a more durable and sustainable long-term approach that will improve the efficiency of PJM’s capacity and energy markets while accommodating state and federal clean energy policies.”

A coalition of consumer advocates, environmentalists and industry stakeholders filed a joint brief arguing for prioritization of state interests.

“We frequently disagree on many issues before this commission, and some of us even disagree on certain aspects of this proceeding, such as the circumstances that should trigger a minimum offer price rule,” said the group, which includes consumer advocates from D.C. and Illinois, the Sierra Club, Natural Resources Defense Council, PSEG Energy Resources & Trade, Talen Energy, Exelon and the Nuclear Energy Institute.

“But as to the commission’s proposal regarding a resource-specific fixed resource requirement alternative (FRR-RS), the joint stakeholders strongly agree the commission’s decision should reflect certain basic principles: The commission should protect customers from paying for duplicate capacity and should preserve states’ ability to achieve clean energy policy goals without forcing states to withdraw altogether from the PJM market.” (See Zero-Emissions Backers Propose PJM Capacity Principles.)

In its standalone brief, Exelon called on the commission to “express its willingness to entertain a Section 205 filing from PJM incorporating carbon pricing.”

“Integrating a carbon price into PJM’s markets would reduce or eliminate the need for states to address carbon emissions from the power sector in other ways,” the company said.

PURPA Resources

Allco Renewable Energy said qualifying facilities under the Public Utility Regulatory Policies Act should have the option of choosing the FRR Alternative but should not be subject to the expanded MOPR, which it said would “unlawfully restrict, interfere and diminish the congressionally mandated right of a qualifying facility to sell energy and capacity.”

Columbia University’s Sabin Center for Climate Change Law insisted state environmental policies do not interfere with FERC-regulated markets. “Unless implemented with care, FERC’s proposed Tariff revisions could interfere with the operation of state clean energy policies, effectively preventing states from exercising their authority over generation,” it said. “There is no valid basis for concluding that REC, ZEC and other clean energy policies interfere with wholesale market operation.”

A Matter of State Jurisdiction

The Governors’ Wind and Solar Energy Coalition said FERC’s minimum bid requirement would intrude on states’ historical right to choose their own energy mix: “If the commission pre-empts or restricts the states’ ability to regulate environmental effects from energy power production, it would constitute a dangerous shift in the balance between state and federal authority.”

However, the Natural Gas Supply Association said it was “heartened” by what it called FERC’s “strong defense of the competitive markets it regulates.”

NGSA said PJM’s status quo would create an “untenable” environment where investment uncertainty erodes reliability and regulators pick winners and losers.

“It is no easy task to achieve a balance that allows states to make their own procurement decisions, while still ensuring those decisions do not harm the wholesale markets in your jurisdiction. Despite considerable pressure to disregard actions that erode the integrity of PJM’s capacity market, the commission had the courage to say, ‘no more,’” NGSA CEO Dena Wiggins wrote.

The American Coalition for Clean Coal Electricity and the National Mining Association also commended FERC on what they viewed as an effort to keep PJM’s market functioning through an expanded MOPR applied to all subsidies.

However, the groups asked for an exception to the MOPR: an exemption on a possible fuel security valuation in the PJM capacity market. They said a new MOPR shouldn’t “counteract federal efforts to ensure grid resilience and promote national security.” The groups urged FERC to require PJM to create a separate capacity auction for resources that can guarantee fuel security for a minimum number of days.

PJM’s “current market design is contributing to the loss of fuel-secure electricity resources, while encouraging reliance on pipeline-dependent and intermittent resources,” ACCCE and NMA said.

EPSA countered that any federal price supports for nuclear and coal units should subject them to the MOPR.

Other Out-of-Market Payments?

In arguing against an expanded MOPR, the Union of Concerned Scientists said PJM’s proposal “would arbitrarily provide an exemption for resources that have one kind of state-supported revenue, but not for other kinds of state-supported revenue.”

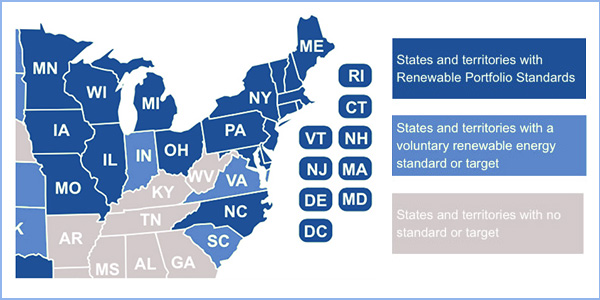

State RPS and impact on PJM | PJM

UCS argued PJM’s fleet of existing resources with state-sponsored out-of-market payments is “substantial” and greater in number than PJM has characterized.

“If the fundamental principles presented by both PJM and the commission are as important as suggested, and the commission has found that any price suppression due to out-of-market payments makes the PJM capacity auction results unjust and unreasonable, then there cannot be MOPR exemptions for investor-owned plants that have been receiving cost-recovery through state-administered rates,” UCS wrote. It also said PJM did not collect the list of states with out-of-market revenues for investor-owned generation through either a renewable portfolio standard, zero-emission credit program or regulated cost-of-service.

RPS National Map | National Conference of State Legislatures

“All of the states in PJM have one or more of these mechanisms that provide the means for generation to either enter or remain viable in PJM’s capacity market,” UCS said.

UCS said the fact that PJM’s Tariff allows zero-priced offers is evidence of state-supported cost recovery to keep resources viable in the capacity market.

APPA: Start Over

The American Public Power Association went for a scorched-earth approach, challenging PJM’s RPM itself.

The group argued PJM’s mandatory capacity market with a strict MOPR is “ill-suited” to achieving a diverse resource mix. It said PJM’s MOPR “now threatens to become an all-purpose restriction on any support for generation outside of revenues obtained through the PJM energy and capacity markets” and could “ultimately raise capacity prices without achieving any clear benefits.”

“The time is ripe to revisit the RPM construct in a comprehensive manner,” APPA said, rather than “doubling down” on a mandatory capacity construct with a “vastly expanded MOPR.”

APPA also argued self-supply resources used to meet the load of public power and cooperative utilities should not fall under an expanded MOPR, arguing vertical integration and tax-exempt financing do not constitute out-of-market support.

IMM’s ‘Sustainable Market Rule’

PJM’s Independent Market Monitor also suggested re-envisioning the RTO’s structure with what it calls a “sustainable market rule” that it argues is simple enough to be implemented in time for the next Base Residual Auction. While the Monitor attempted to differentiate its proposal from a MOPR, it would require all resources to offer into the BRA at their avoidable cost rate (ACR).

“A competitive offer in the capacity market is the marginal cost of capacity, or net ACR, regardless of whether the resource is planned or existing,” the Monitor wrote. “All capacity has a must-offer requirement and all capacity offers are included in the supply curve in the capacity market at competitive levels. All megawatts required for reliability are included in the capacity market demand curve (VRR curve).”

The Monitor acknowledged that load-side fears might be realized with this approach, but that “the possibility that customers may pay twice has been accepted by the courts” and FERC.

CASPR Appears

Vistra Energy and Dynegy Marketing and Trade proposed the Capacity Performance with Sponsored Supply (CaPSS), which it said is based on ISO-NE’s FERC-approved Competitive Auctions with Sponsored Policy Resources (CASPR) structure.

The two-stage auction would require all resources to offer in at their going-forward costs. PJM would create a table of resource-type ACRs, and any resource that believes its going-forward costs are below its applicable value in the RTO’s table would request a review to validate its argument. The second stage would be “purely voluntary” and allow existing resources that received a capacity obligation but are willing to permanently exit PJM’s markets to “give up” their obligations “in their entirety” to resources seeking subsidies that didn’t receive obligations in the first stage.

Next Steps

FERC faces a daunting task of threading the needle between at least eight proposed options for the MOPR and numerous modifications on both its FRR concept and PJM’s carve-out. Reply briefs in the docket will be due Nov. 6.